Mining - what is it in simple terms?

In this article, you will learn what cryptocurrency mining means.

What is mining?

New bitcoins are generated in a process called mining. This process is complicated, but in simple terms, mining is when computers solve mathematical equations, and as a reward they receive bitcoin or other cryptocurrencies.

The term “mining” means “digging”, i.e. creation of new coins. This is done by the so-called miners, who, in the case of bitcoins, add the next block to the blockchain and collect a reward for this. Blockchain is a ledger that keeps track of how many bitcoins someone has and who transfers them to where.

Important terms and clear explanations

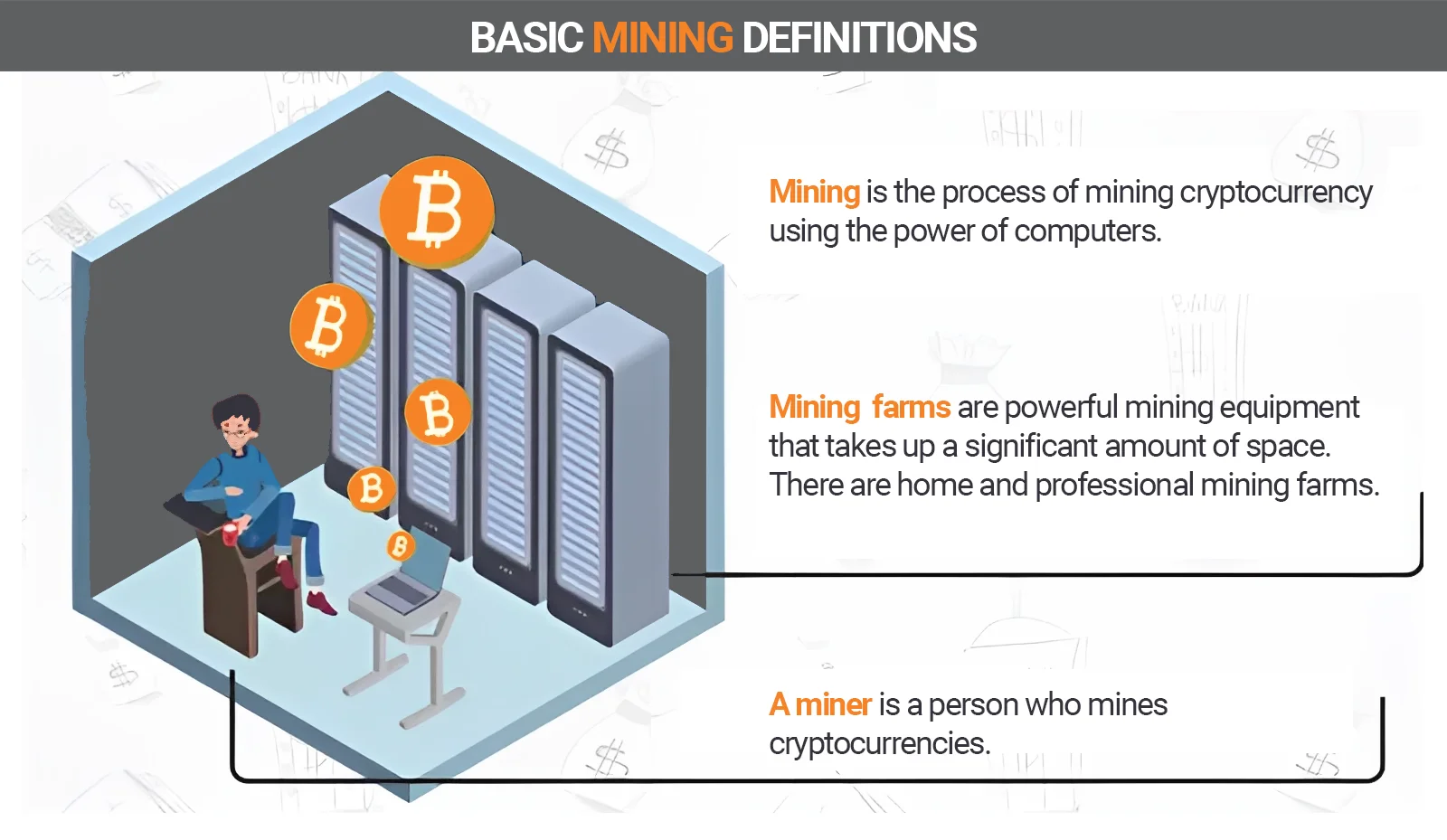

- Mining

- The process of mining cryptocurrency using the power of computers. Calculations are carried out using specialized integrated circuits (ASIC)1 or video cards (GPU). These devices solve complex problems (hashes). At the same time, a new block of bitcoins is found, for which miners receive a reward.

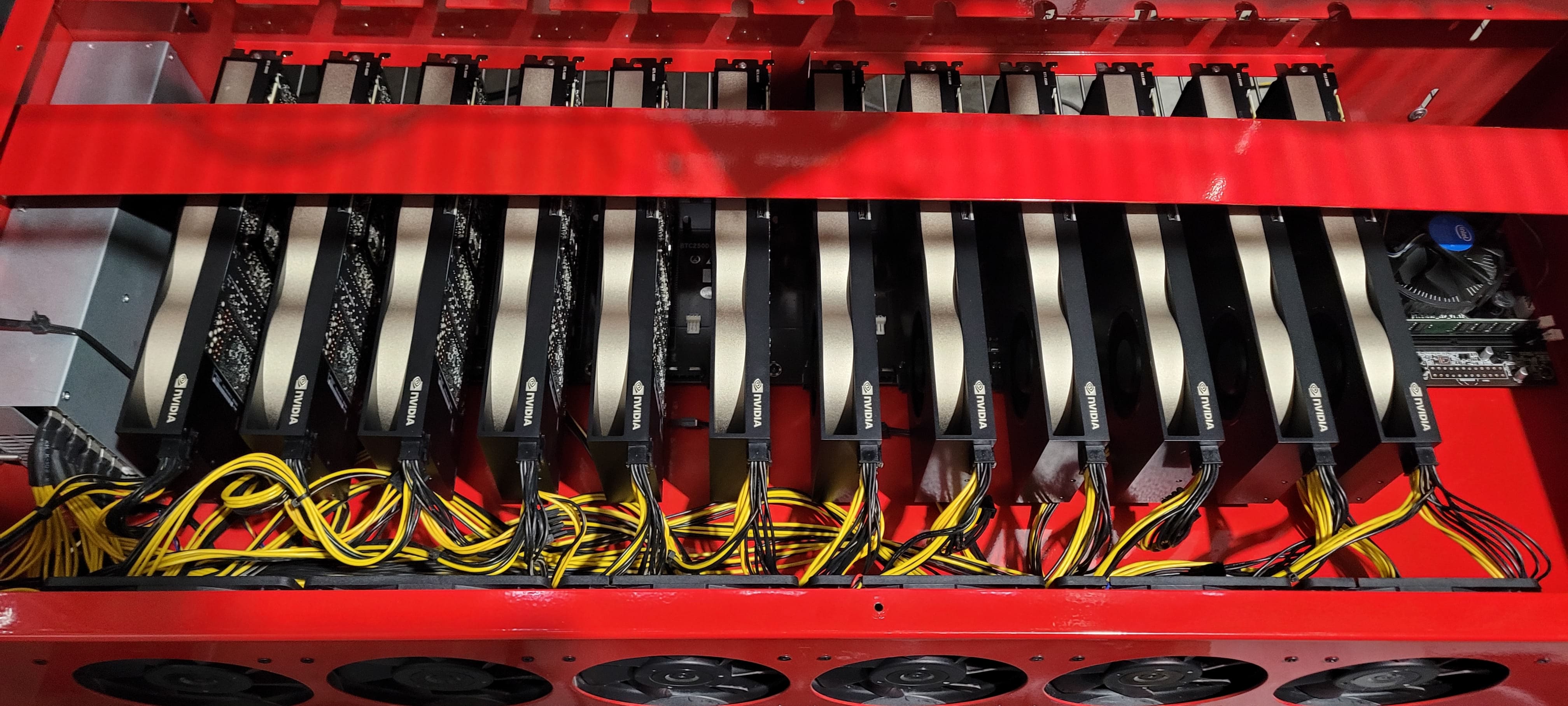

- Mining farms (mining rig)

- Powerful high-performance computing rigs for mining, occupying a significant amount of space. Several devices are combined into farms to make them easier to maintain.

- Miner

- A person who mines cryptocurrency. The cryptocurrency mining software itself is also sometimes called a miner.

The idea for the name of the process of creating new cryptocoins arose from a comparison with gold miners looking for gold in mines.

In English, the term “mining” refers more to the extraction and extraction of valuable metals in mines and tunnels.

Comparing cryptocurrency mining with gold mining, the name becomes clear. In both forms of mining, miners perform work and are rewarded in the form of an uncirculated asset. Along with digital gold, natural gold is also mined from the ground and becomes part of the economy.

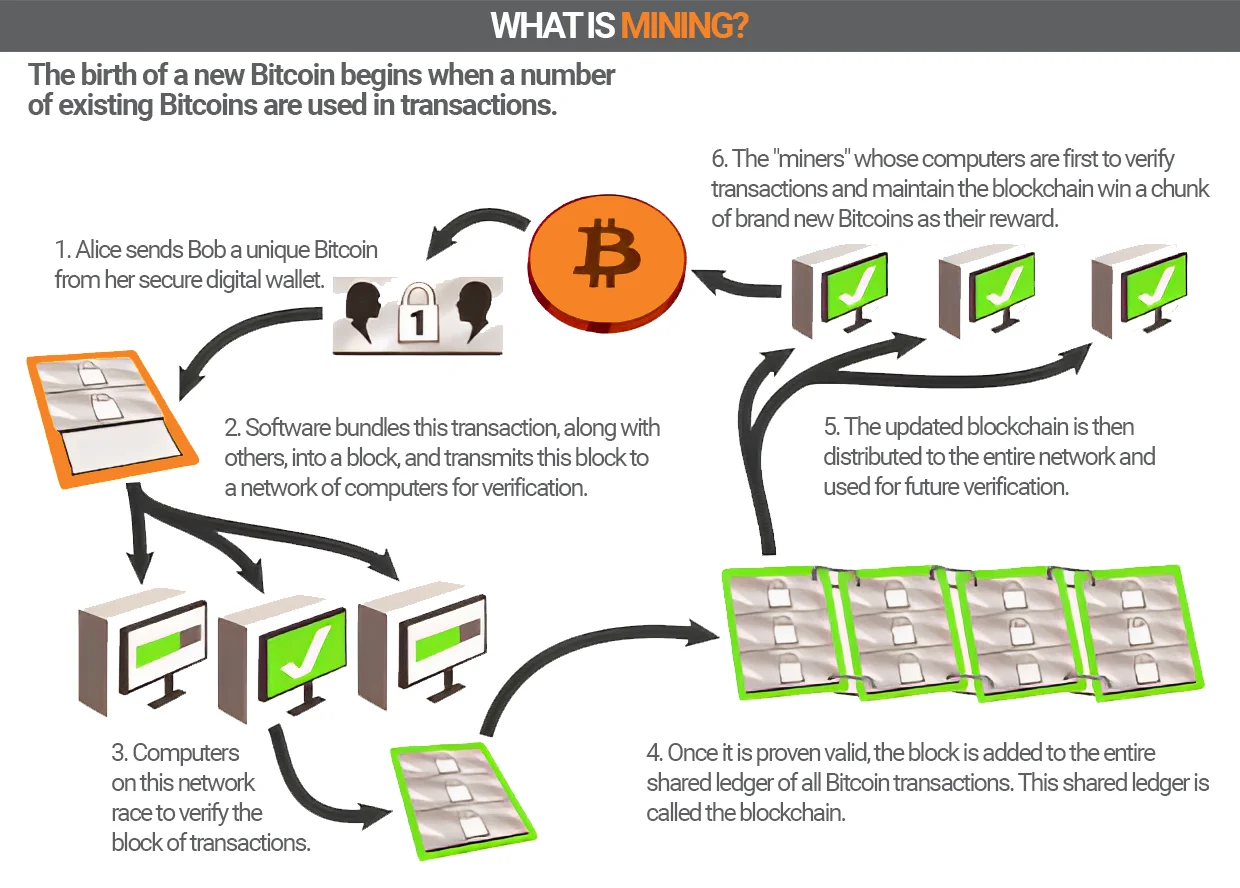

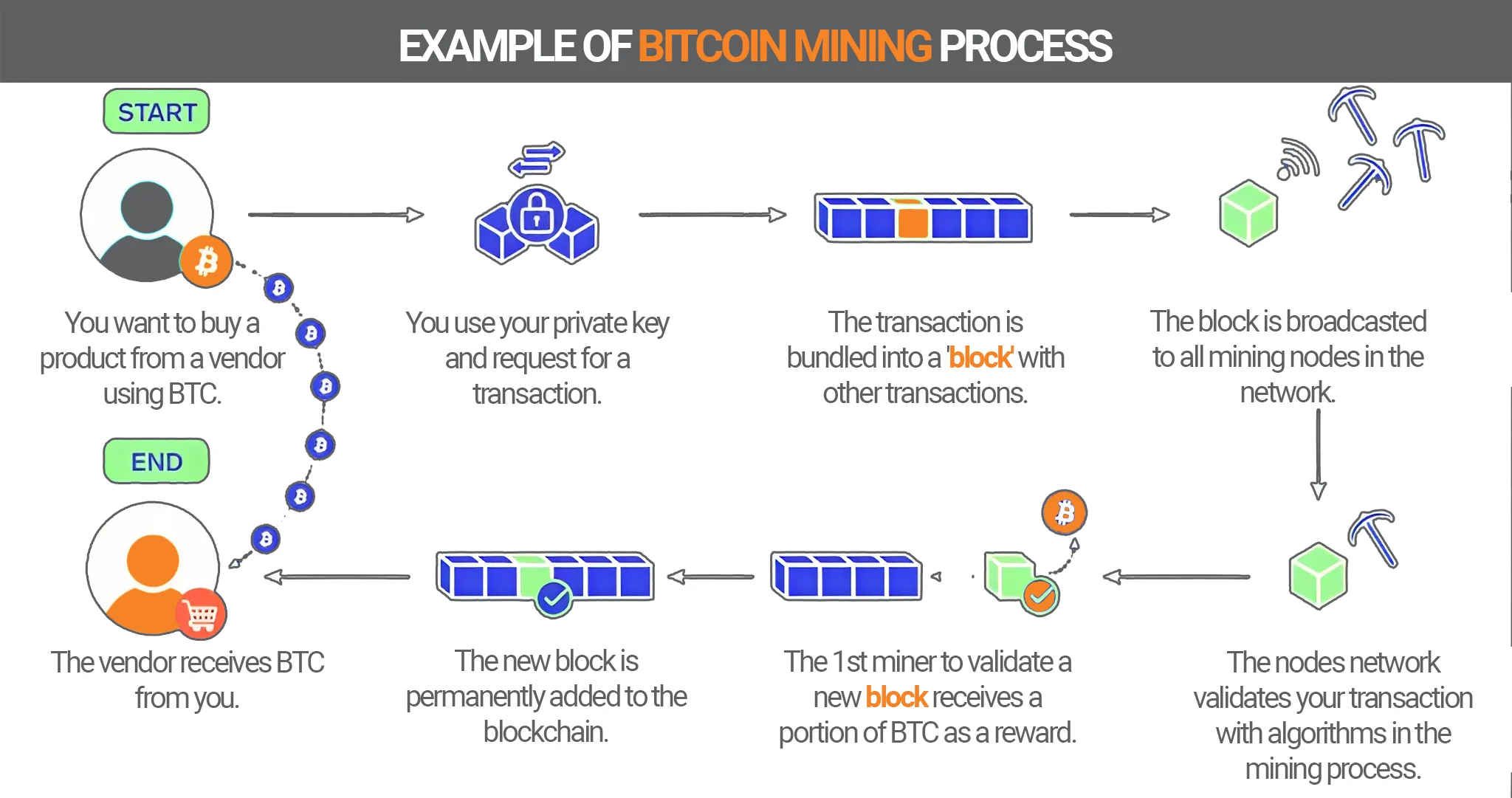

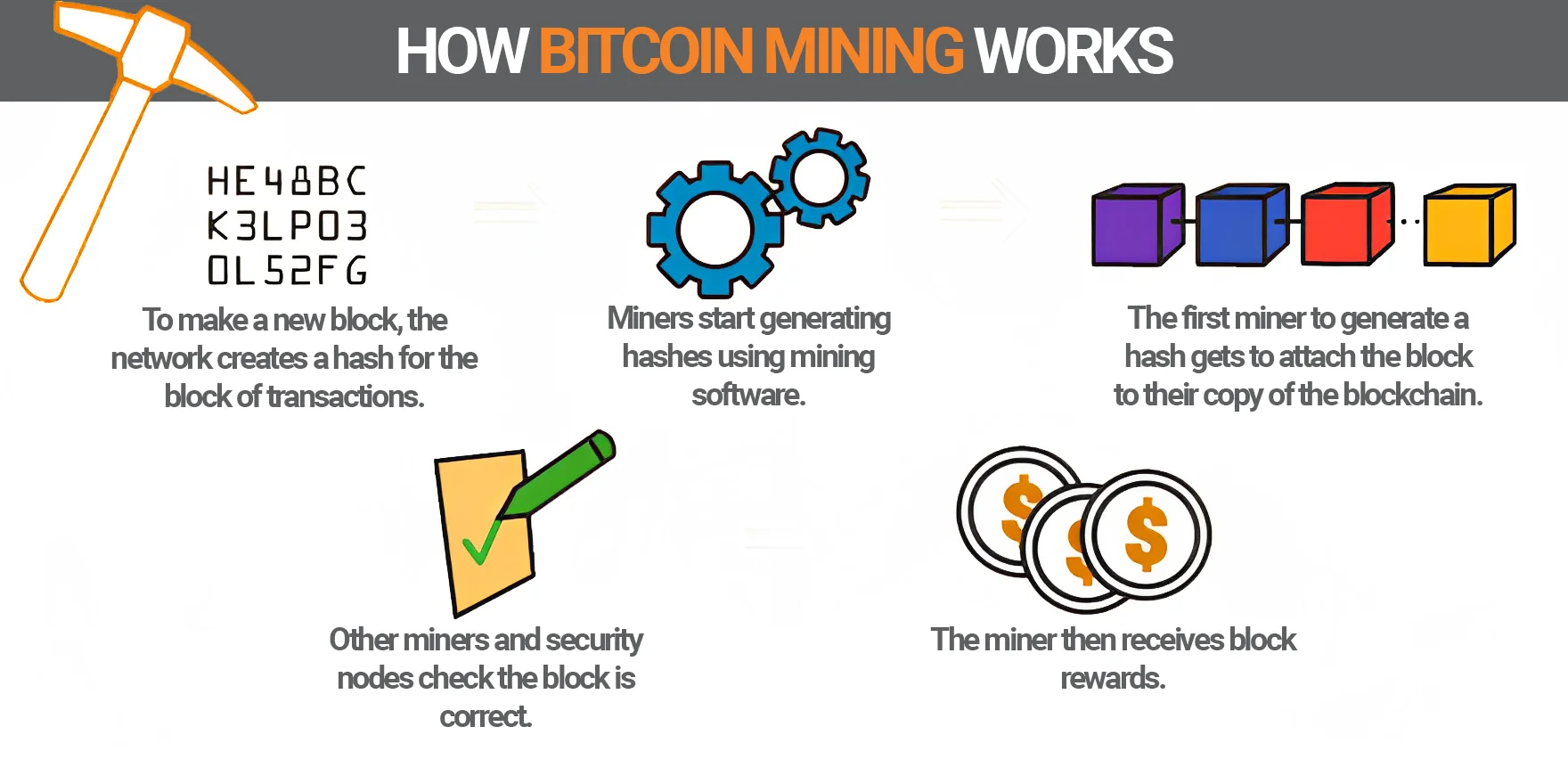

How does it work

When using cryptocurrency, transaction details are recorded in the so-called blockchain (registry). The miner is tasked with solving the complex problem behind this transaction. The process ends when the miner confirms the legitimacy of the transaction. Once this is done, the transaction will be visible to everyone on the blockchain.

Simply put, it is about solving complex mathematical problems. Therefore, the transaction verification process requires miners to use high processing power.

The more miners involved in the verification process, the faster the transaction is confirmed. For conducting such a transaction, the miners receive a part of the transaction as a commission. Each successful transaction generates additional new coins that are put into circulation on the blockchain network.

What is calculated?

Mining farms are engaged in the calculation of “hashes” according to a given algorithm for cryptocurrency. These hashes are mathematically calculated sequences of letters and numbers stored in blocks.

The most famous cryptographic hash functions used in cryptocurrency algorithms include “SHA-256” in Bitcoin, “Ethash” in Ethereum Classic, “Scrypt” in Litecoin.

Calculating hashes

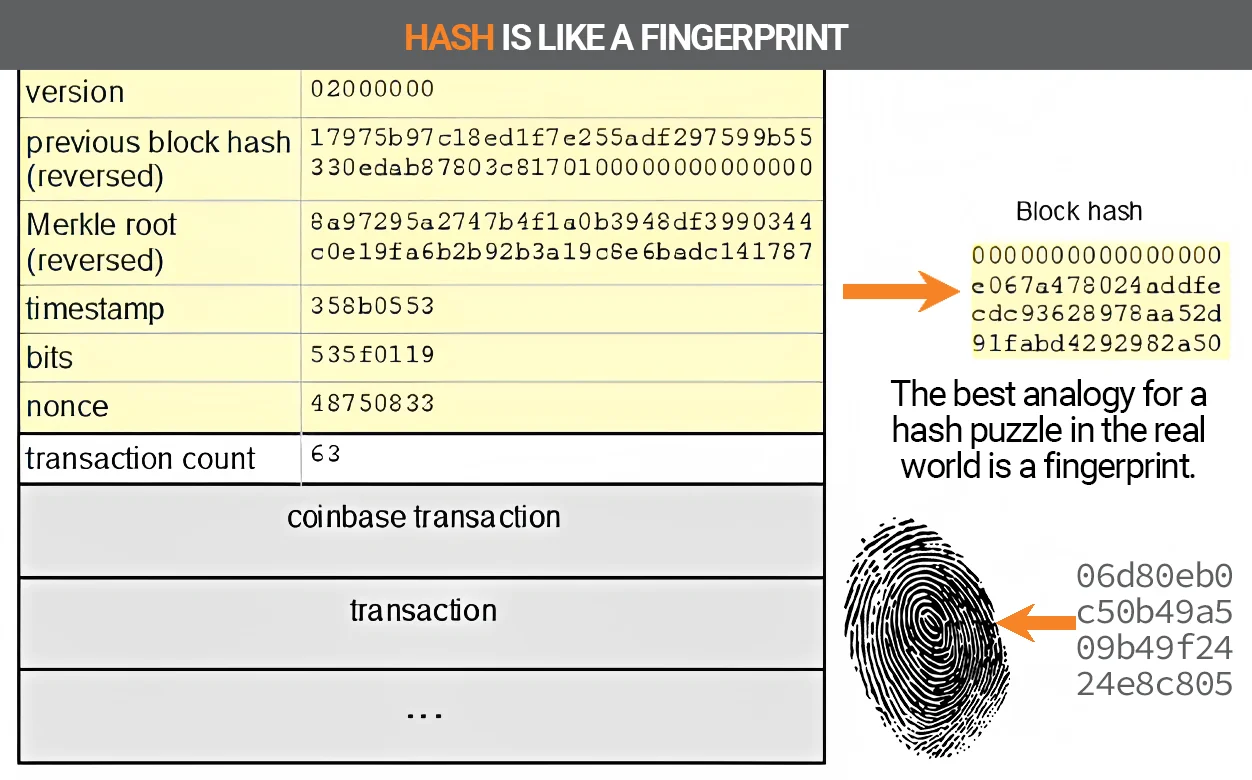

A Bitcoin block contains hashes, which store the hashes of previous blocks, as well as transaction details.

- hash

- A hash in the Bitcoin blockchain is a fixed length of a unique sequence of random numbers containing data of any size. Each hash is unique, so you can’t look at a hash and guess what data it contains.

To understand the complex nature of a hash, consider an analogy: every Bitcoin hash is like asking someone to flip a coin 160 times and write it either heads or tails. In the case of heads or tails, there are only two variables on the coin. However, with numbers and letters, the possibilities of a 160-character Bitcoin hash are endless. There will never be two identical values.

In a hash puzzle, the resulting fingerprint is a list of characters (let’s call it a word), for example, “cat”, after which your task is to find the desired “fingerprint” of this word. To do this, all you can do is try all possible combinations of numbers (of a certain length), one by one.

Hashrate and hashing

To summarize the information above, a hash is a randomly generated alphanumeric code, and hashing is the process of guessing that code. Hashrate here is the speed of mining, hashing (solving the puzzle).

- Hashing

- transformation and generation of input data of any length into a fixed-size string, which is performed according to a certain algorithm. Specifically, the Bitcoin hashing algorithm is SHA-256 or 256-bit Secure Hashing Algorithm.

- Hashrate

- A measure of the processing power per second used in mining. Simply put, this is the speed of mining. It is measured in hash units per second, which means how many calculations can be performed per second. Machines with high hashing power are very efficient and can process a large amount of data per second.

Here it becomes obvious that the more powerful our hashing machine (aka mining farm), the faster we will find a solution to the algorithm and get income.

But powerful devices will immediately find all Bitcoins, right? No, there is a complexity parameter in the algorithm for this.

Network complexity

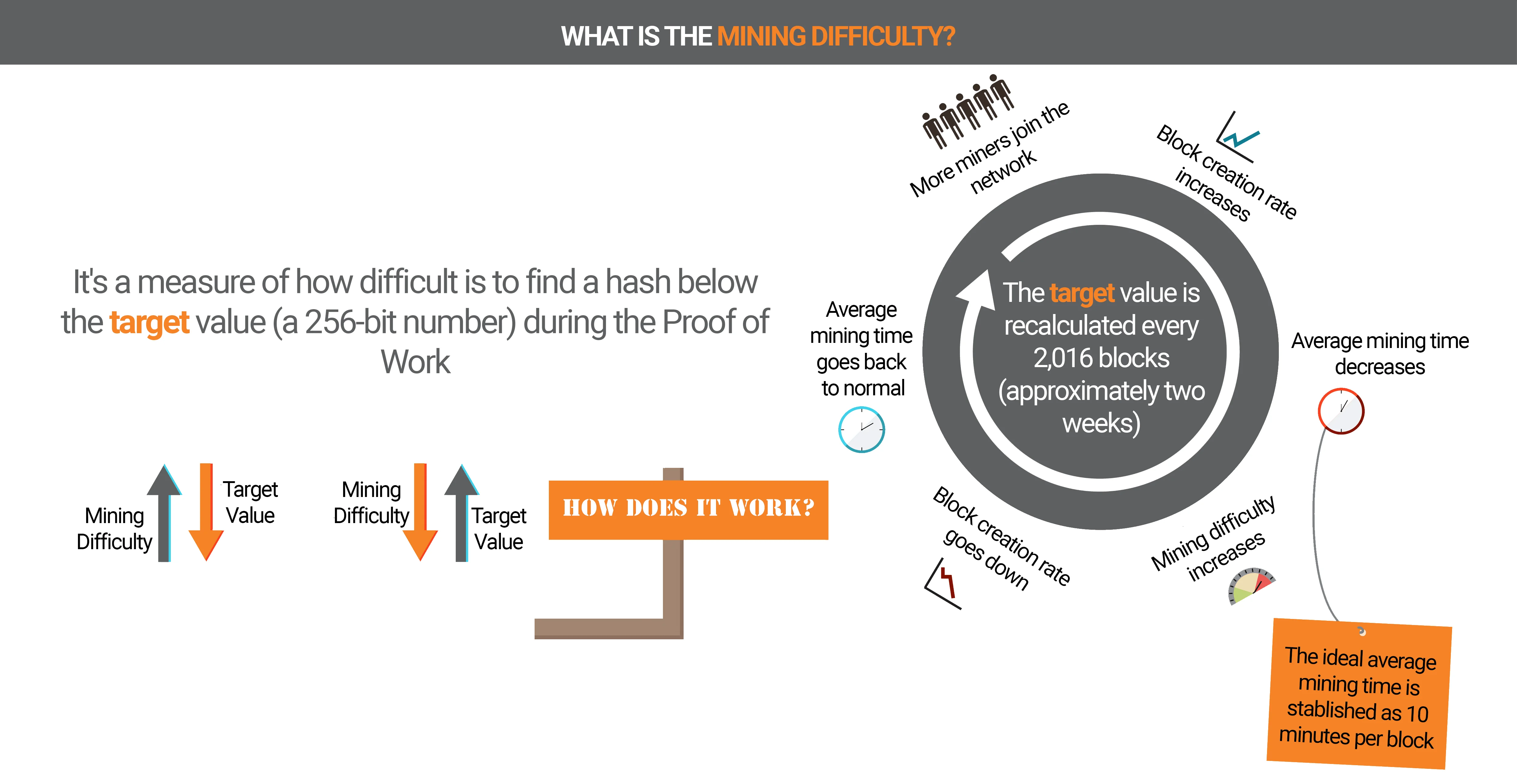

Mining difficulty is how difficult it is to find a given hash below the target value.

The target value is recalculated every 2016 blocks, with the mining difficulty being inversely proportional to the target value.

As mining difficulty increases, the target value decreases, and vice versa.

In simple terms, for beginners, it is about solving complex mathematical problems. Therefore, the transaction verification process requires miners to use high processing power.

As mining speed increases, mining difficulty also increases. As a result, the speed of block creation is reduced to the desired 10 minutes, as mentioned earlier. All this is described in the Proof of Work2 algorithm.

Once the mining difficulty increases, the average mining time returns to normal and the cycle repeats approximately every 2 weeks.

Equipment and Requirements

Mining uses the processing power of a video card (for some cryptocurrencies, a processor) to mine coins such as Monero or Ethereum Classic.

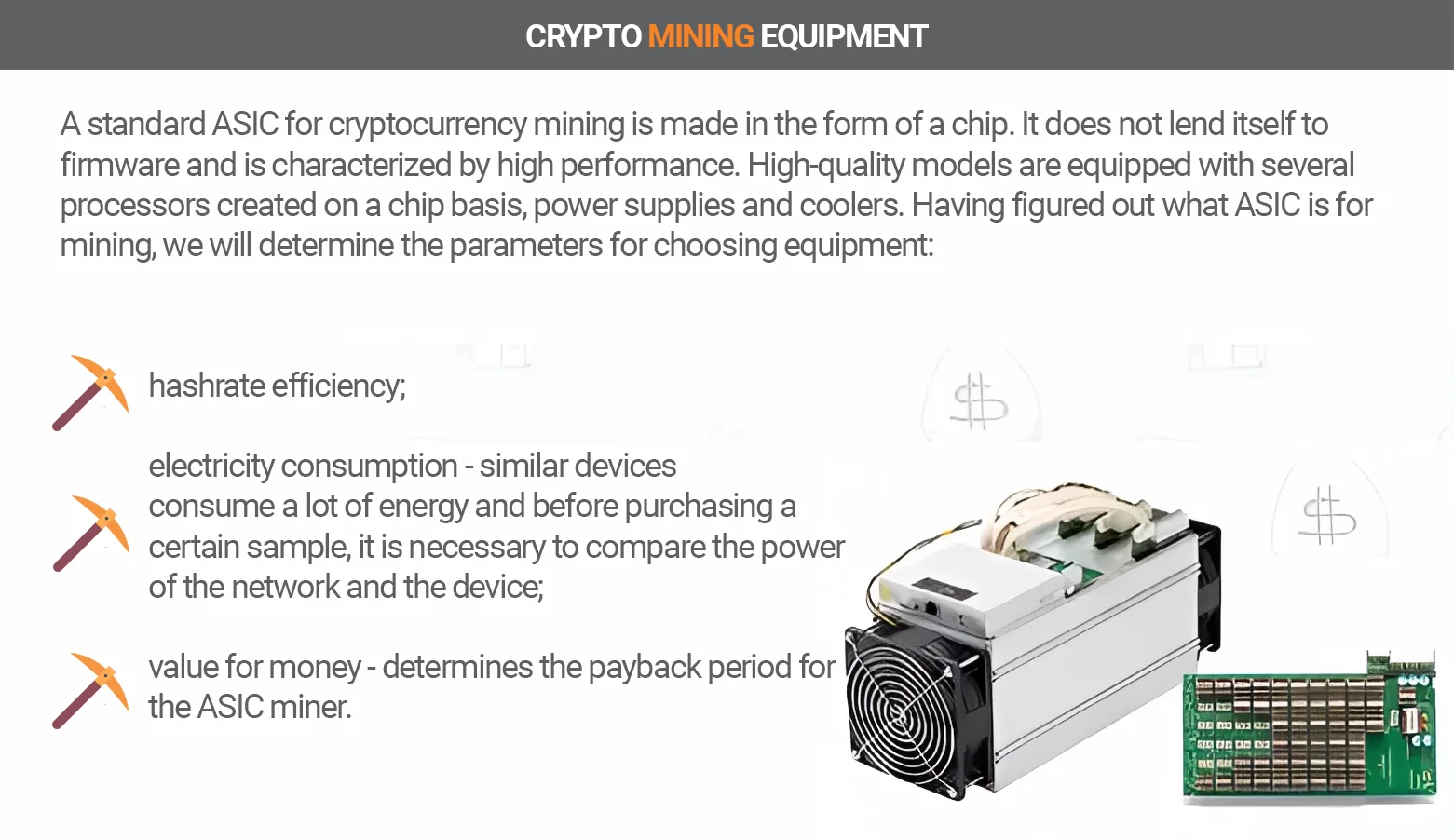

There are also ASICs specially designed devices, such as Bitmain and Antminer.

Cryptocurrency mining requires a special GPU (Graphic Processor Unit) designed to solve complex equations inlittle time. If you want to start crypto mining without your own hardware, so-called cloud mining farms are available.

What is better ASIC or mining farm

Initially, the creators of Bitcoin planned to mine it on the central processing units (CPUs) of widely used laptops or desktop computers. However, ASICs have outperformed both processors and graphics cards (GPUs) due to their lower power consumption and higher processing power.

Thus, ASICs are better than processors and video cards in mining. They are more powerful in terms of processing power. They can process much more data per unit of time.

Ultimately, more and more miners with high computing power will be more successful than smaller home miners.

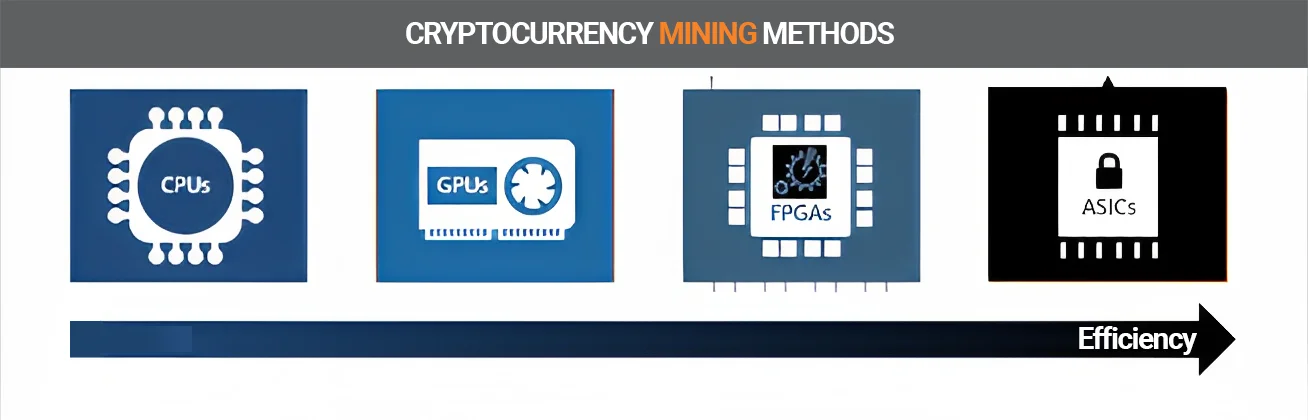

The performance hierarchy is as follows:

- CPU - The central processing unit of the computer. The lowest efficiency.

- GPU - Graphics processor (video card). Average efficiency.

- FPGA - Integrated Circuit. High performance.

- ASIC - Application Specific Integrated Circuit. Top performance.

- Pools

- Mining rigs allow miners to harness the combined processing power of multiple machines, channel it into mining pools, and distribute a reward (share) for each successfully mined block.

Mining methods

There are different approaches to cryptocurrency mining. Here are the 4 most popular types, ranked by the degree of simplicity.

Mining methods:

Cloud mining. As the cost of acquiring GPU or ASIC miners is getting higher compared to revenues, cloud mining farms are becoming more and more popular. Cloud mining allows individual miners to take advantage of large corporations and specialized facilities. With a cloud solution, you can rent cloud hardware for a specific period of time.

CPU mining. In the early days of technology, CPU mining was the easiest way to start mining. To start cryptomining, a simple home PC with a good processor was enough. However, mining on processors is too slow and does not bring that much profit, if you take into account the costs of electricity and cooling.

GPU mining. Several GPUs, so-called video cards, are combined into a large mining farm, which increases the processing power used.

ASIC mining. Unlike GPU miners, ASIC miners are specifically designed for cryptocurrency mining, so they can produce more units of cryptocurrency than GPUs. However, the acquisition costs of such ASIC miners are many times higher than those of GPU or CPU miners.

ASIC farms are used for bitcoin mining.

What cryptocurrency is being mined? All coins with the proof of work algorithm can be mined on farms. And mining rig3 is part of the farm.

Mining is not profitable?

It is said from time to time that mining is dead. There are several factors at work here. Even if the miners are profitable, you must consider upfront costs such as hardware purchases and ongoing electricity costs. Only when all the costs are calculated can one see if it is profitable.

The benefit also depends on the type of equipment. For example, according to a report by the Congressional Research Service, a hash rate of 14 terahashes per second can be obtained either from a single ASIC miner with a power of only 1800 watts, or from more than half a million 40 megawatt Sony game consoles.

Halvings and rewards

Bitcoin rewards are halved every four years. This is a process known as halving4. Therefore, miners must become more efficient and faster in order to maintain a constant profit.

- When Bitcoin was first released in 2009, a miner was earning 50 BTC per block.

- By 2012, the reward was 25 BTC per block.

- After Bitcoin halved in 2016, the reward was halved again to 12.5 coins.

- The reward is currently 6.25 BTC per block.

- The next halving is expected at the end of May 2024. Then the block reward for miners will be halved to 3.125 BTC.

In the protocols of many cryptocoins, a halving formula has been introduced. This is important to take into account when calculating.

Power consumption

You can use various online profitability calculators to decide if mining is profitable for you based on electricity cost, device efficiency, mining time and currency value.

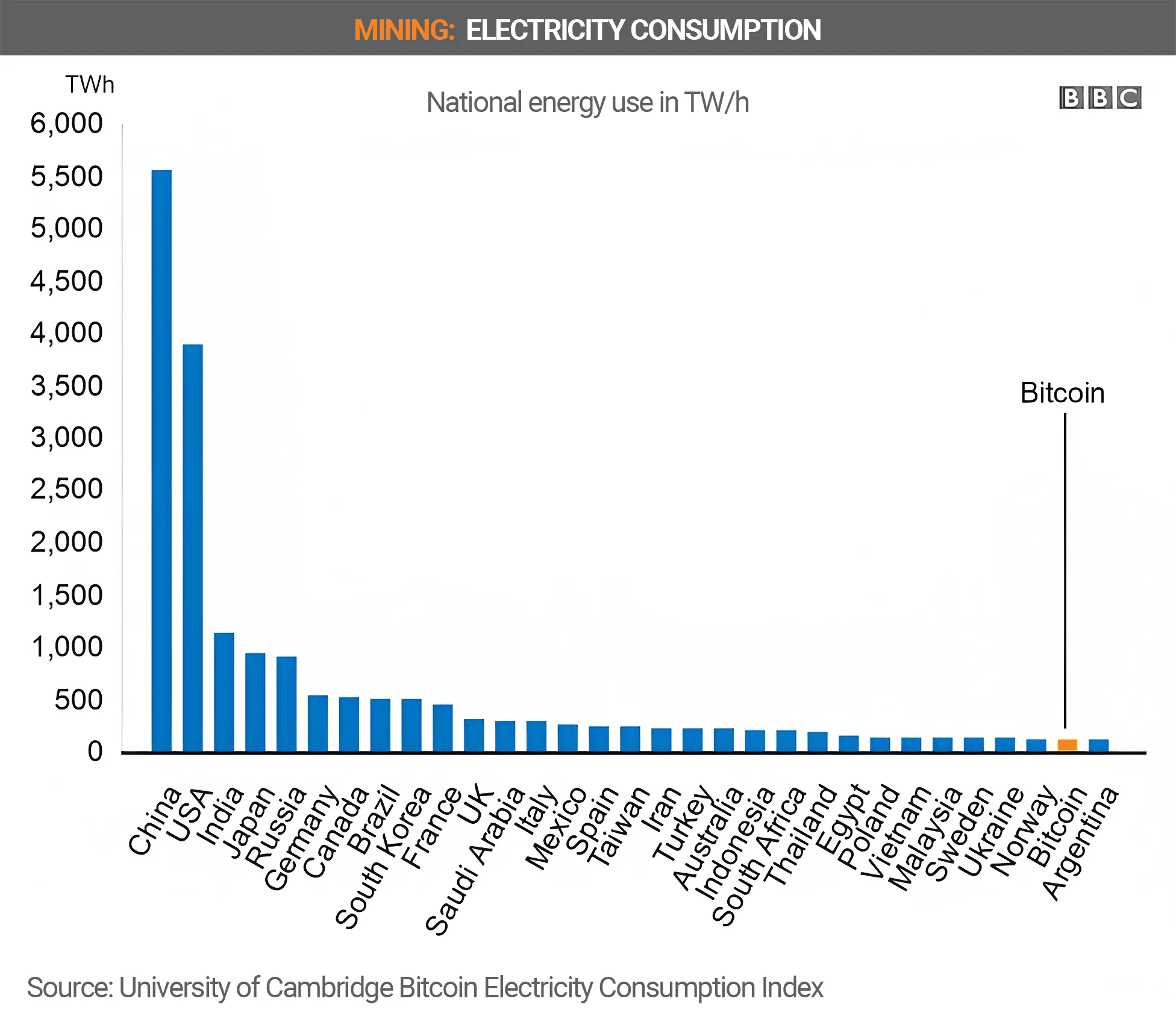

According to the Cambridge Center for Alternative Finance, the energy demand of the global Bitcoin network is about 90 terawatt-hours. This currently corresponds to about 0.4 percent of the world’s electricity.

By comparison, air conditioning systems in the US alone last consumed about 2,199 terawatt-hours. This is more than 24 times the energy requirement for global bitcoin mining.

The BBC estimated Bitcoin’s electricity consumption to be higher than in Argentina (121 TWh), the Netherlands (108.8 TWh) and the United Arab Emirates (113.20 TWh) and is gradually approaching Norway (122.20 TWh). ).5

Proponents, on the other hand, see more benefit in mining: they argue that mining can protect the power grid from fluctuations or failures. To maintain the power grid, a certain voltage must always be maintained.

Yes, the energy demand for bitcoin mining is high and will continue to rise as the number of miners increases. But network security will also grow.

According to the Bitcoin Mining Council6, almost 60 percent of the energy needed for global Bitcoin mining already comes from natural sources such as wind or solar energy: this share currently stands at 58.9 percent.

What happens when mining ends?

The maximum supply of Bitcoin is rigidly defined and will never exceed the limit of almost 21 million coins7. Thus, the supply of BTC cannot be expanded.

Because of the halving, the last bitcoin won’t be mined until around 2140. According to the analytical company Coinmarketcap8, there are currently just over 19 million coins in circulation. This means that it will take miners at least 117 years to mine the remaining two million coins - that is, for the remaining ten percent.

Law

Crypto mining itself is completely legal, but some crypto miners use malware to obtain cryptocurrencies in an illegal way.

This scam is called cryptojacking. These are programs used to covertly search for digital currency on hacked computers.

Conclusions

Cryptocurrencies are decentralized, that is, neither a central bank, nor a central database, nor a single central authority manages the monetary network. Cryptocurrencies do not have a central authority. Rather, they are run by the cryptocurrency community and, in particular, by cryptocurrency miners.

Miners add transactions to the blockchain. Different cryptocurrencies use different generation methods, if cryptocurrencies use mining at all. (Most cryptocurrencies do not use mining.)

Various mining and consensus methods are used to determine who creates new blocks of transactions and exactly how blocks are added to the blockchain.

Question answer

A promising historical coin rate and low mining difficulty are the most important criteria if you want to mine cryptocurrency.

Bitcoin creator Satoshi Nakamoto was the first miner. Information is circulating on the Internet that before the start, he managed to secretly get a big fortune. However, these are just rumors. According to official information, Satoshi was only able to mine 750 coins. The pioneers mined "crypto" using the computer's central processing unit.

Best mining software: PhoenixMiner, NiceHash, XMRig, Gminer, Lolminer, TeamRedMiner and T-rex Miner.