Ethereum Fusaka – A Hard Fork ETH Holders Need to Know About

Learn how the upcoming Ethereum Fusaka upgrade, aimed at enhancing network scalability and security through 12 technical improvements, could become a catalyst for ETH’s price growth.

What will the Fusaka update do?

The analogy is simple: before, everyone had to check the entire book for errors, but now everyone just looks at one random page. This makes the process incredibly efficient!

Introduction

The release date for Fusaka, a major Ethereum upgrade, has been set. The price of ETH typically rises around such events, especially in a bull market. The 4th quarter of the crypto market’s 4-year cycle has historically been a period of strong growth, so the price of ETH could skyrocket! Source: 4-Year Crypto Growth Cycles.

This is why we will break down everything you need to know about Fusaka in detail, including the changes it brings, their significance for Ethereum’s future, and the potential impact on the price of ETH.

What is Fusaka?

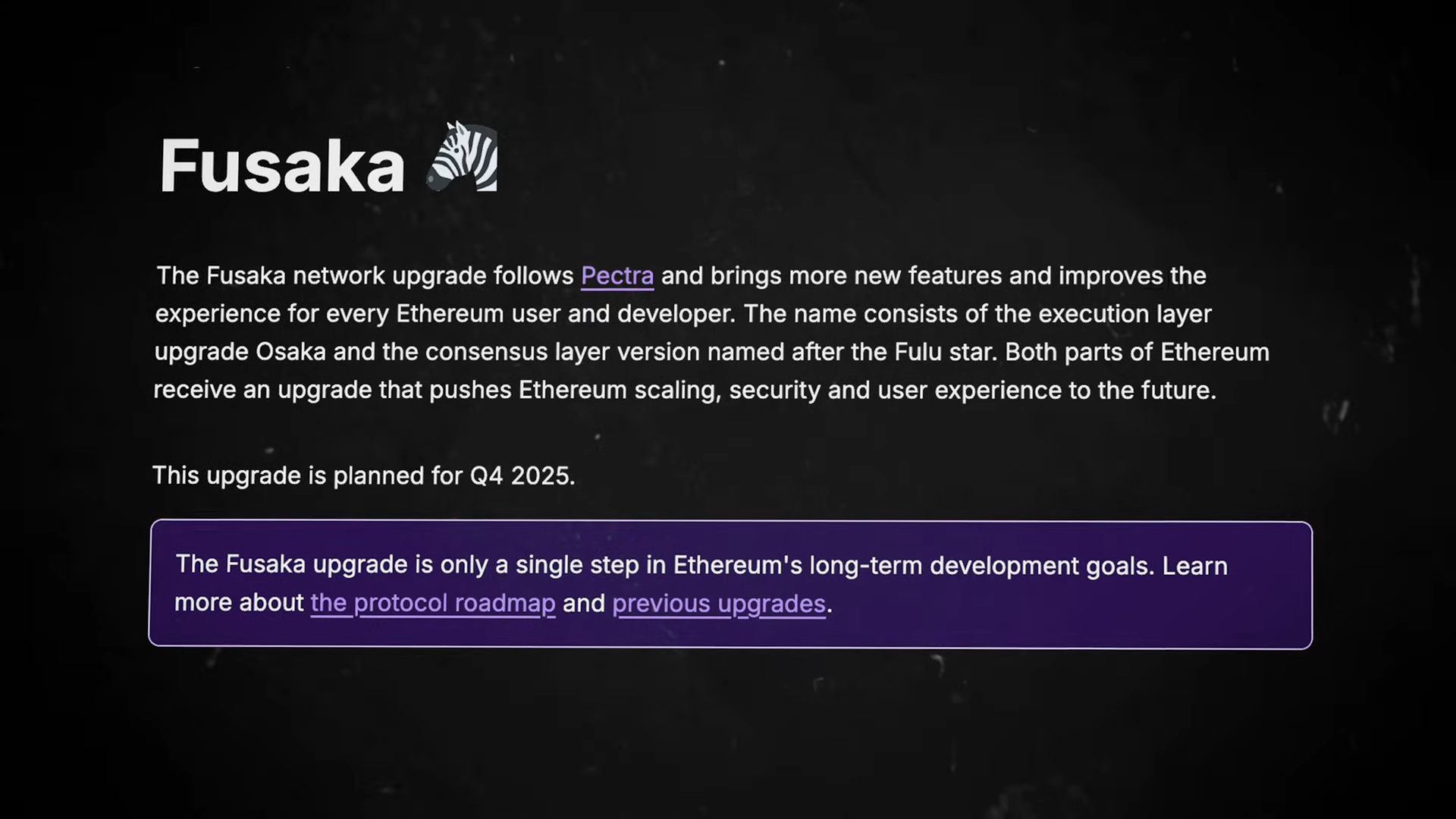

Fusaka is a major blockchain upgrade for Ethereum in the form of a hard fork, scheduled for December 3rd. It will update both the consensus and execution layers.

Fun fact: Each consensus layer upgrade is named after a star, in this case - Fulu, and each execution layer upgrade is named after a Devcon location, in this case - Osaka. Fusaka is simply the combination of these two names.

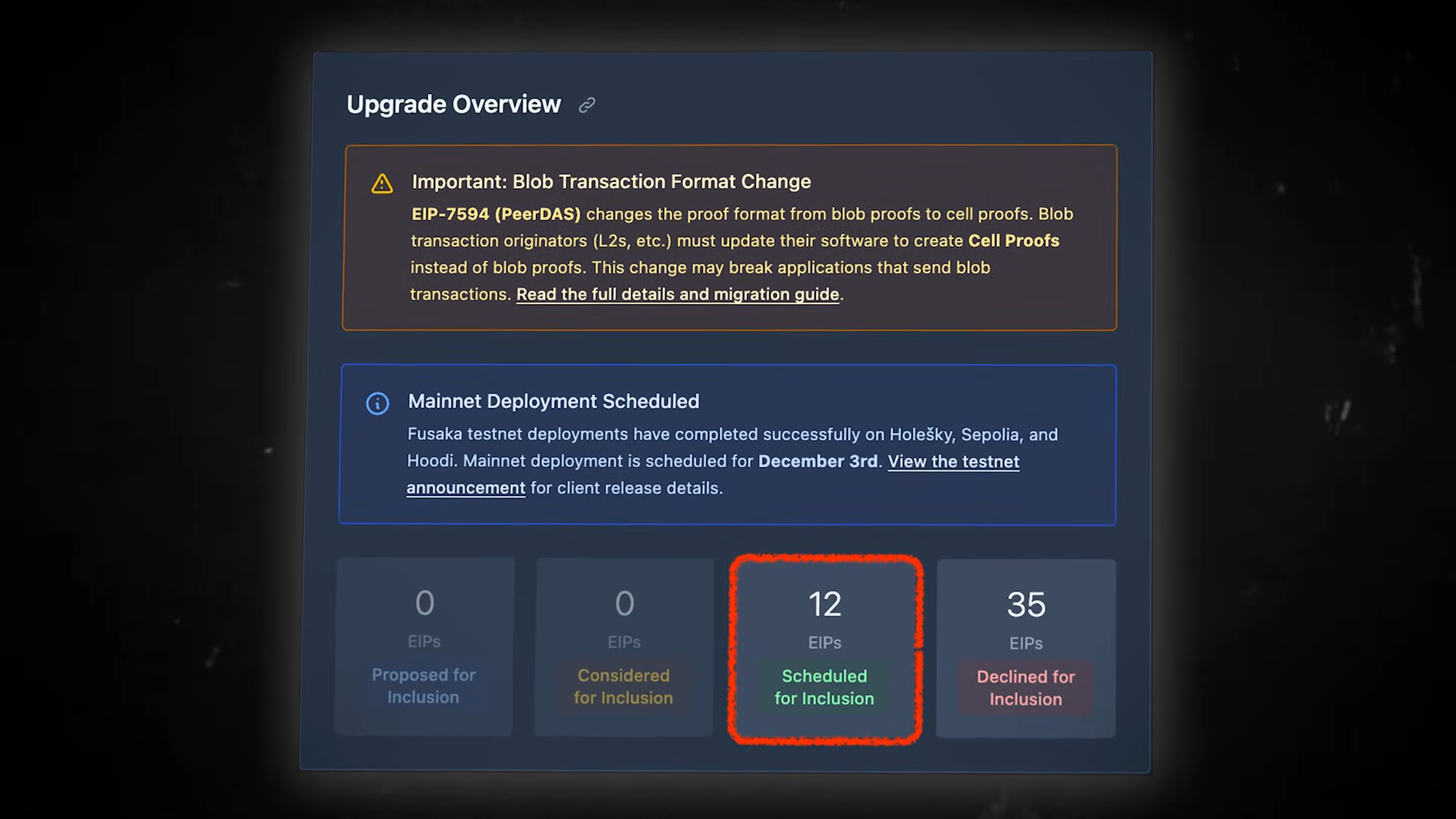

Deployment Status

Fusaka has been successfully deployed on 3 testnets: Hlesi (October 1st), Seapoleia (October 14th), Hoody (October 28th). All deployments went smoothly. The mainnet launch was postponed from early November to December 3rd. Delays are also a tradition in Ethereum!

Technical Details of the Upgrade

In short, Fusaka implements 12 improvements, known as Ethereum Improvement Proposals or EIPs. Each EIP addresses a specific technical aspect of the Ethereum network, collectively aiming to enhance Layer 1 scalability, i.e., scaling Ethereum itself.

Let’s look at each EIP and its contribution. Be warned, it might get a bit technical, but we’ll try to simplify. For clarity, we’ll proceed in numerical order.

Significance of Fusaka for Ethereum’s Future

Unlike previous upgrades with visible user-facing improvements, such as smart wallets, Fusaka enhances Ethereum’s internal data processing.

While this might seem subtle now, in the long run it will improve scalability and security - key factors for the institutional adoption of ETH. Fusaka also brings Ethereum closer to solving Vitalik Buterin’s blockchain trilemma, balancing security, decentralization, and scalability.

The 12 EIP Upgrades

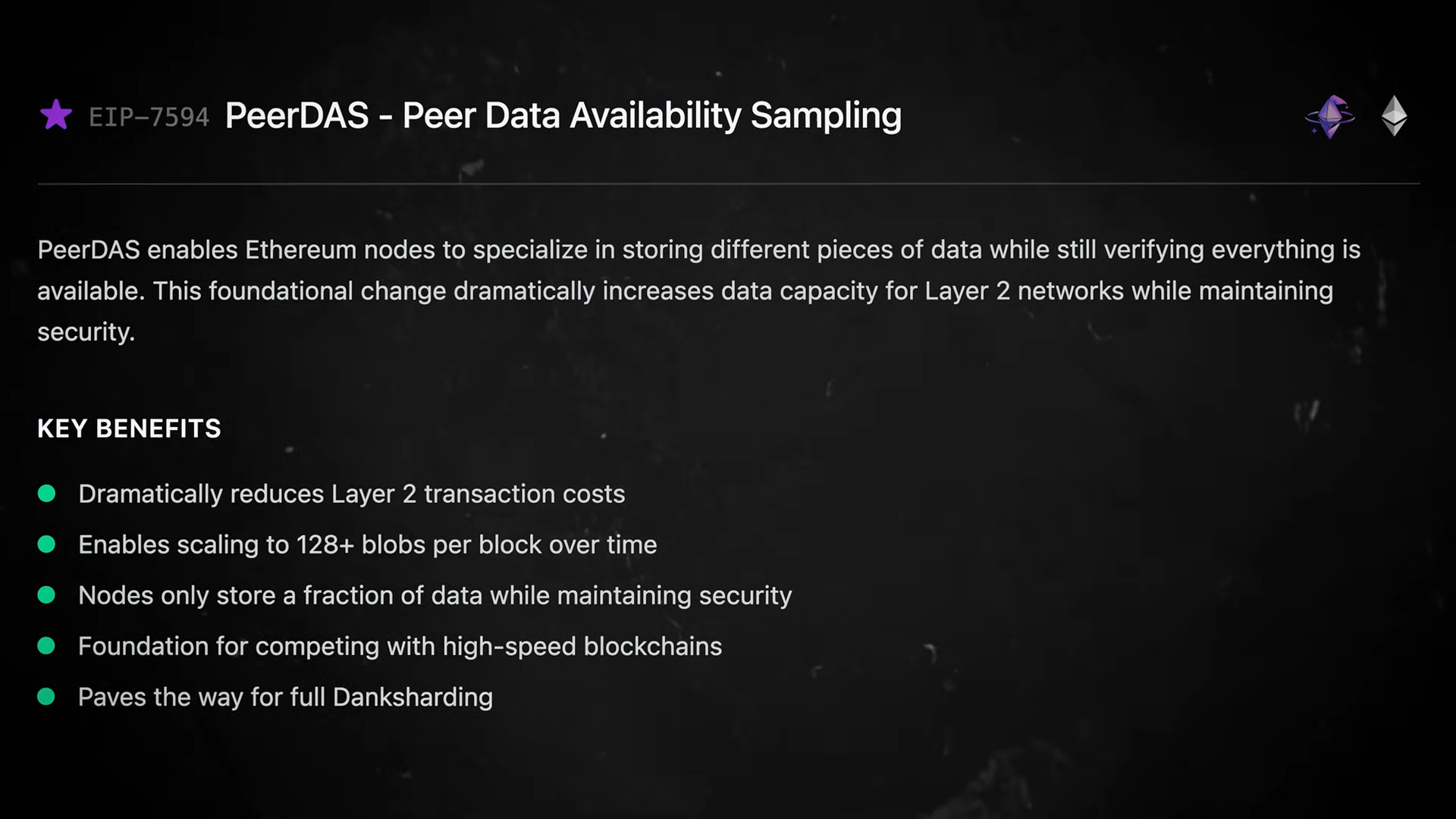

EIP-7594 (PeerDAS)

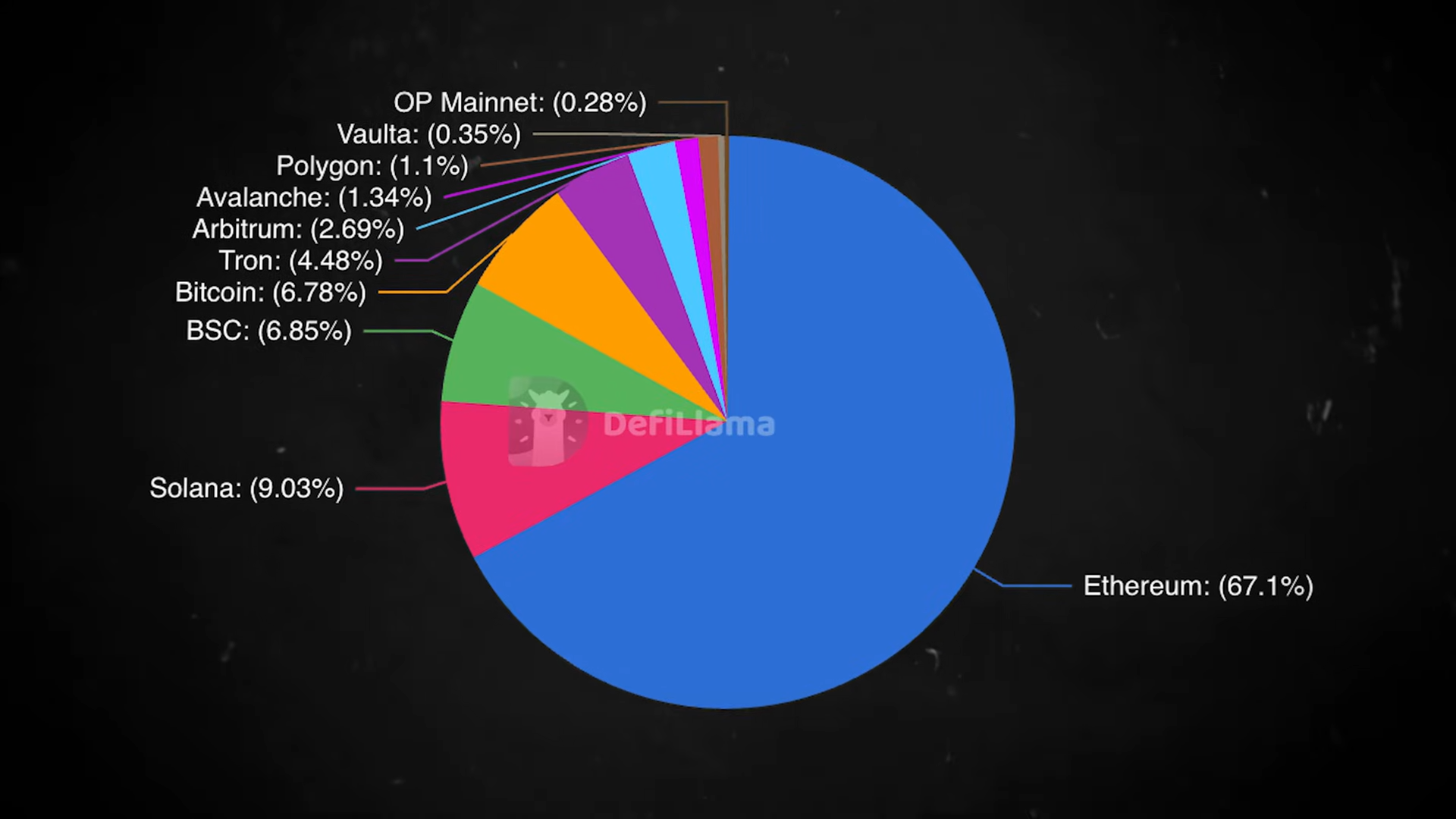

The first upgrade is EIP-7594, known as PeerDAS. This is the “star of the show”. PeerDAS allows Ethereum nodes to store only a portion of the data when verifying a transaction. This increases data throughput for rollups, reduces transaction costs, and lays the foundation for Ethereum to compete with faster blockchains, for example, with Solana.1

EIP-7642

Optimizes the way data is transmitted and stored on the network. It makes the process more efficient by eliminating outdated and unnecessary data.2

EIP-7823

Prevents certain types of Denial-of-Service (DOS) attacks and also introduces more consistent gas pricing and predictable costs for Layer 2 smart contracts.3

EIP-7825

Introduces a per-transaction gas limit to prevent a situation where a single transaction occupies most of the block space, enhancing network fairness, stability, and block validation time predictability.4

EIP-7883

Makes the network more economically sustainable and prevents abuse by malicious actors using underpriced operations.5

EIP-7892

Gives Ethereum more flexibility to meet the growing data demands of Layer 2 solutions and helps developers plan for scaling more predictably.6

EIP-7917

Allows validators to know in advance who will propose future blocks, instead of finding out at the start of each epoch, improving efficiency.7

EIP-7918

Reduces sharp fee spikes and prevents the collapse of the blob fee market.8

EIP-7934

Protects the network from excessively large blocks that could cause congestion or instability and ensures consistency with consensus-layer limits.9

EIP-7935

Directly increases the mainnet’s throughput, reducing transaction queues and speeding up confirmations.10

EIP-7939

Makes Ethereum faster and cheaper to use and is particularly favorable for zero-knowledge functionalities.11

EIP-7951

Finally, the 12th upgrade allows Ethereum to verify signatures from devices like iPhones, Android phones, and hardware wallets, improving Ethereum’s integration with existing Web2 infrastructure.12

The Role of EIP-7594 (PeerDAS)

PeerDAS solves the data availability problem for Layer 2 rollups. Rollups batch transactions together, but nodes still had to download all the data for verification, creating a bottleneck and a threat to decentralization. PeerDAS allows nodes to verify random chunks of data instead of the full set, eliminating the bottleneck and making running a node more accessible.

However, it creates a 3-tier system with super-nodes (full data), which could become concentrated among large operators.

Some Ethereum developers have expressed concerns that this concentrates the full data layer in the hands of a few large players, while others argue the design is safe because the system only relies on their availability, not on trusting them.

Additional Benefits

Beyond PeerDAS, Fusaka also introduces changes that make Layer 1 transactions faster and cheaper. This means more activity on Ethereum and, consequently, greater demand for ETH.

Fusaka’s focus on scalability might even reduce the need for some users to rely on Layer 2 solutions, further stimulating demand for ETH on Layer 1.

Fusaka also makes application development more efficient by providing greater flexibility and lower costs, encouraging long-term innovation on Ethereum. It also improves the user experience on Ethereum, which will contribute to its long-term adoption.

After all, signing transactions with Face ID or phone biometrics is much easier than manually confirming transactions with unreadable strings of code. Thus, collectively, Fusaka makes Ethereum’s future bright and, potentially, positive for the price of ETH.

The Impact of Forks on ETH’s Price: Historical Context

Now the question arises: how could Fusaka affect the price of ETH? The answer can be found by looking at ETH’s price reaction to previous upgrades. After all, history doesn’t repeat itself, but it often rhymes.

Judging by the price reaction to past upgrades, before The Merge, the price of ETH rose by 57%, but after it, it fell by 24%.

Before the Shapella upgrade, the price jumped 35%, then rose 11% after launch, but later fell by 13%.

Before the Dencun fork, the price increased by 84%, and after the upgrade, it fell by 25%.

Pectra followed a price drop of over 60%, but a month before deployment, ETH rose 23%, and then 50% after launch. Fusaka could repeat this pattern with a run-up before and a possible correction after, affecting the price through improvements and increased staking.

Fusaka Forecast

So, what does this mean for Fusaka? Simply put, it seems that Fusaka could be a turning point and help launch a solid recovery rally for ETH.

The question of whether this can push ETH to new all-time highs remains debatable, and let’s face it, in current market conditions, it’s unlikely!

If history teaches us anything, it’s more likely that we’ll see a modest recovery in ETH as Fusaka brings back optimism to Ethereum enthusiasts, followed by another sell-off when the hype dies down.

However, this time there is a difference, and it lies simply in the fact that ETH is well-positioned to outperform BTC and most altcoins in the short and medium term, regardless of what happens with Fusaka. Nevertheless, we wouldn’t be surprised if Fusaka becomes the catalyst that triggers an upward trajectory for ETH, or the catalyst that marks the end of the upcoming rally.

Alternative Growth Catalysts

So, Fusaka is likely to be a bullish factor for Ethereum and could trigger an ETH rally. Skepticism is also understandable due to recent price volatility.

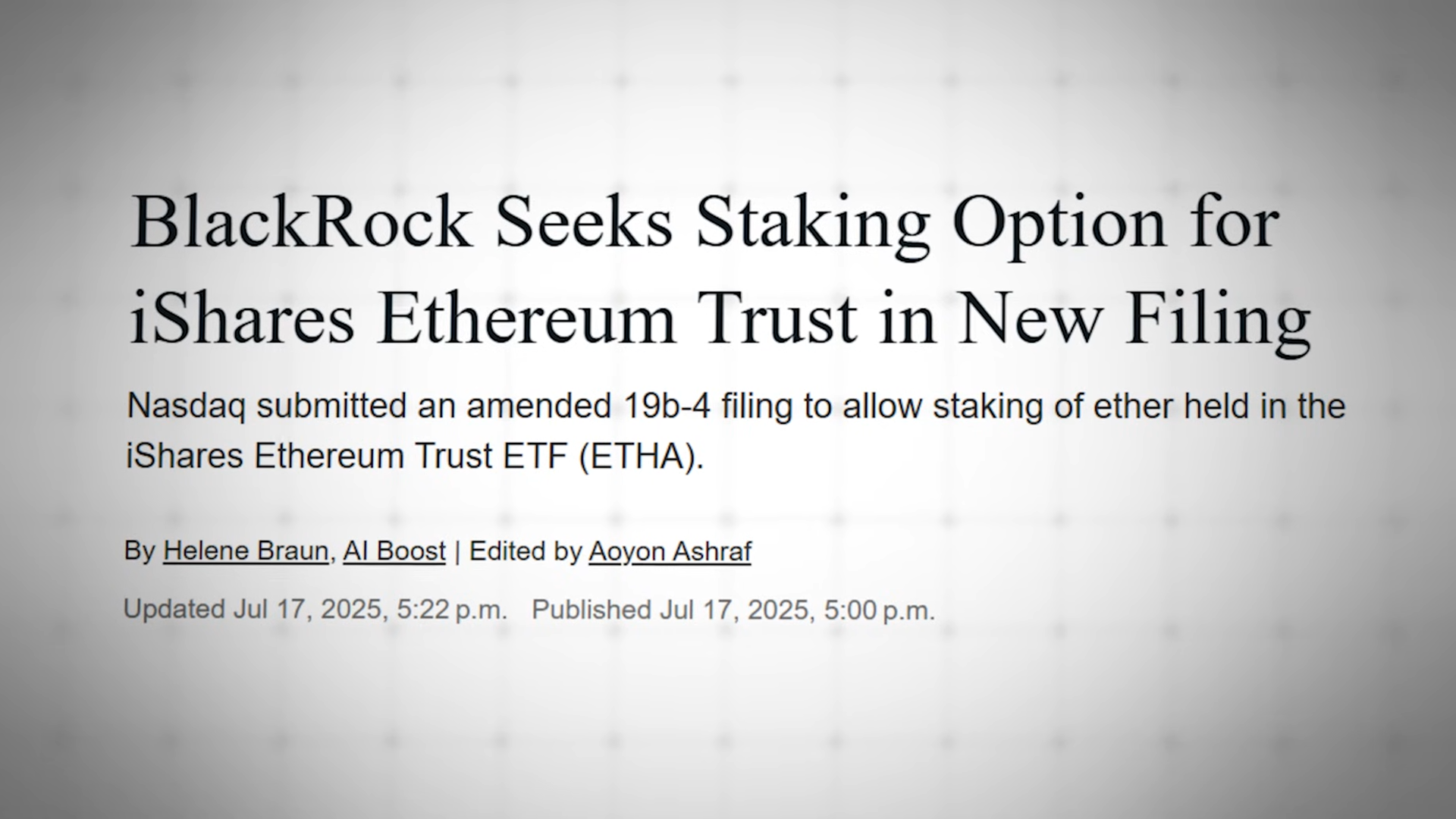

But another major anticipated event is Ethereum staking ETFs, which would allow institutional investors to earn additional yield.

Major asset managers like BlackRock and Fidelity have already filed for such ETFs. In principle, these ETFs could be approved quickly and attract significant capital.

Focus on Institutional Adoption

Ethereum is focused on institutional adoption. In January of last year, they launched Ether Realized to promote Ethereum on Wall Street, and recently the Ethereum Foundation created a website for large investors, positioning Ethereum as a reliable blockchain for asset tokenization, DeFi, and stablecoins. This amplifies the hype around ETH and influences its price.

After Fusaka, the Glamsterdam upgrade is expected in the first half of 2026 to improve resilience and scalability.

An SEC initiative to create a regulated sandbox for crypto businesses is also expected, which would bring additional innovation and support Ethereum’s market dominance.

Potential Challenges and Risks

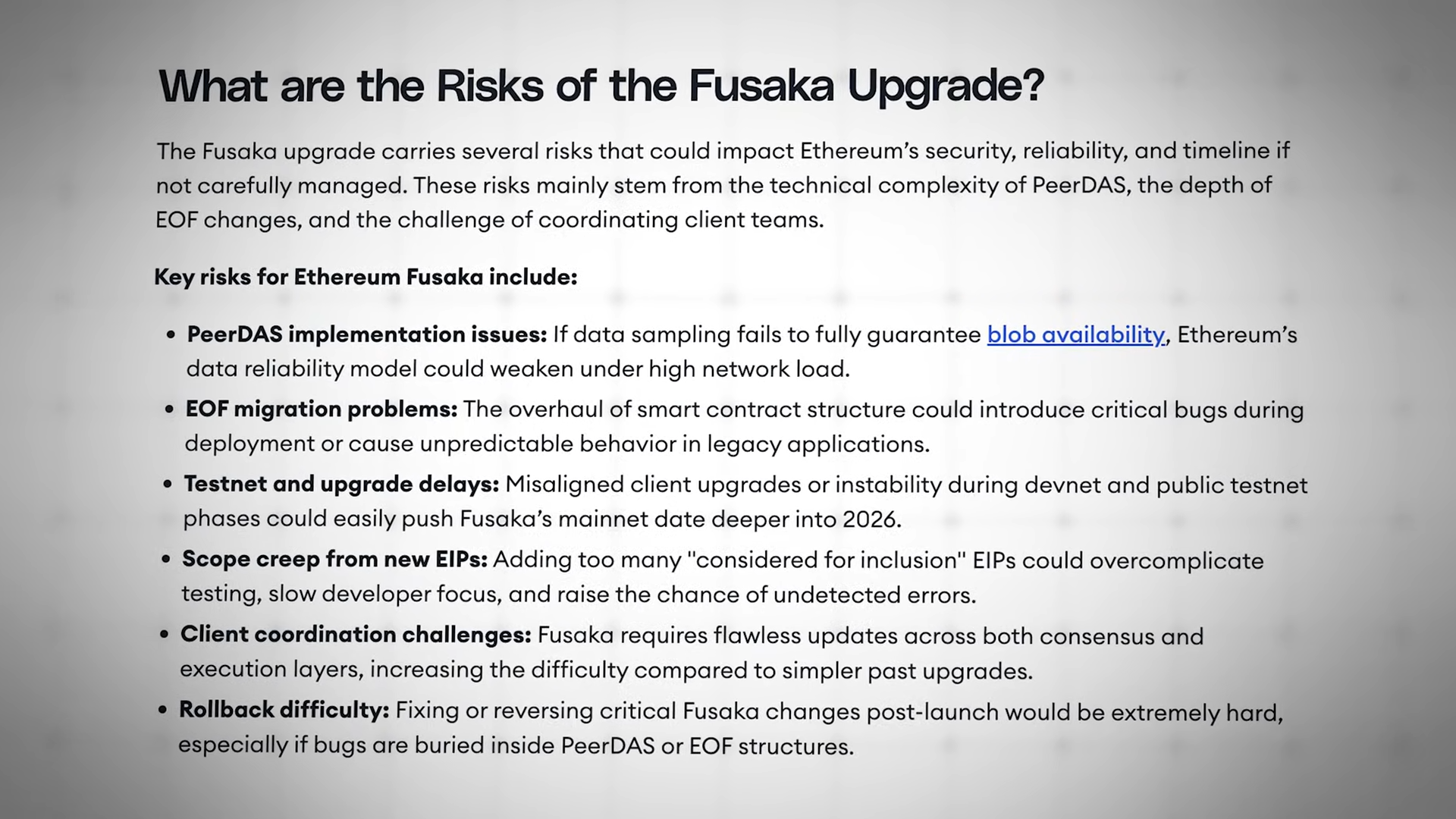

Ethereum is poised for growth even without Fusaka, but its success depends on a bullish crypto and macro environment. The main risk is potential bugs and technical issues during the Fusaka launch, which could undermine investor confidence.

The upgrade works “under the hood” and might not generate enough hype for new all-time highs. If there are problems with PeerDAS or client coordination, it could delay scaling and reduce network reliability. Overall, Fusaka is an important step, but its success is not guaranteed.

Additional Downward Pressure

Ethereum is facing pressure from treasury companies that recently sold part of their ETH reserves after a major $20 billion liquidation on October 10th, adding to the downward pressure.

However, ETH has likely bottomed and could outperform Bitcoin and altcoins in terms of growth.

Bitcoin’s dominance has been declining since July, indicating growing interest in altcoins, where ETH will be a leader. Fusaka could be a bullish catalyst, supporting a positive sentiment towards ETH despite recent volatility.

Criticism

Implementing a complex upgrade like the Fusaka hard fork carries technical risks. Any undetected bugs in the code or deployment issues on the mainnet could lead to network disruptions, which would immediately undermine the confidence of both retail investors and institutional partners, for whom reliability is a key criterion.

Despite significant technical improvements, Fusaka is primarily an under-the-hood upgrade, offering no instant, noticeable changes for the average user. This creates the risk that the upgrade will fail to generate sufficient market hype needed for sustainable price growth and could turn out to be a non-event in the short term, especially against the backdrop of potential adverse macroeconomic conditions.