Cryptocurrency: what it is, how it works and use cases

This article breaks down what it is, how it works, what types of cryptocurrency exist, the pros and cons, and use cases. Learn the basics and understand cryptocurrency simply!

Definition

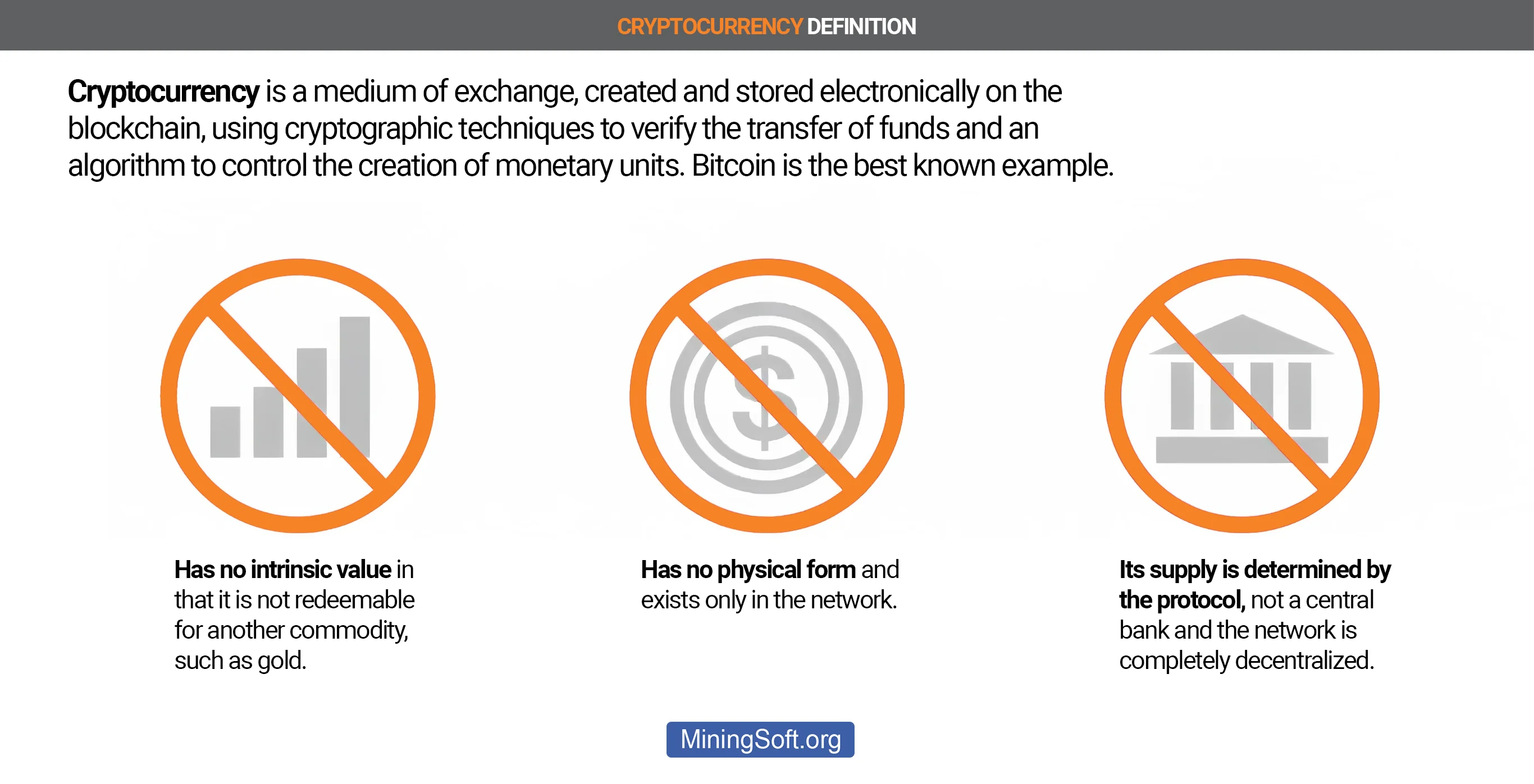

Cryptocurrencies are encrypted digital currencies that are created and stored electronically. They can be spent like regular money, but can also be used to buy and sell other digital currencies.

Virtual money has no material equivalent and is a record in a special database (blockchain). The base is very reliable, and the technology built on it, perhaps, gives humanity even more value than the coin itself.

Simply put, cryptocurrency is digital money created from code using mining farms or validators. The balances of the owners are stored in the ledger (register), which is distributed on many independent computers. This means that the blockchain registry does not belong to one person or organization, but exists as a complete copy on a large number of devices.

When a new transaction is made, it is verified by every computer in the blockchain network and then validated. This makes any falsification almost impossible.

Is there a physical cryptocurrency?

Think of cryptocurrency like owning a piece of land. You may not physically own it, but your ownership is recorded in the local government ledger. In the event of a dispute, you can enter your name on the ledger as the registered owner to prove that you bought and own the land.

Only in the case of digital assets, you do not need to confirm the ownership in the local government or in the bank.

Decentralization rules everything here, not banks.

Important terms and brief explanations

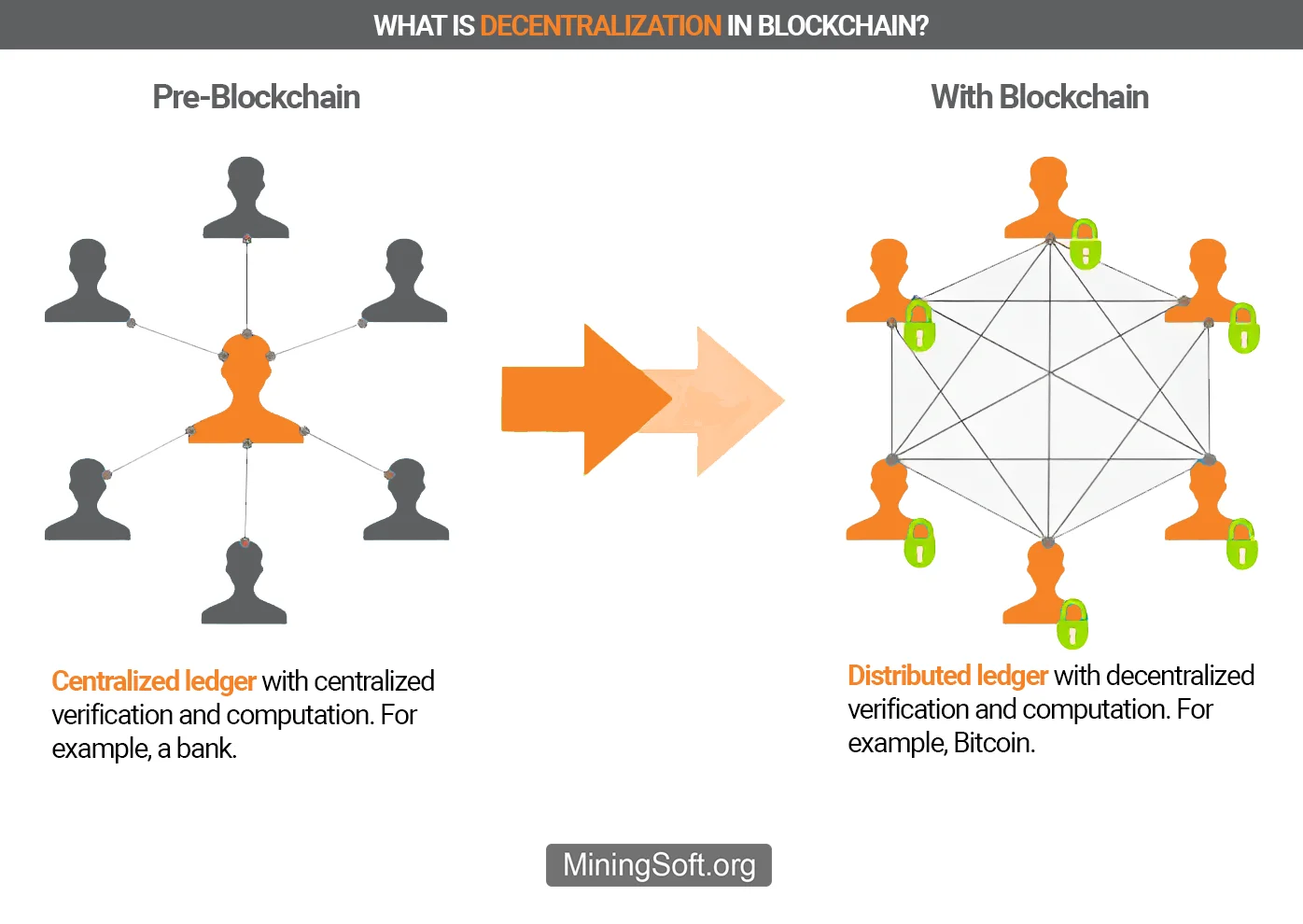

What does decentralized cryptocurrency mean?

- Decentralization

- With decentralization, no one person or group has control - instead, all users collectively retain control. Decentralized blockchains are immutable. This means that the entered data is irreversible.

- Decentralized

- The term means that the decision is made at different nodes. Each node determines its behavior, which ultimately affects the behavior of the entire system. This ensures that no node has complete system information.

Cryptocurrencies are actively implementing decentralized and distributed systems in their favor. All popular digital assets have these characteristics.

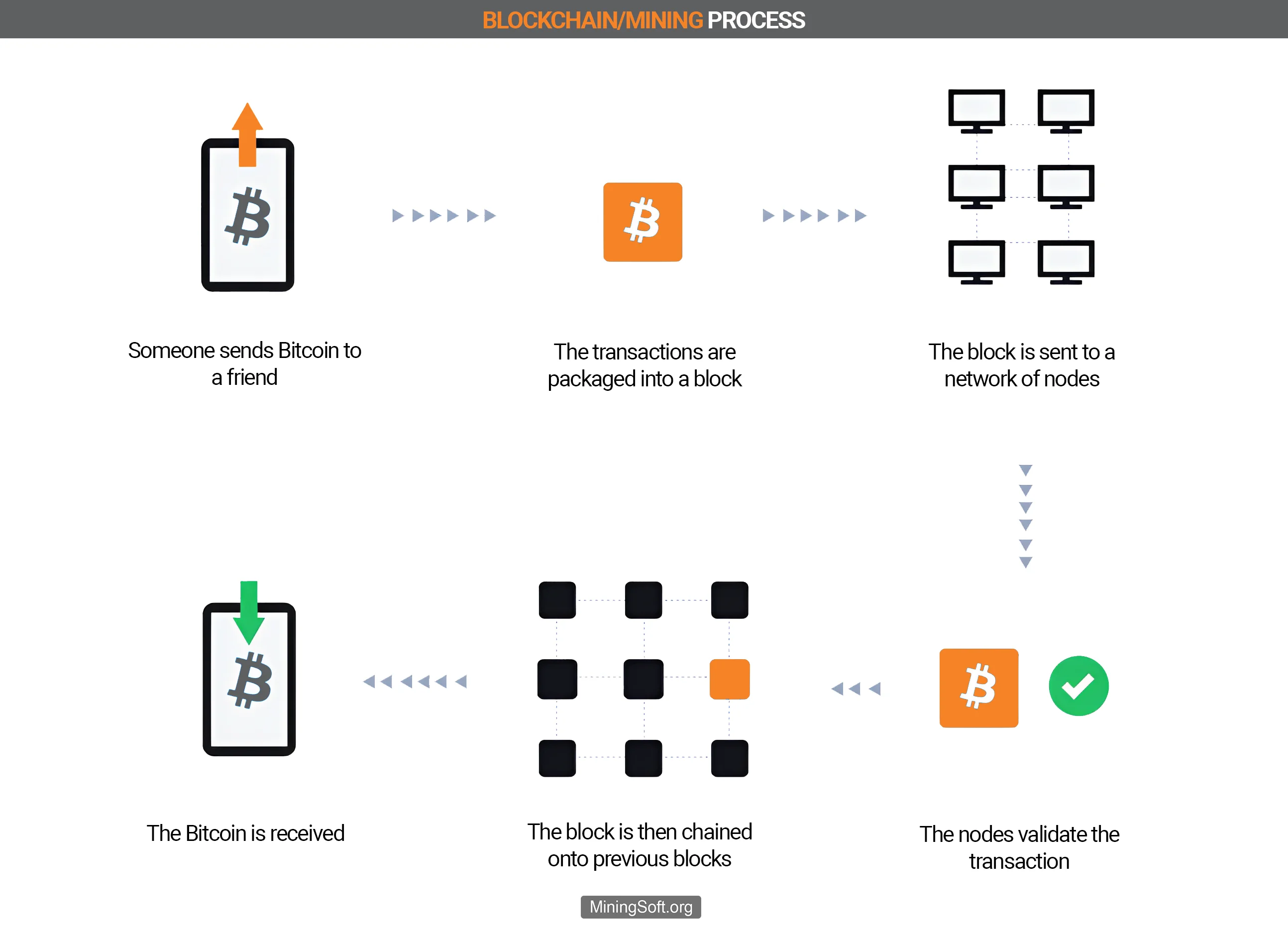

Principle of operation

Let’s take a look at how cryptocurrencies work. Digital currencies run on the blockchain. It makes transactions with virtual currencies especially secure. You can think of it as a log containing every cryptocurrency transaction. To protect against attacks, transaction data is distributed decentralized across multiple computers (nodes) that form a peer-to-peer network.

Several transactions are combined into an encrypted data block. If it is full, it closes and can no longer be changed. Block by block, a chain is created that exists in the same way on all computers on the network. If someone tries to manipulate the chain on one of the computers, they will be blocked.

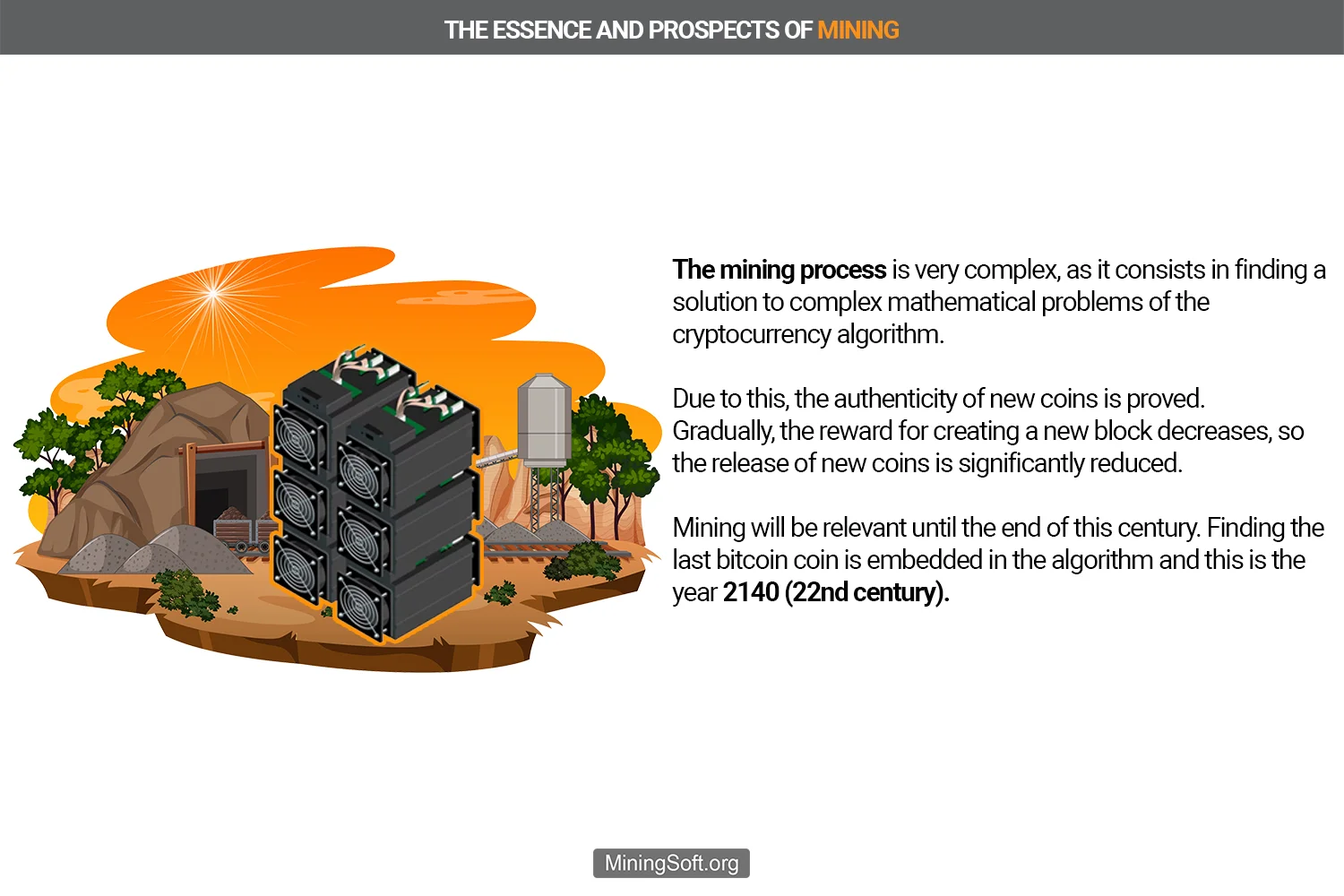

Mining: how blocks are added to a blockchain

Main article: How mining works

To process, secure and synchronize the growing number of transactions on the network requires huge computing power. If you lend your computing power to this “mining” process, you will be rewarded with coins. However, mining consumes a huge amount of electricity - as much as the Netherlands in a year.

New coins are generated in the process of mining, i.e., deciphering the tasks for issuing coins.

In this way, coins are created by a network of participating users (miners). They are needed to decrypt cryptographic tasks for issuing tokens and coins.

Transactions in progress are checked for validity by thousands of computers on the network, verified and stored in a decentralized manner.

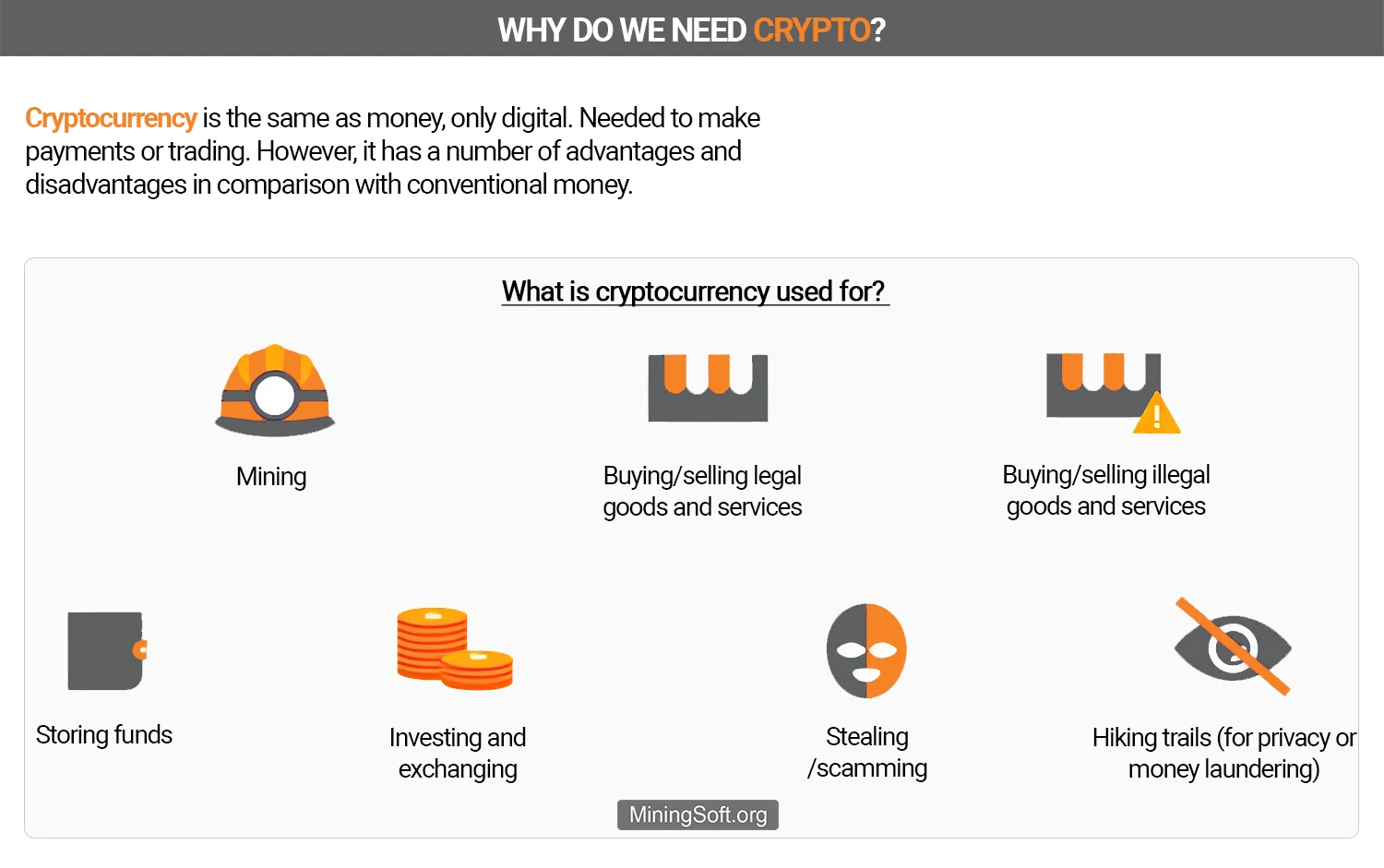

Usage

Cryptocurrencies are designed to operate as independent, decentralized and cryptographically encrypted payment systems. The goal is to create better and more secure means of payment. Unlike official currencies, most cryptocurrencies are decentralized and usually limited in number. Some of them can also be used anonymously.

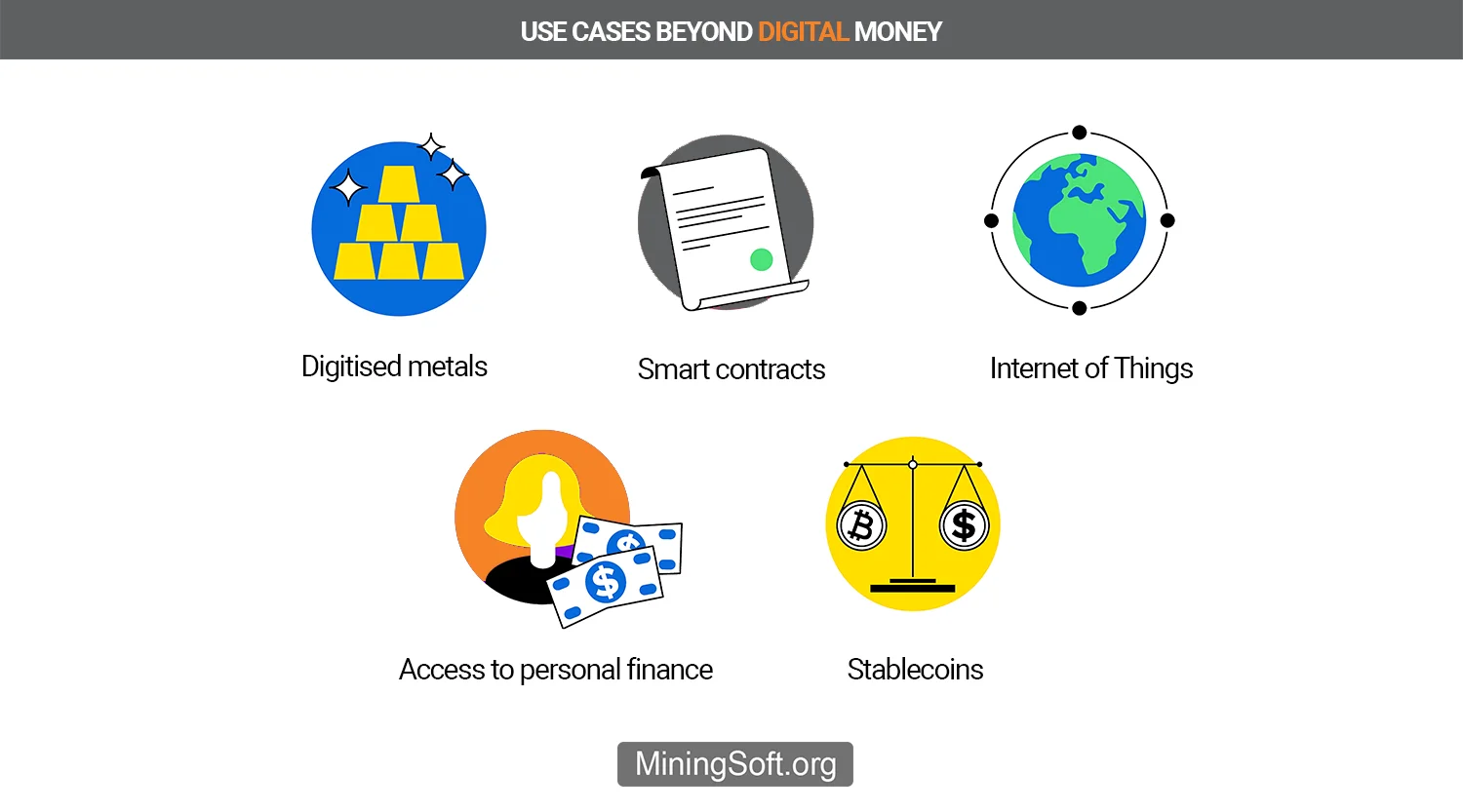

Cryptocurrency is needed for:

- Access to personal finance,

- conclusion of smart contracts,1

- use of the Internet of things,

- digitization of metals,

- stablecoins,

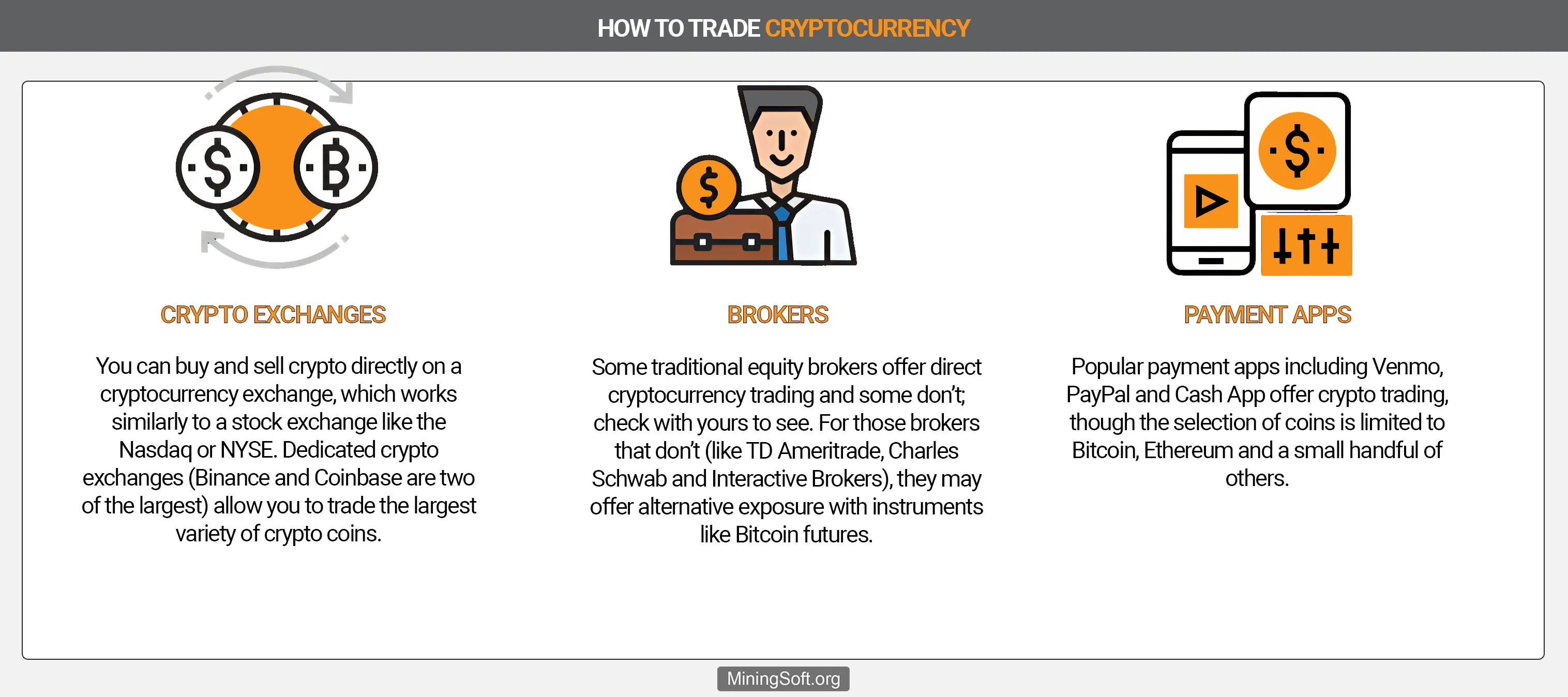

- crypto money can be traded on special exchanges or through crypto brokers.

In general, the use of cryptocurrencies as a means of payment is declining and banned in some countries.

Several companies accept payment with bitcoins. In most cases, online payment is accepted. Restaurants, cafes and shops are the exception rather than the rule. To be able to pay at the checkout, a corresponding QR code is usually required.

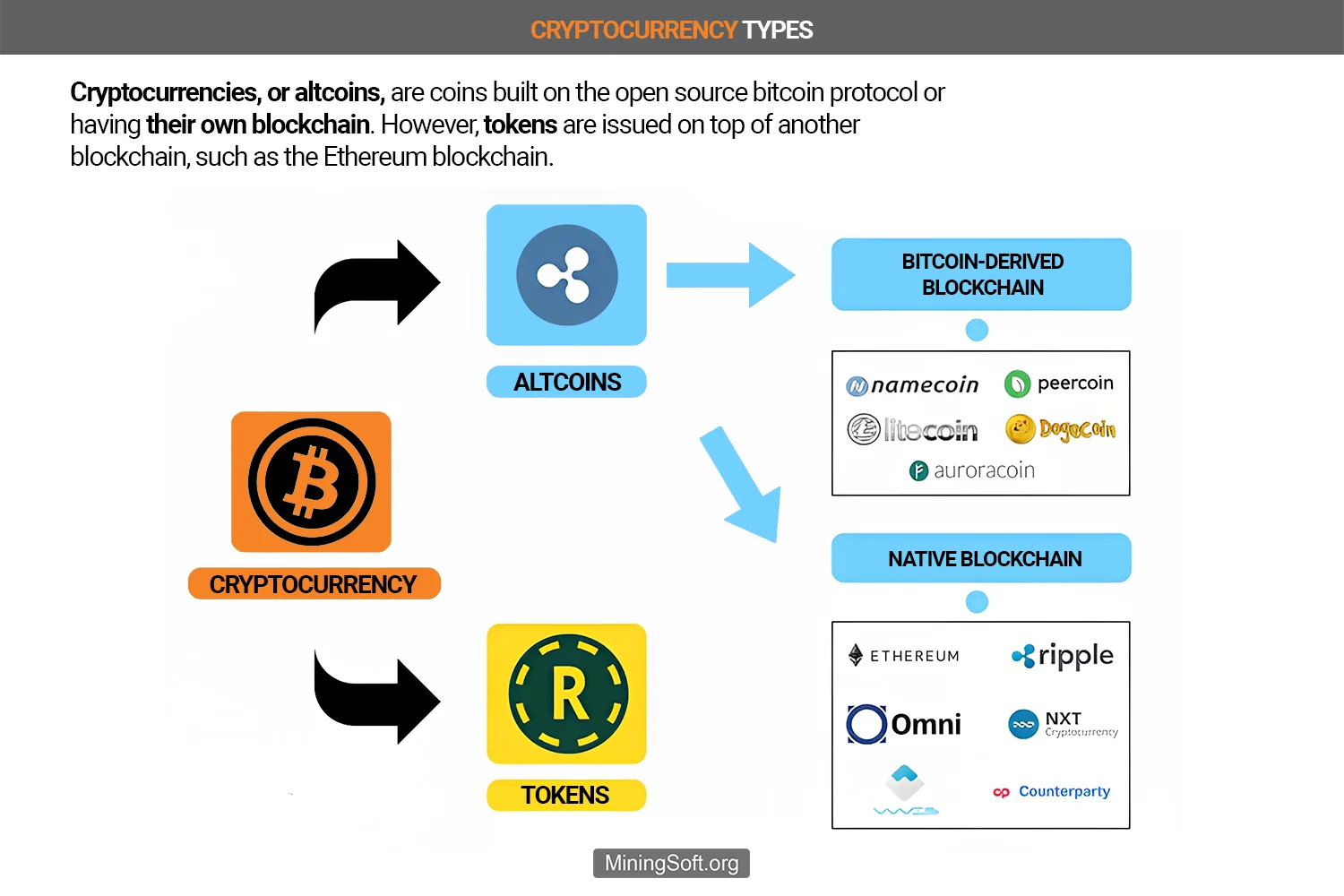

Types

Main article: How Bitcoin works

Bitcoin is the most famous of the virtual currencies. Since it was developed in 2009, its cost has skyrocketed. If you had bought Bitcoins for little money then, you would be a millionaire today.2

What are all the different types of cryptocurrency?

Classic cryptocurrencies on the blockchain that change their value as a result of the interaction of supply and demand . Examples: bitcoin, ethereum.

Stable coins with a certain fixed value - the rates never change here. For example, Tether USDT.

Tokens - coins that do not have their own blockchain. They exist as part of an ecosystem of another network.

Meme coins - comedians of the crypto world. These coins are gaining popularity thanks to memes and social networks.3

Alternative coins (altcoins).

Altcoins

Contrary to what the name might suggest, altcoin is not one single cryptocurrency that bears that name. The “ALT” part of the word does not refer to any one new virtual currency such as “BIT” in Bitcoin. The word “alto” comes from the word “alternative”.

Altcoin refers to all cryptocurrencies developed after bitcoin.

Thus, altcoin is an alternative to the first digital currency. For example, Ethereum is considered an altcoin.

Cryptocurrency can be called an altcoin only if certain requirements are met, which BTC also has. This requirement is simply called: blockchain. Only cryptocurrencies that are also based on the same technology as Bitcoin can also be called an alternative to Bitcoin.

This point is important for distinguishing an altcoin from a cryptocurrency.

Promising

In the years since the first bitcoin transaction in 2009, thousands of additional cryptocurrencies have emerged, creating a confusing environment for investors. Some of these altcoins feature major technical innovations that set them apart from Bitcoin, while others have simply become popular digital currency brands and social media memes.

Cryptocurrency investing remains highly speculative, but it can be highly lucrative for investors willing to take risks in the hope of big payouts.4

Ethereum (ETH)

The next major digital currency after Bitcoin is Ether. On the Ethereum network, you can enter into smart contracts, that is, digital contracts that come into force after the contractual agreement is fully fulfilled.

- On the market since 2015.

- Much more environmentally friendly due to the update Ethereum 2.0.

- Uses its own blockchain.

- Traded as the leading currency after bitcoin.

Ripple (XRP)

Banks love this cryptocurrency because the payment network works with them and speeds up international bank transfers. Mining is not required - all coins have already been generated. There are 100 billion XRP in total.

- On the market since 2012.

- Considered a classic bridge currency.

- Price fluctuations in the cent range.

Litecoin (LTC)

Bitcoin’s little brother, the efficient Litecoin blockchain can generate more blocks and therefore process more transactions in less time.

IOTA

This network is designed for IoT applications (Internet of Things) and allows transactions between machines or devices. In the future, you can use it, for example, to pay for charging an electric car or to protect e-health data. There are many large companies on the side of IOTA. Instead of a blockchain, there are nodes and a graph system. The project becomes faster and more secure with every connected user.

Cardano (ADA)

The network wants to fix the first problems of other cryptocurrencies by combining their advantages. The project is easier to scale, conduct faster transactions and provide even greater security.

- Created in 2015 by the co-founder of Ethereum.

- More focus on sustainability and interoperability.

- Any scalability.

- Encryption.

- Considered a new generation of cryptocurrencies.

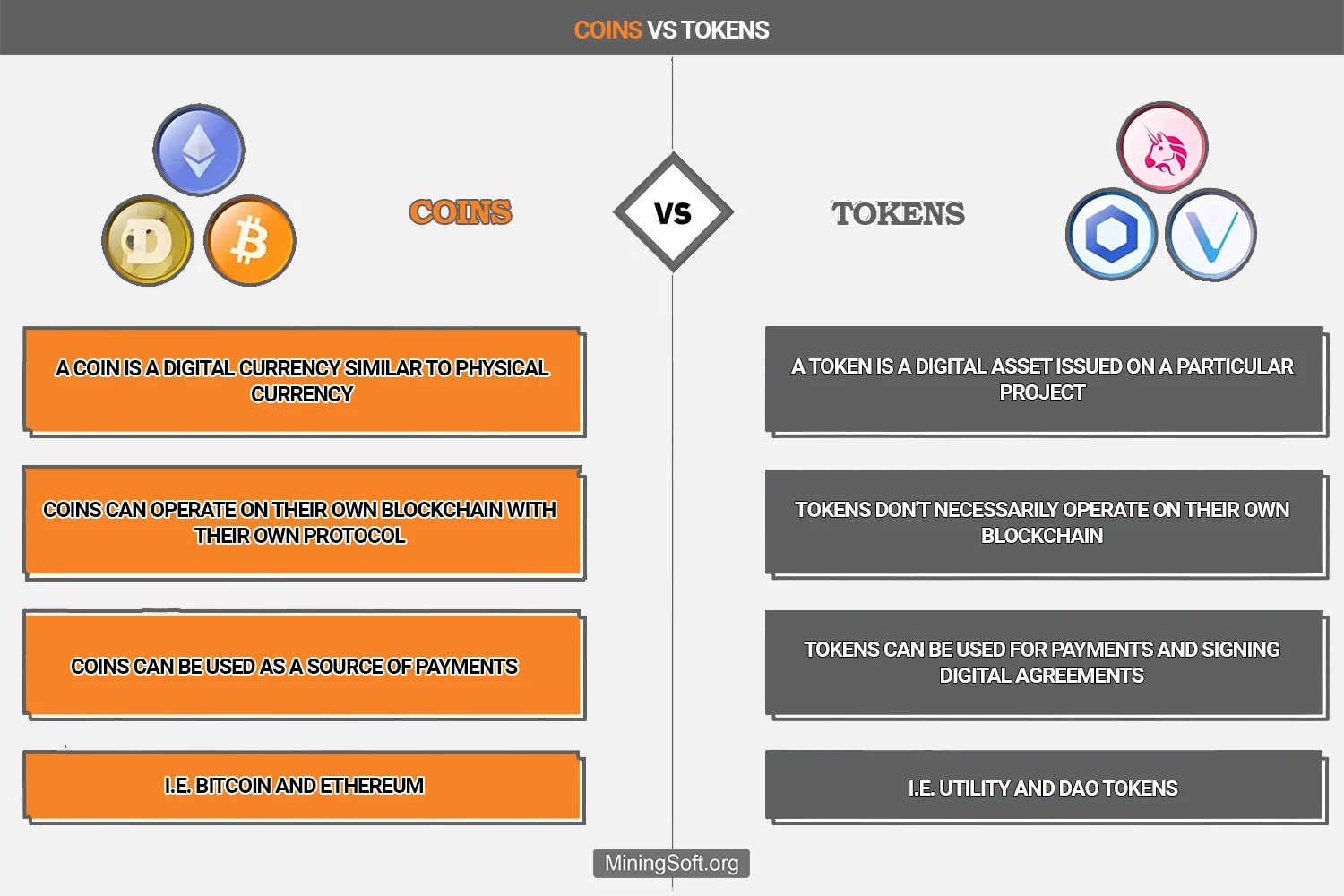

Sometimes you can hear that some altcoins are called tokens. In this case, the term is correct if the altcoin is built on the platform of another coin. For example, tokens Tether (USDT), USD Coin (USDC) or SHIBA INU (SHIB) exist on the Ethereum platform.

Tokens

It is not easy for beginners to recognize the difference between cryptocurrencies and tokens. Tokens are digital assets that are embedded on other blockchains and do not have their own blockchain to run and operate. For example, many of the most popular tokens in the crypto space are built on the Ethereum blockchain and are often referred to as ERC-20 tokens.

Tokens can represent an asset, such as digital art, or provide the holder with a specific service or application access.

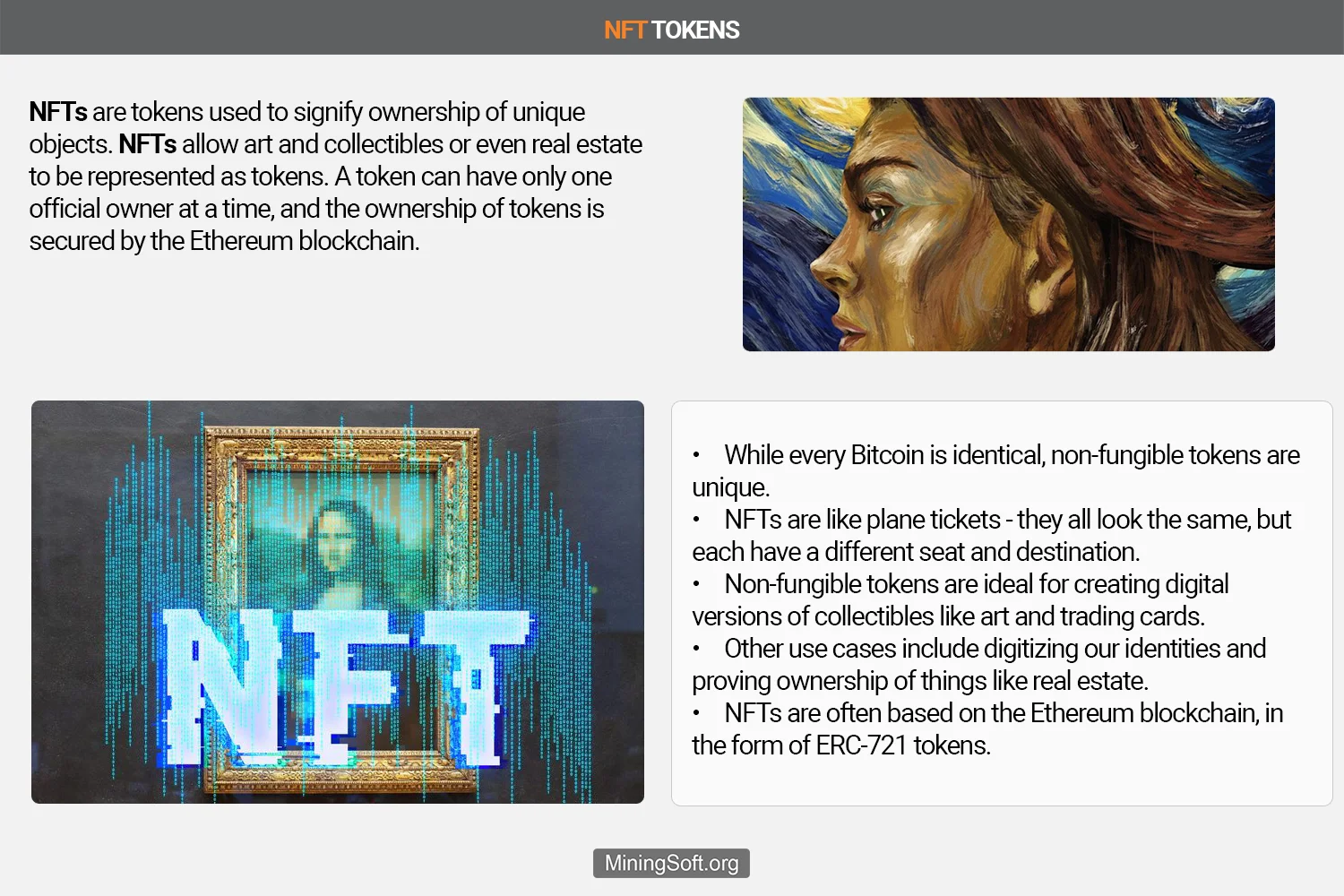

Nft tokens

NFT (English non-fungible token - “non-fungible token”), also a unique token, is a digital entity that represents a specific physical or virtual object in the blockchain, which makes it unique. You can think of it as a painting by a famous artist. No matter how many copies or reprints there are, the original is always unique.

As digital proofs of authenticity, NFTs can display any virtual or real object on the blockchain.

NFTs are best known for the hype surrounding digital art such as GIFs and memes. A reworked version of the popular cat cartoon “Nyan Cat” has been auctioned for the equivalent of around 500,000 euros.5

Meme coins

Meme coins are cryptocurrencies based on a meme - an Internet joke that has become popular. It doesn’t have a purpose behind it like bitcoin wants to make the global financial system fairer.6 They were made for fun.

Memecoins are a group of cryptocurrencies that have no intrinsic utility or function, but simply act as a kind of funny currency. The first meme coin was Dogecoin, which started as a parody of Bitcoin. Many investors showed great interest in the fun currency, and over time, the price has risen significantly.

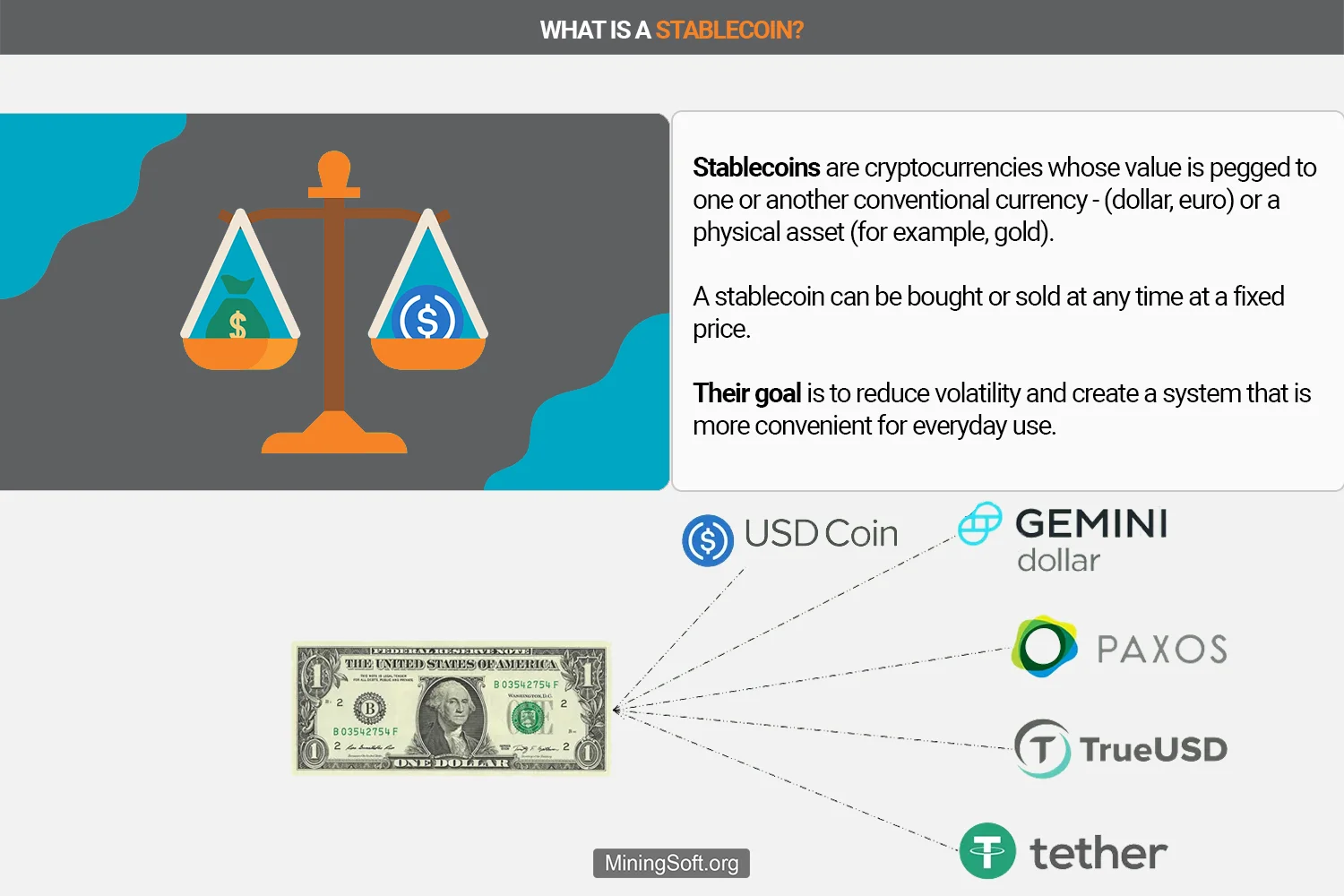

Stablecoins

A stablecoin is a cryptocurrency whose value is pegged to the price of another asset, hence the term “stable”. For example, a dollar-pegged stablecoin should always be valued at 1 USD if it functions properly.7

Tether is a classic example of a stablecoin. The rate remains always stable one to one to the dollar. The circulation is controlled by the company issuing it - Tether Limited and the Bitfinex exchange.

The table provides comparisons of stablecoins with digital assets.

| Cryptocurrencies | Stablecoins |

|---|---|

| Traded algorithmically and without reference to any other currency | All stablecoins are always pegged to different assets (fiat currencies, commodities, etc.). |

| Great growth opportunities | Lower volatility to trade and store value |

| High volatility | Suitable for hedging crypto profits |

| High risk of losing everything | Cheap money transfers abroad are possible |

| Better accumulate interest | |

| No Growth Opportunities Like Traditional Crypto Assets |

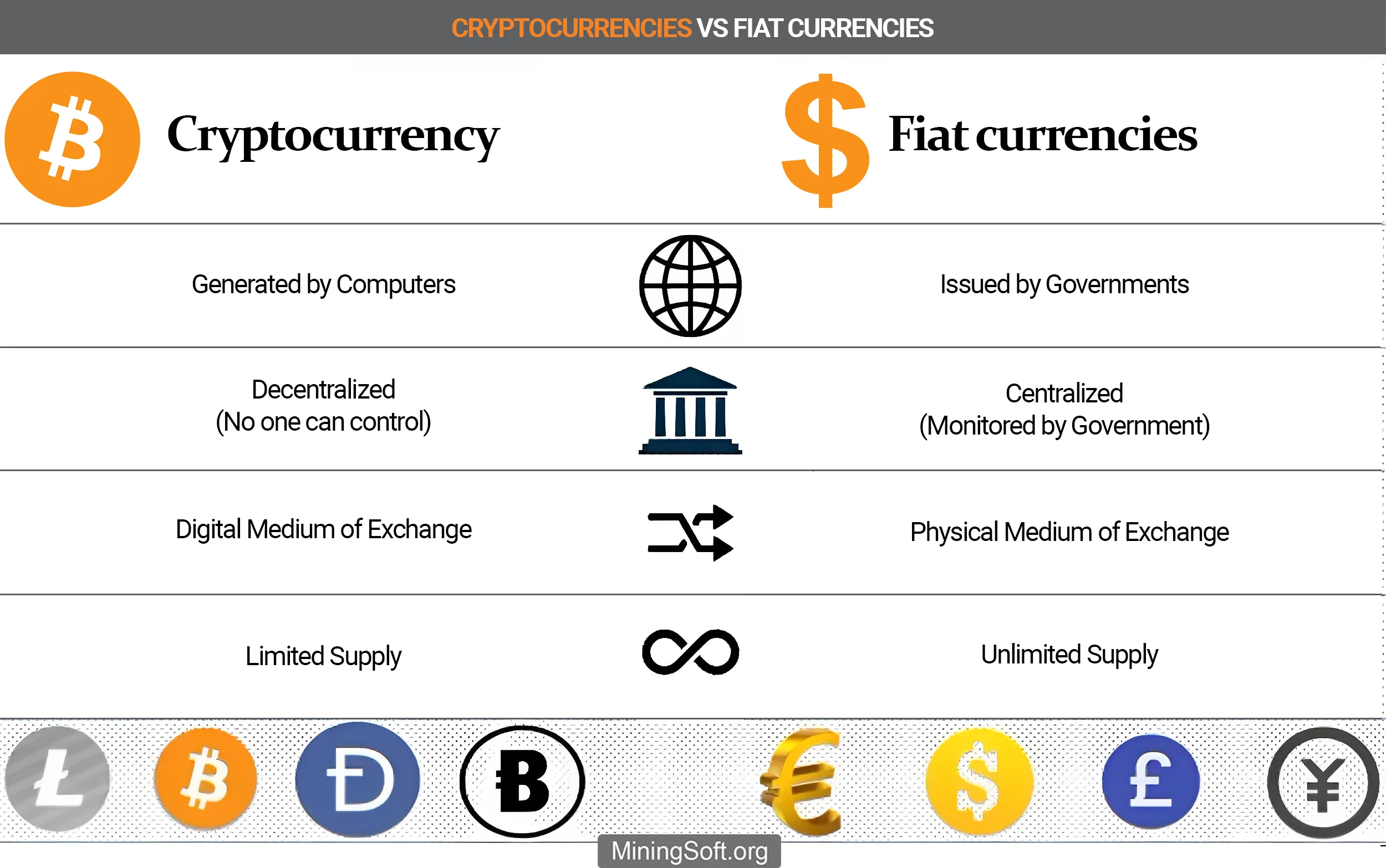

Comparison with fiat money

Fiat currencies, also “Cash” are traditional, paper money that everyone is used to. These currencies are only valuable because the regulators say so, and because the people who use them still believe in their value. Fiat money like dollars can be used to exchange for goods and services.

Let’s compare fiat currencies and digital ones.

| Cryptocurrencies | Fiat currencies |

|---|---|

| Brand new | Well established |

| Can be used anonymously | Not anonymous |

| Have no limits of use | Limited by borders |

| Without inflation (limited release) | Subject to inflation |

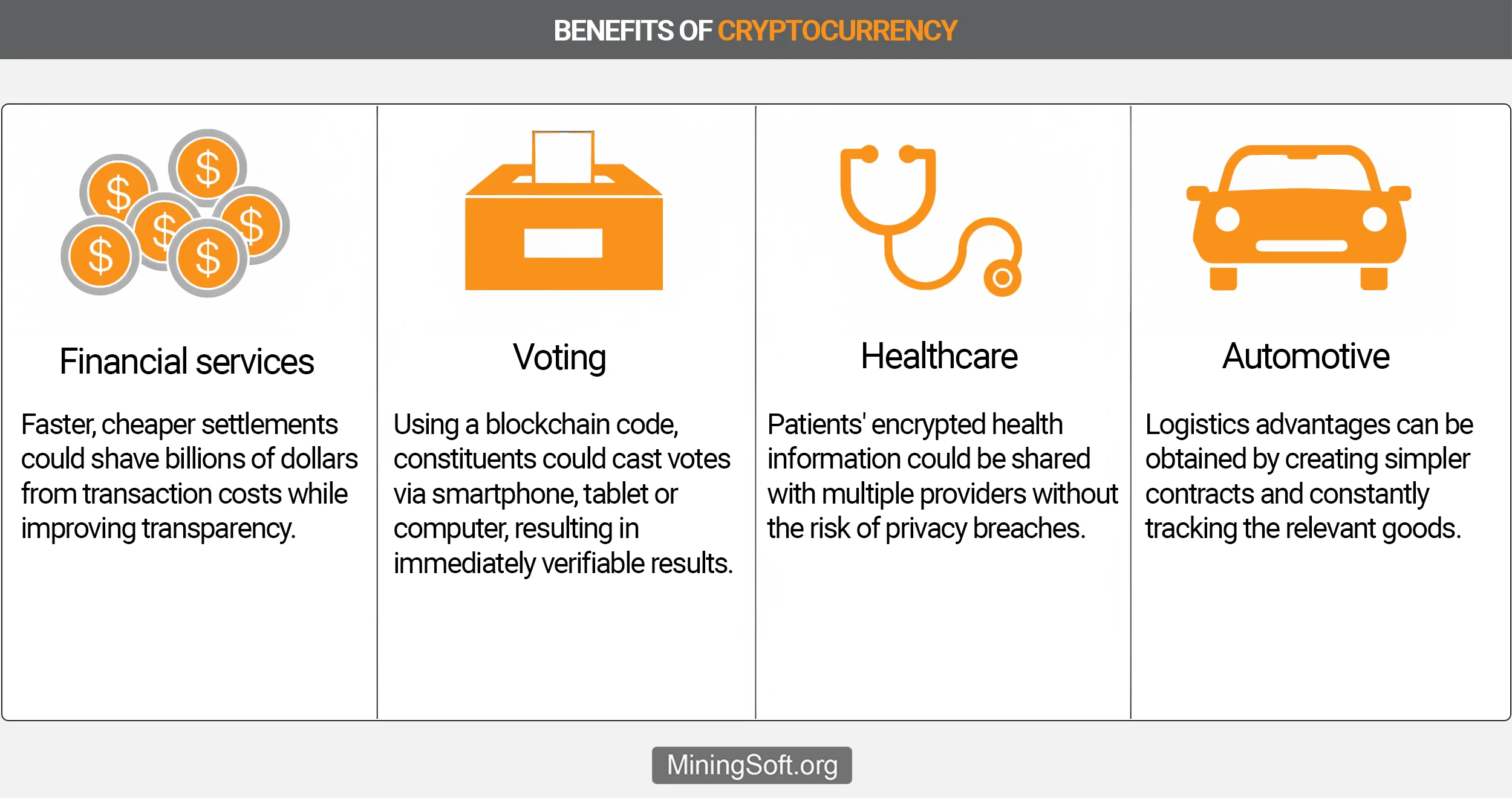

Advantages

Cryptocurrencies, and even more so blockchain technology, can lead to improvements at a fundamental level with the approach to decentralization in various economic and social areas. As a result, entire sectors of the economy can be turned inside out in the long run. Traditional systems will no longer be needed.

The main advantages are the storage and transport of all information in a tamper-proof and fault-tolerant manner.

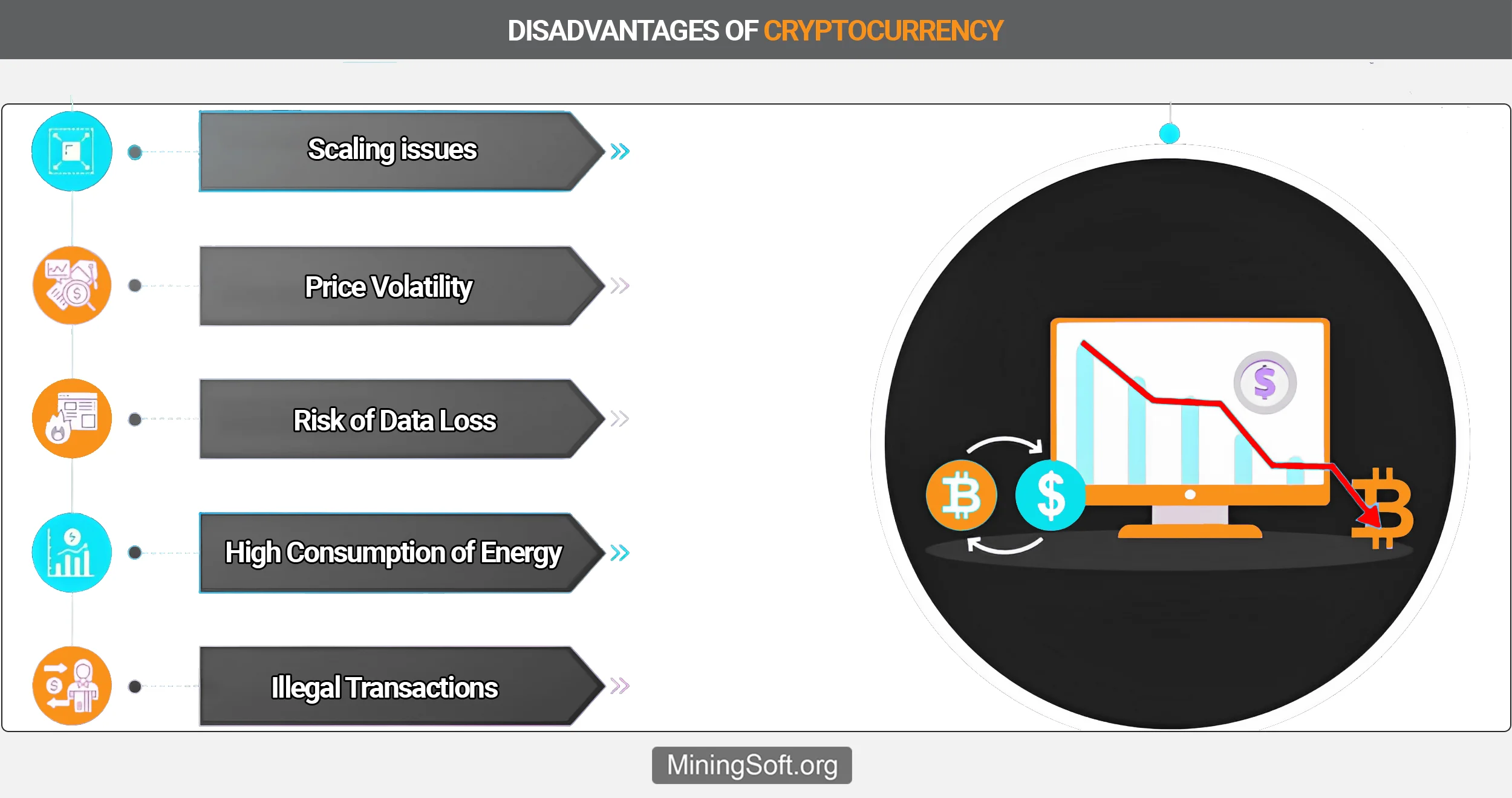

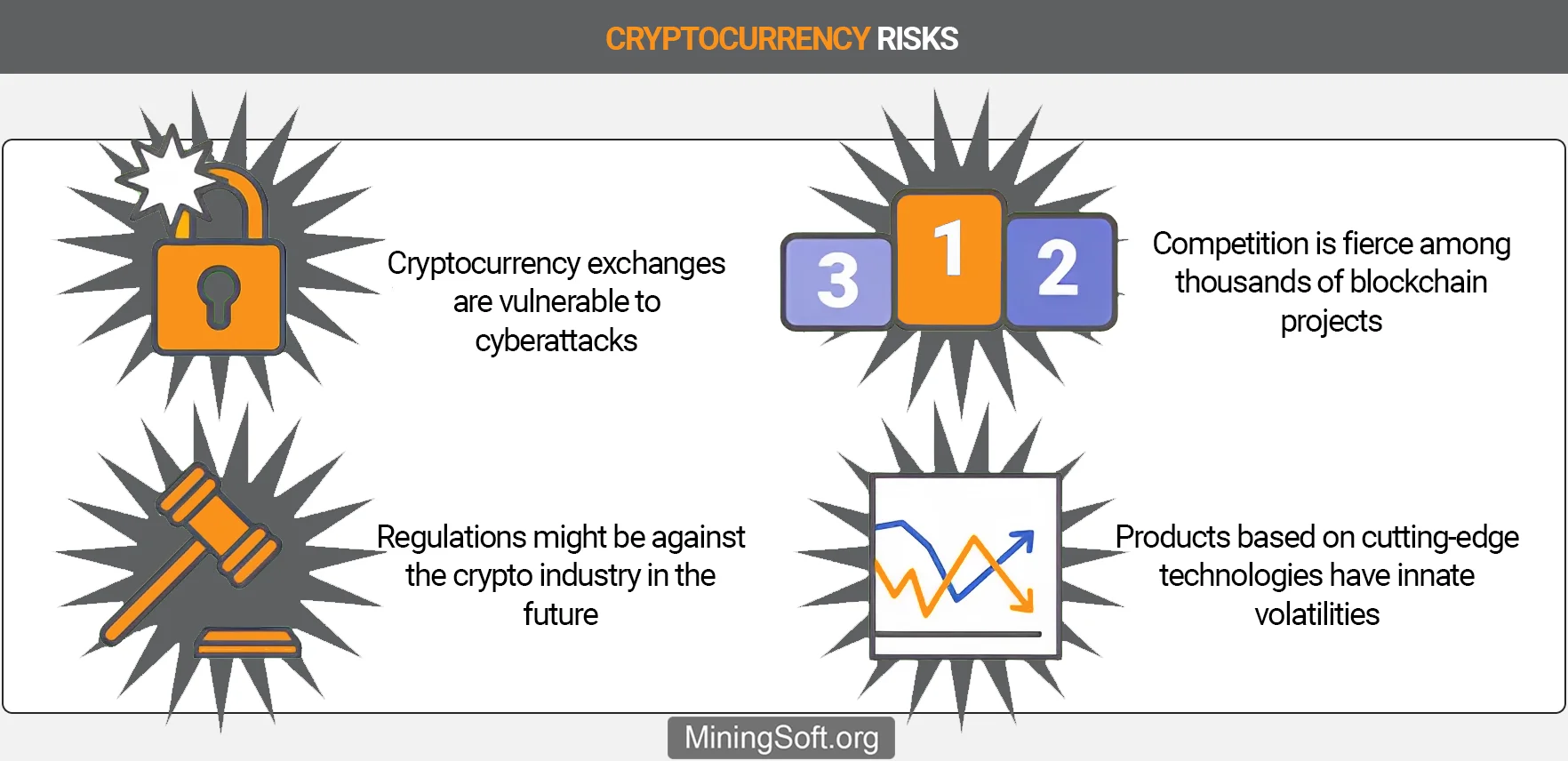

Disadvantages

In addition to the numerous advantages of cryptocurrencies, the risks cannot be neglected. Moreover, a beginner in the crypto world needs to carefully understand both the advantages and disadvantages.

The following theses are usually attributed to the disadvantages of cryptocurrencies:

- Low liquidity compared to traditional financial instruments.

- Strong price fluctuations.

- Possible total loss of funds or data.

- Due to the lack of regulatory mechanisms, there are no guarantees for the safety of electronic crypto wallets.

- Loss of a password to an electronic crypto wallet or its inoperability leads to the irretrievable loss of all coins.

The developers of some digital assets are partially unknown and are engaged in deceiving users. You should be attentive to the crypto project, study it.

Risks

A serious risk to consider is that billions of dollars worth of digital assets have been stolen from cryptocurrency exchanges over the past few years.8

Therefore, it is extremely important to beware of unlicensed platforms and only buy cryptocurrency from a regulated exchange or broker, of which there are not many. If you want to store your cryptocurrencies in your own wallet, there are fewer risks.

It is possible to unequivocally answer the question: is cryptocurrency good or bad by summing up the advantages and risks.

| Features / benefits | Risks / disadvantages |

|---|---|

| Decentralization | Volatility |

| Transparency of all operations | No clear regulation |

| Flexibility in use cases | Often there is no real solution to the problem |

| Protection against unauthorized access | High consumption of resources and energy |

Despite the disadvantages and risks, you should not hope for the collapse of cryptocurrencies.

“Bitcoin, however, will not disappear because it is in fact decentralized and is still in high demand as a replacement for obsolete money by individuals, corporations and nation states.” - Samson Mou, CEO, JAN3

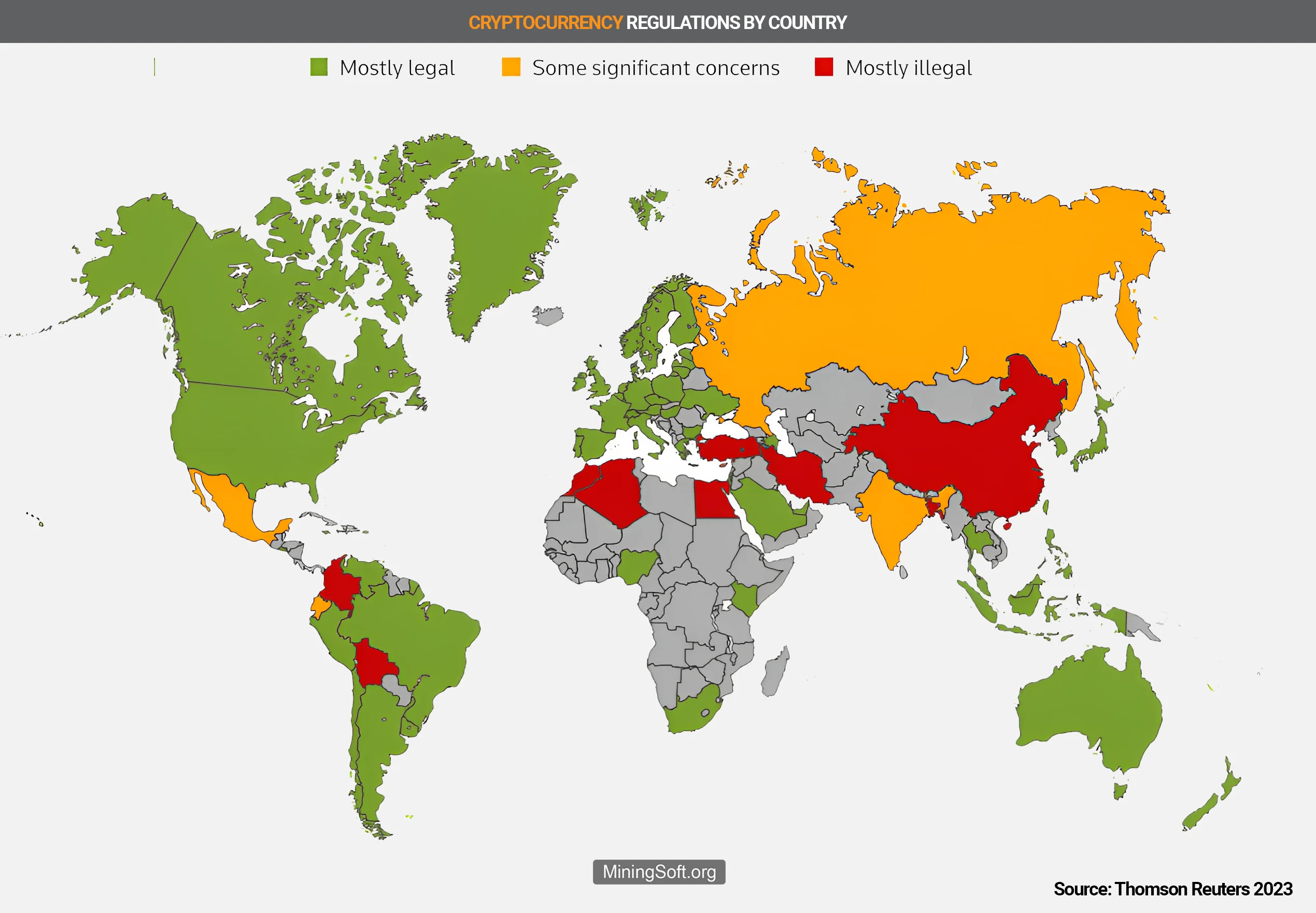

Law: bans and adoption

Regulation in most countries, which is mostly just beginning, is a risk that should not be underestimated when investing.

In addition to supporters, there are a number of opponents of cryptocurrencies. States like El Salvador feel their chance to become more independent of the dollar. Other states, such as China, are fiddling with their own digital money and have driven mining out of the country and banned trade.9

The amount of energy or computing power required for mining, including the required hardware, and the high energy consumption of each transaction is a thorn in the side of many government officials around the world.

On the other hand, there are supporters who see digital assets as a great opportunity for their country and are determined to follow this trend so as not to miss the stage of technological development, as was the case with the Internet and the so-called FANG shares. (Facebook, Amazon, Netflix, Google).

Even among supporters, the picture is divided. Some see more regulation as a positive thing, as it will build confidence. The other side insists on decentralization and anonymity at all costs.

A general and worldwide ban is in doubt. Partial regulation is likely to have a negative impact on the whole situation, at least in the short term, but then may clear the way for institutional investors and thus pave the way for the very broad masses.

Therefore, a definitive declaration of a general ban is not possible.

What Is crypto Backed By?

Cryptocurrencies are not backed by real assets or tangible securities. They are traded between the parties by agreement without a broker and tracked in digital ledgers.10 The rate is not backed by anything other than actual supply and demand.

At the same time, the cryptocurrency is provided by the value that the users of the Network give for it, reliability, limited emission and a number of other factors. According to many analysts, they have an even greater impact on the stability of the monetary system than gold and foreign exchange reserves.

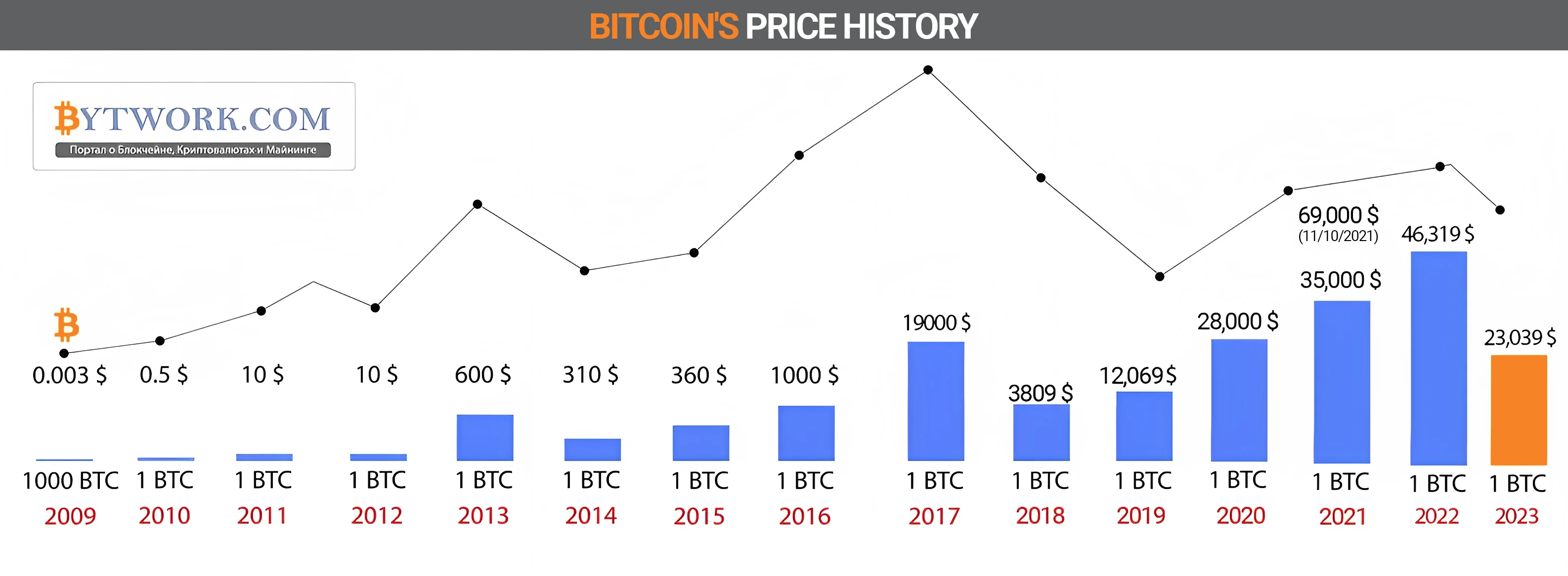

What Determines Price?

As a general rule, if the stock market crashes, then the cryptocurrency market crashes with it. There are also influencing factors, such as the legal regulation of cryptocurrencies, which is still largely open.

The reasons vary, but it’s still worth taking a look at Bitcoin’s price history since its inception and cycles of the huge ups and downs that accompanied it.

Sometimes there are sharp and unpredictable price fluctuations. It is impossible to say why the rates rise or fall. This represents a potential risk for investors. Due to the high volatility, investors are quicker to sell these high-risk investments.

How does crypto make money?

Cryptocurrencies allow you to earn money in various ways:

- Trading speculation in cryptocurrencies or CFD contracts.

- “Reward” for doing various work on the network

- “Winning”

- Crypto lending and staking

- Investment

- Airdrops and forks

- Mining

Trading

If you buy cryptocurrencies and the price rises, you can sell them and make a profit. It sounds very simple. However, for beginners it is important that theymore thoroughly dealt with cryptocurrencies. For example, not all digital currencies are equally suitable for trading and earning.

Contract Trading (CFD)

It is important to decide in advance whether you want to buy cryptocurrencies or want to trade CFDs without buying cryptocurrencies yourself.

Contracts for difference (CFDs) are derivatives that allow you to bet on how the price will develop. CFDs exist on stocks and other real assets, as well as cryptocurrencies.

Remember that CFDs are very risky. Depending on what price action the bet is on, whether the price goes down or up, you can make a mistake and lose.

Crypto lending

Crypto lending offers the opportunity to earn interest by lending your cryptocurrencies. This can be done on peer-to-peer lending platforms, some crypto exchanges, and through so-called DeFi, decentralized financial applications, among others.

Investing

Investing is a long-term strategy for buying and holding crypto assets for a long time. Cryptocurrency assets are usually well suited for a buy and hold strategy. They are extremely volatile in the short term but have huge upside potential in the long term.

Staking

Simply put, staking is like a bank deposit with interest. The user transfers funds to the account, stores them and receives passive income for this. The more funds in the account, the higher the earnings. However, the more participants, the less income.

Mining

Crypto coins are generated in a process called mining. This process is complicated, but in simple terms, mining means that computers solve mathematical equations and receive bitcoins or other cryptocurrencies as a reward.11

Airdrops and forks

An airdrop is a process by which a company distributes its tokens to the wallets of specific users, completely free of charge, in order to stimulate brand awareness.

Why would companies just give away their tokens? This is an effective way to get fast network usage and create hype around new blockchain based business. This acts as a way to reward investors and clients.

Some companies may use Airdrops for technological reasons, such as for a hard fork.

A hard fork occurs when changes are made to the code that create two paths for a project to develop. This is exactly what happened with Bitcoin Cash (BCH). After the fork, all BTC holders received BCH.

Conclusions

To sum it up, it is important to do a thorough research, both in terms of the cryptocurrency you plan to add to your portfolio, and in terms of the exchange or broker you are opening an account with.

Cryptocurrencies are not a form of investment with safe interest rates. Still, earning on cryptocurrency is possible. If you are willing to take on a high risk with this type of investment.

Cryptocurrencies are an incredibly exciting trend that is no longer a dream of the future. Large profits are possible, but extensive knowledge of the financial market and investments is required.

Before diving into the crypto adventure, you should collect a lot of information, which is also described on the MiningSoft.org resource. Then you are more likely to celebrate successes rather than mourn losses.