6 Best Crypto Debit Cards - Comparison of Terms and Fees

Find out which crypto debit card is the best? 6 options for comparison

More and more crypto projects are issuing their own cards, and even some popular crypto exchanges and custodial wallets are now joining this trend.

Comparison of All Crypto Debit Cards

The table below collects the terms for each card for quick comparison.

| Card | Supported Assets | Fees | Cashback | Geography | Features |

|---|---|---|---|---|---|

| Bybit Card | BTC, ETH, XRP, USDT, USDC, TON | Crypto Conversion: 0.9% Currency Exchange: 1% Issuance & Maintenance: 0€ |

2% - 10% (depends on VIP level) | Europe, Asia-Pacific, CIS | Auto-top-up from crypto wallet, compatible with Apple/Google/Samsung Pay |

| MetaMask Card | USDC, USDT, AUSDC, WE, Yuri, GBPE (on Linea network) | Gas (~$0.02) Swap non-stable coins: 0.875% Maintenance: 0€ |

1% (3% with metal card) Up to 8% Coinmunity Cashback |

USA, UK, Europe, Argentina, Brazil, Mexico, Switzerland | Direct integration with MetaMask wallet, own IBAN |

| Spend (Mercurio) | BTC, ETH, USDC | Inactivity (3 months): 1€/month Other fees: 0€ |

Information missing | European Economic Area (EEA) | Integration with Ledger wallet via Ledger Live |

| WhiteBit Nova Card | BTC, ETH, SOL, USDC | Virtual card issuance: 0€ Physical card: 12€ Maintenance: 0€ |

Up to 10% (limit 25€/month) | European Union (EU) | Choice of 3 cashback categories (can be changed daily) |

| Choice.com | Over 30 assets (BTC, ETH, BNB, USDT, USDC) | Physical card issuance: 15€ Maintenance: 3€/month* Additional virtual card: 1€ |

3€ refund on top-ups from 299€/month | Information missing | Prepaid Card Conversion at top-up, not at payment |

| 1inch Card | BTC, ETH, USDT, USDC | Transaction Fee: 2% Conversion: 1.75% Issuance & Maintenance: 0€ |

Up to 2% (in BTC or USDT) | Unknown | Developed by the 1inch protocol |

Conclusions:

- Highest Cashback: Bybit (up to 10%) and WhiteBit Nova (up to 10%, but with limits)

- Lowest Fees: MetaMask (no maintenance, minimal gas fees)

- Unique Features: Bybit - auto-savings, MetaMask - IBAN and on-chain rewards, Choice - conversion at top-up

- For Ledger Owners: Spend card integrated with Ledger Live

Below we reveal all the details and conditions.

Bybit Card

Supported Assets and Payments

The Bybit Card supports both Mastercard and Visa depending on your region. It is available in regions such as Europe, Asia-Pacific, and CIS countries (Kazakhstan). It connects directly to your exchange wallet and supports Bitcoin, Ethereum, XRP, USDT, USDC, and TON.

When making a payment, your fiat balance1 is used first. If it’s insufficient, the system automatically uses the selected cryptocurrency, in which case a conversion fee of 0.9% is charged. A foreign transaction fee of 1% is also charged if you spend in a currency different from your card’s base currency.

Cashback and Additional Features

Cashback starts at 2% and goes up to 10% depending on your VIP level. An auto-savings feature is also available, which can be activated to earn up to 8% APY on any unused balance on the card.

Choose between a virtual or physical card; it works with Apple Pay, Google Pay, and Samsung Pay. Getting started is free: card issuance requires no payment, and there are no annual fees.

Source: Bybit Exchange

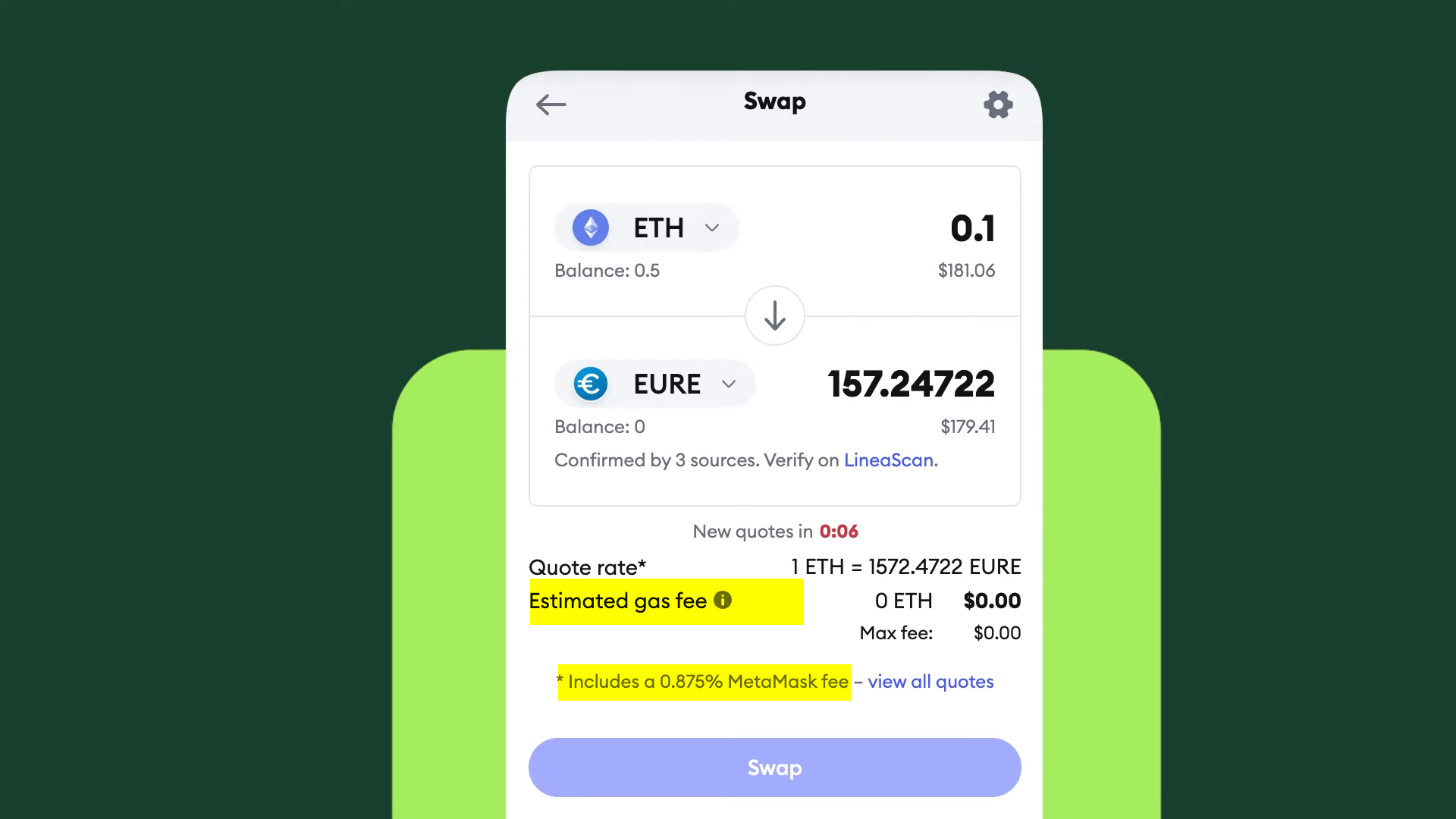

MetaMask Card

Let’s start with the MetaMask Card, which connects directly to your MetaMask wallet and allows you to spend cryptocurrency anywhere Mastercard is accepted.

Features and Support

The card can be used with Apple Pay and Google Pay for mobile payments.

The card supports assets such as USDC, USDT, AUSDC, WE, Yuri, and GBPE on the Linea network.

Financial Terms and Cashbacks

Thanks to MetaMask’s integration with Monerium, you can now get an account number IBAN2 linked directly to your wallet. This means you can transfer euros to this IBAN and receive them directly in MetaMask.

When paying, your cryptocurrency is converted to the local currency. A small fee is charged for each transaction: typically around 2 cents for gas on the Linea network when using stablecoins and a swap fee of 0.875% for non-stable coins like WETH.

But besides that, there are no annual fees or maintenance charges!

The card also comes with several reward systems. For regular users, there is 1% cashback for every transaction made using USDC, which increases to 3% when using the metal version of the card.

There is also a separate loyalty program called Coinmunity Cashback, launched in partnership with Linea, which offers up to 8% back in on-chain assets, including DeFi tokens, stablecoins, memecoins, and even NFTs!

Availability Geography

The card is in pilot mode and available only in a few regions: most US states, the UK, most of Europe, Argentina, Brazil, Colombia, Mexico, and Switzerland.

Source: MetaMask Wallet

Spend Card (Mercurio and Ledger)

How It Works and Compatibility

Next, let’s consider the Spend card, issued by Mercurio in partnership with Ledger, which can be found in the Ledger Live app.

It works by converting cryptocurrency, such as Bitcoin, Ethereum, and USDC, into fiat at the point of sale. This allows you to spend funds directly from your Ledger wallet anywhere Mastercard is accepted. The card also supports Apple Pay and Google Pay for mobile payments.

Maintenance Cost and Availability

A monthly maintenance fee of €1 is charged, but only if the card has been inactive for 3 consecutive months. Otherwise, there are no fees. The card is available only in the European Economic Area, but a wider launch is planned.

Source: Spend

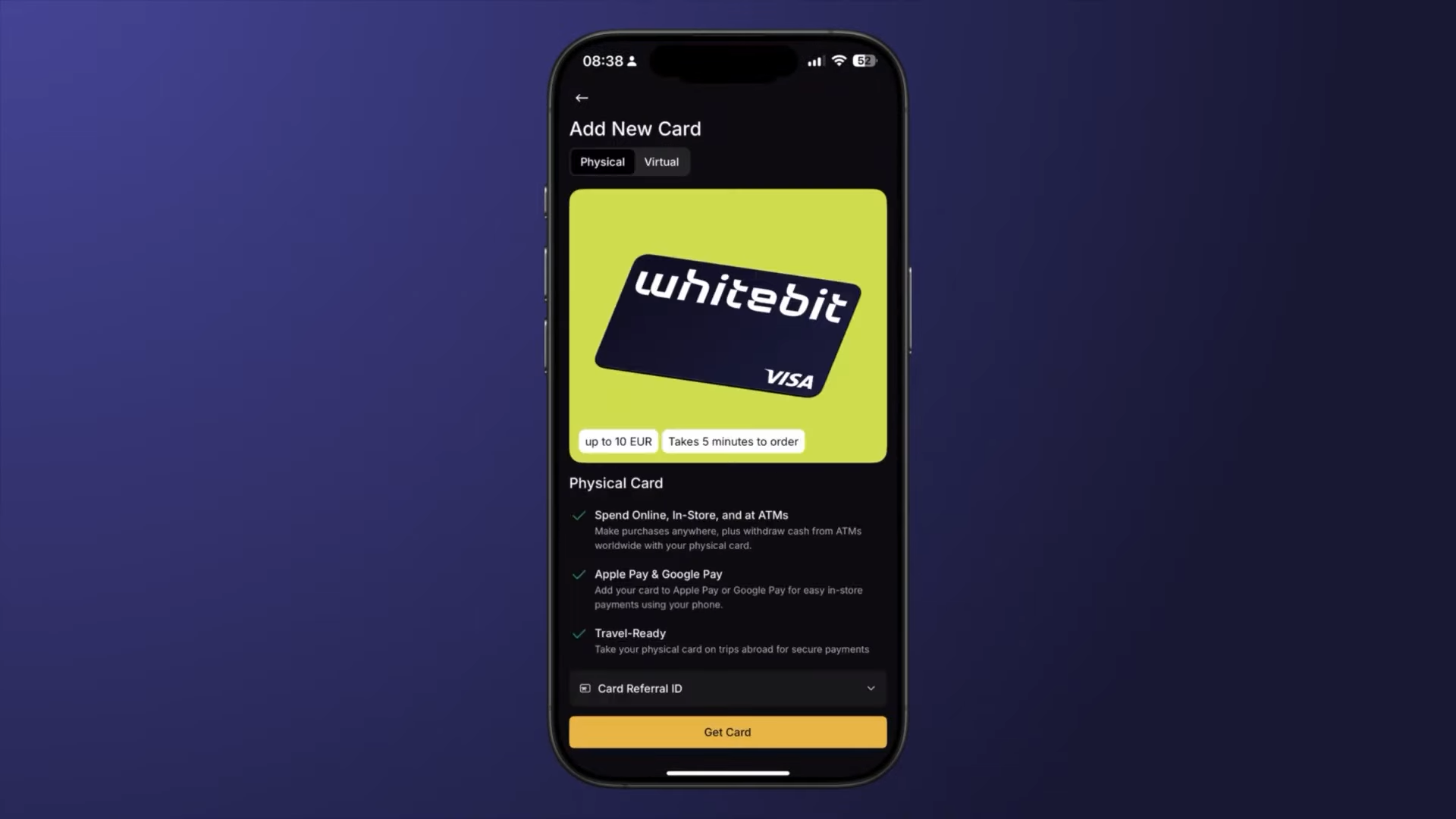

WhiteBit Nova Card

General Characteristics

Next on the list is the WhiteBit Nova Card, issued by the WhiteBit exchange in partnership with Visa.

The card is currently available for residents of European Union countries. This card allows you to spend assets like Bitcoin, Ethereum, SOL, and USDC directly from your exchange balance on WhiteBit.

Terms and Cashback

There are no fees for opening or maintaining the card. If you want a physical card, it will cost €12, or you can use the virtual version with Apple Pay or Google Pay.3

There is also a cashback system that reaches up to 10% depending on the category. Choose up to 3 categories per day and change them as needed!

Cashback is limited to €25 per month, and you need to accumulate at least €5 to receive it.

Source: WhiteBIT Exchange

Choice.com Card (formerly Crypterium)

Top-up Features and Card Types

You might know the next card by its old name, Crypterium, before the platform was renamed to Choice. The Choice.com Visa card is a prepaid debit card that links to your wallet via the Choice app. Upon issuance, it is linked to a dedicated IBAN account.

When you top up the card with cryptocurrency, this crypto is converted to euros and credited to the IBAN. That is, conversion happens at top-up, not at the point of sale, unlike most crypto debit cards.

Choose between a virtual or physical card. The physical card costs €15, the first virtual card is free, and each subsequent one costs €1.

Fees and Supported Assets

The monthly maintenance fee is €3, but if you top up your account with at least €299 per month, this amount is refunded via cashback. The card supports top-ups with over 30 cryptocurrencies, including Bitcoin, Ethereum, BNB, USDT, and USDC.

Source: Choice

1inch Card

Technical Specifications

The 1inch Card is a product from the 1inch protocol, which operates on the Mastercard network. It supports assets such as Bitcoin, Ethereum, USDT, and USDC. The card is compatible with Apple Pay and Google Pay for mobile payments and works on the principle of converting cryptocurrency to fiat at the point of sale.

Fee System and Cashback

Like most other cards, it has a cashback system that offers up to 2% back on every purchase, usually paid in tokens like Bitcoin or USDT.

The card charges no issuance or maintenance fees, but a 2% fee is charged on each card transaction, plus a 1.75% fee when converting cryptocurrency to fiat or another cryptocurrency.

Upcoming Releases

Kraken Card

It’s worth noting a few other notable crypto debit cards that are expected to launch soon. The first is Kraken, which, in partnership with Mastercard, will release a crypto debit card in both physical and digital formats. It is expected to launch first in the UK and Europe and will be integrated with Kraken Pay, the exchange’s cross-border payment platform that already supports over 300 crypto and fiat currencies.

OKX Card

Another exchange joining this space is OKX, which is working with Mastercard on the upcoming OKX card. It will support stablecoin payments and allow merchants to receive settlements directly in assets like USDC and USDP.

Exodus

And finally, the Exodus wallet is also releasing its own card, which will allow spending cryptocurrency directly from the Exodus wallet.

Risks and Criticism

Regulatory uncertainty creates the risk of crypto cards being blocked in some countries, which could lead to frozen funds and service termination without the ability to quickly withdraw assets. Additionally, hidden fees and cryptocurrency exchange rate volatility can cause additional financial losses even in the absence of annual fees.

"MiningSoft" does not provide investment advice; the material is published for informational purposes only. Cryptocurrency is a volatile asset capable of causing financial losses.