Stablecoin USDT: What is it? How does it work? Is safe? [Explained]

In this guide, you will learn everything about the Tether (USDT) cryptocurrency.

Theter (USDT) is the most widely used stablecoin and the most traded cryptocurrency in the world.

Stablecoins are cryptocurrencies whose value is pegged to another asset, most often a fiat currency (for example, the dollar, euro, pound sterling, yuan).

Due to the difficult economic situation in the world, thousands of people began to pour money into crypto. However, cryptocurrency is a highly volatile asset. You can fall into a real “crypto winter”. That’s why people came up with Stable Coin.

Stablecoin is a digital currency pegged to a “stable” reserve asset such as the dollar or gold. Stable Coin in English spelling consists of two words and literally means “stable currency”. Simply put, this is when one “wrapper” is, as it were, equal to one dollar. It turns out the cryptodollar.

And everything would be clear and transparent if the Fed (Federal Reserve System) printed the cryptodollar, like the regular USD. But no. Not only are cryptodollars printed no one knows where and by whom, but countless numbers of them have also been divorced.

We will dedicate this guide to the most popular and muddled cryptodollar on the planet - Tether USD, aka USD.

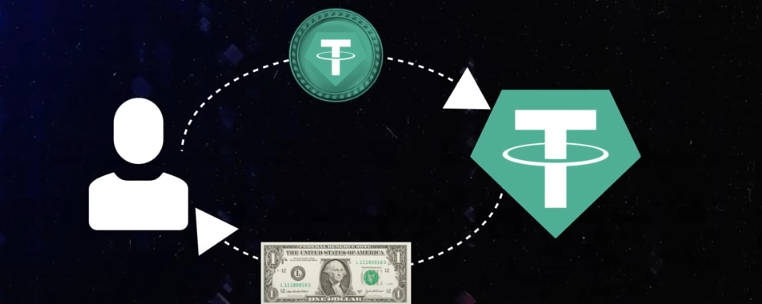

How does Tether work?

1 - maintains corporate accounts

Tether works by keeping traditionally stable assets in corporate bank accounts to keep the exchange rate stable.

2 - guarantees reserves

According to Tether, they guarantee almost equal value to the dollar. For example, if a stablecoin is pegged to the dollar, there is a corresponding dollar reserve for each stablecoin issued.

3 - guarantees the exchange

Theoretically, you can exchange each USDT for one dollar. However, not all stablecoins remain pegged to fiat currencies. As mentioned, some stablecoins rely on other mechanisms to maintain the peg.

USDT backed by usd or gold?

Most people are comfortable with the fact that one USDT can be exchanged for one real dollar. Next, we will tell you how it happened and what risks this pyramid has.

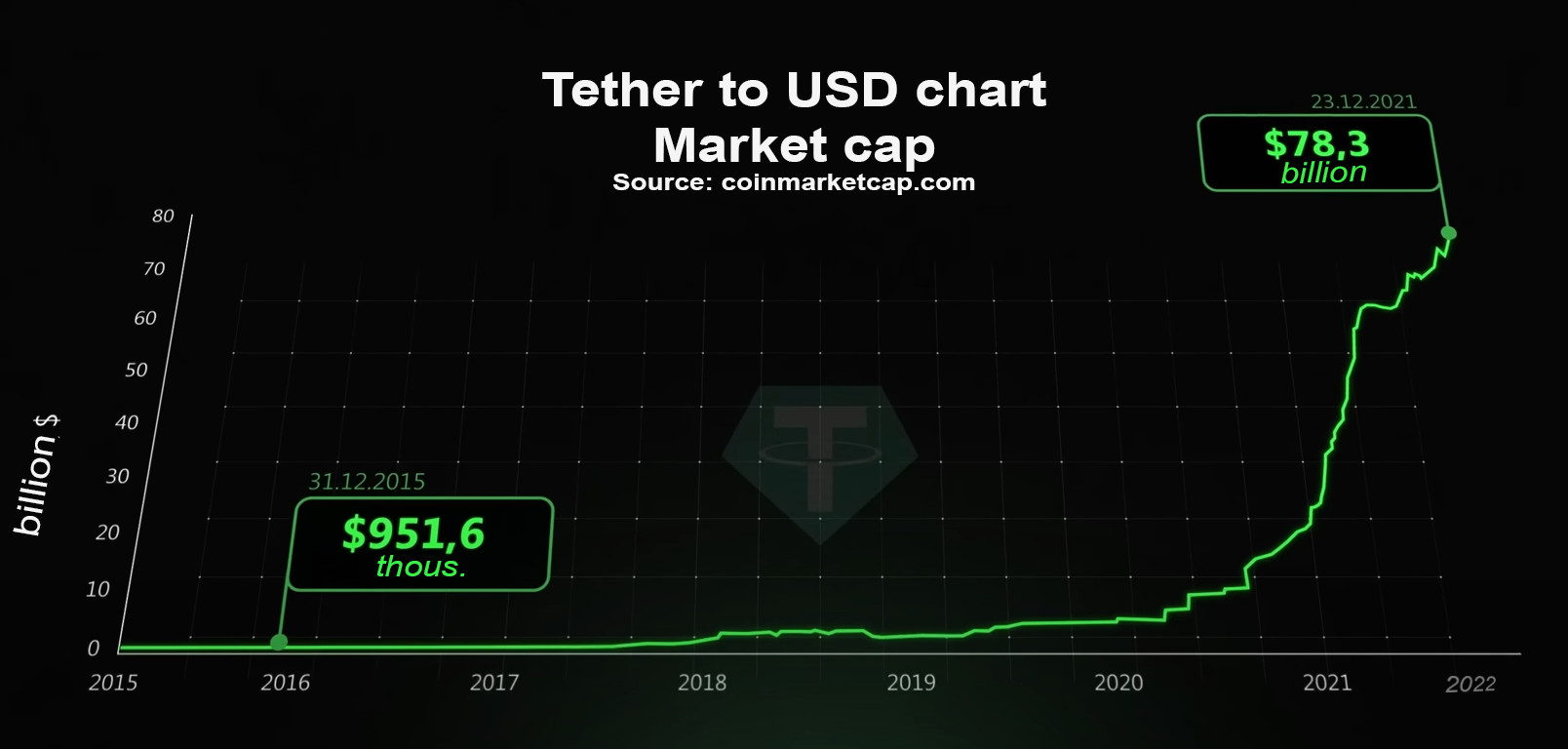

How did it happen that in 2015 the capitalization was under a million dollars, and six years later it became under 80?

Many people have a question: where does the money come from?

USDT is printed by a specific legal entity - Tether International Limited. It was established in Hong Kong in 2014. And in theory, we emphasize in theory, this office issues one USDT for one real dollar. And in theory, you can also contribute to this.

The situation is typical: come after the work shift, give 100 thousand regular dollars, get 100 thousand cryptofantiks on your account. And in theory, the opposite is also true: come with cryptofantas, and in return you get real dollars. In such a situation, everything is clear, simple and transparent. One USDT is backed by one real dollar.

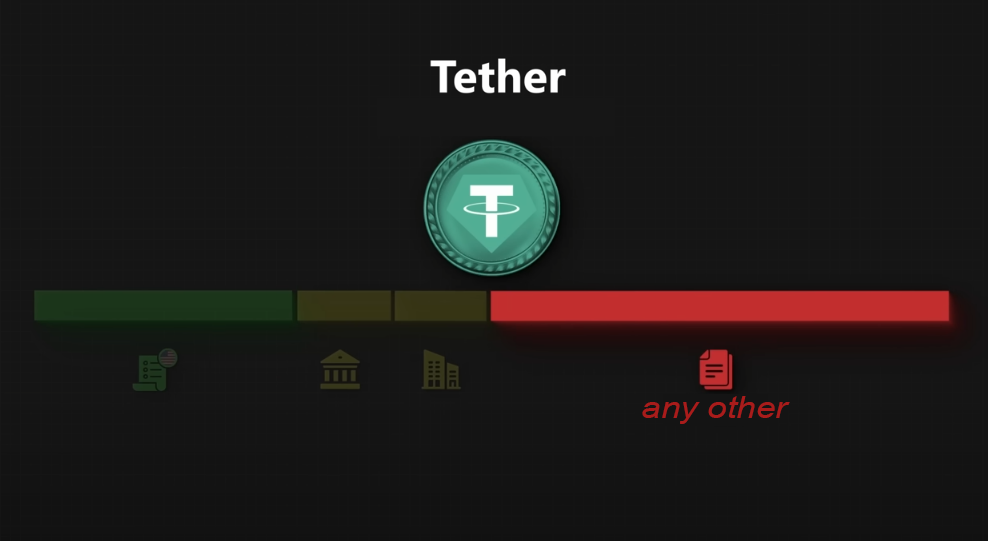

Real collateral

But the reality is not as beautiful as the idea.

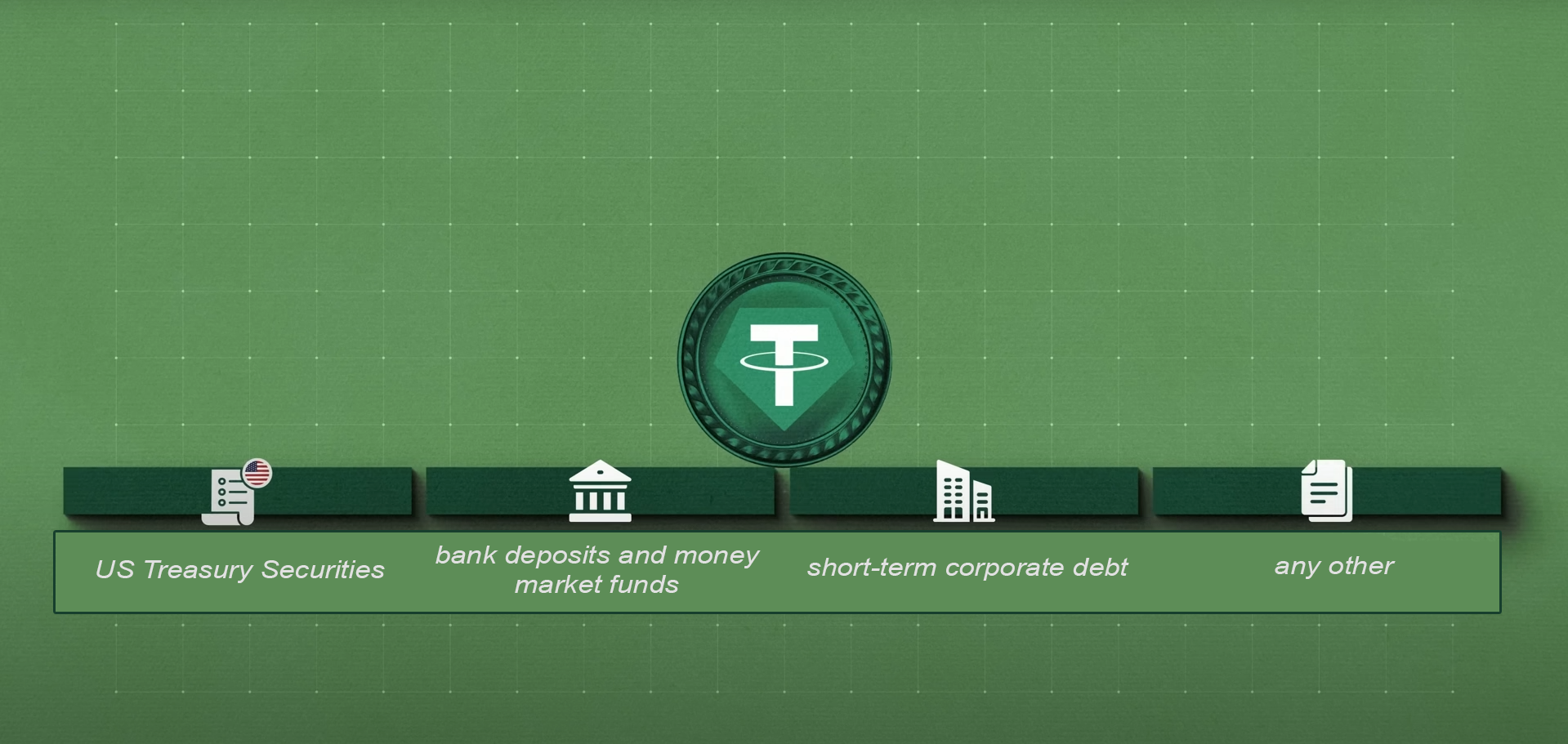

In fact, USDT collateral looks like 4 categories:

- short-term US government bills,

- bank deposits and money market funds,

- short-term corporate debt and

- any other.

There are no questions regarding the first category of stablecoin collateral. These are US Treasury Securities. They are issued by the US Treasury and will only turn to dust if the US defaults1.

The second category is bank deposits and money market funds. The category is also safe, but with a caveat: if we know what kind of banks they are and consider them stable.2

The situation with the third category of collateral is the same as with the second category - it is not known what kind of securities it is. It’s one thing if there are Microsoft bonds, and another thing if it’s from a Chinese developers.

And the fourth category of backing the USDT is literally all sorts of different things. Here are loans to unspecified firms, and precious metals, and even digital tokens. This is an opaque and incomprehensible category.

For easy understanding, these four categories can be divided according to the traffic light principle:

- 1 - green,

- 2, 3 - yellow,

- and the fourth one is red.

Accordingly, the conclusion is made: the more green in the provision, the safer. The more red, the more dangerous. And now let’s see in what shares USDT is backed.

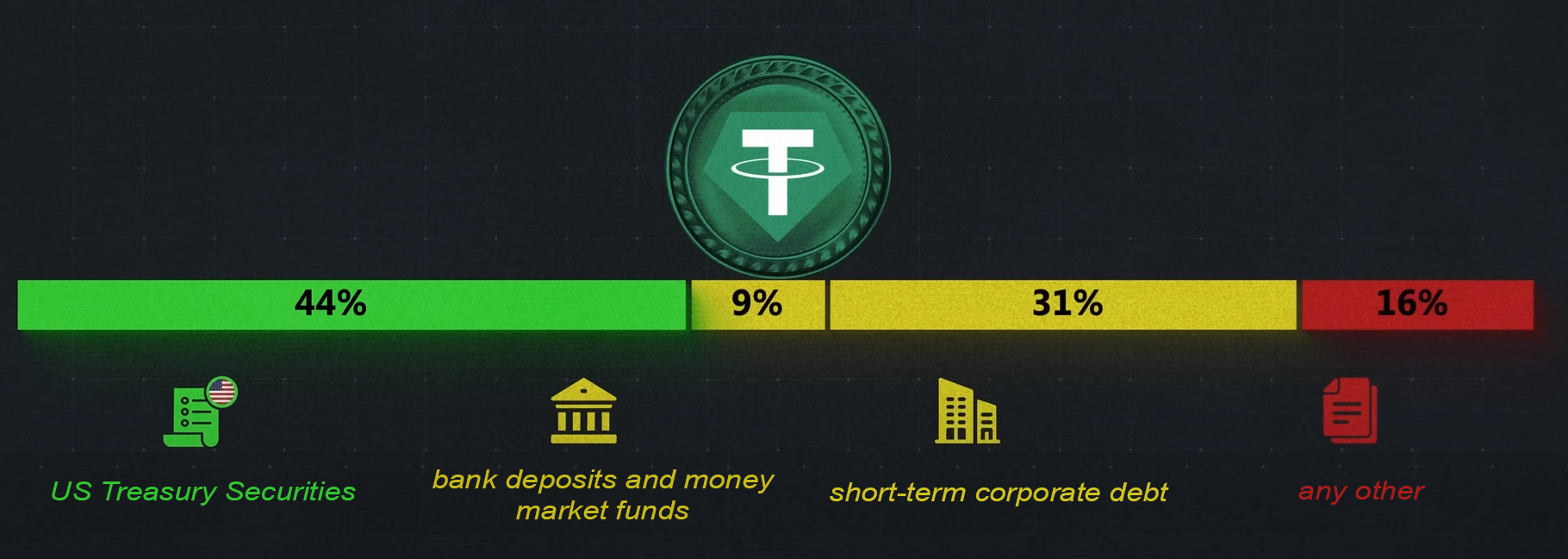

By the end of last year, the lineup looked like this:

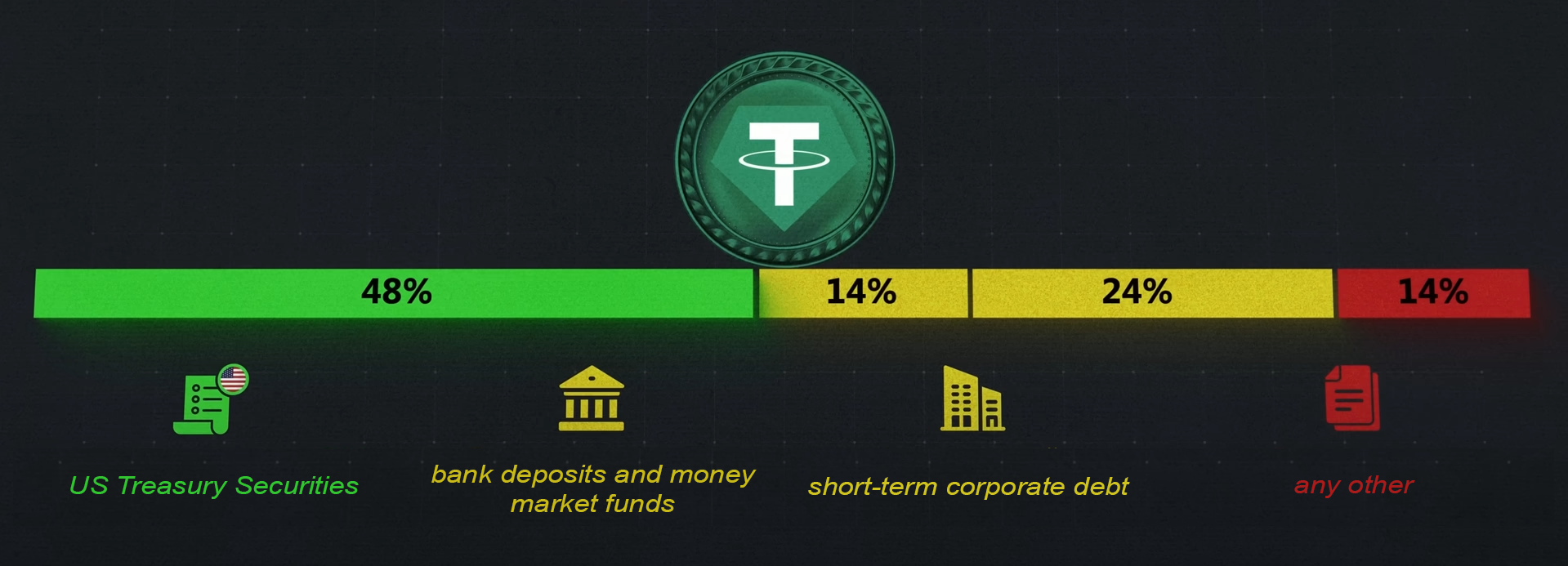

Even closer to our time, the situation is slightly improving: red - a little less, green - a little more.

Here comes the common question:

why do these different types of backing? Why can’t you just keep one real dollar for every one crypto dollar on your balance sheet?

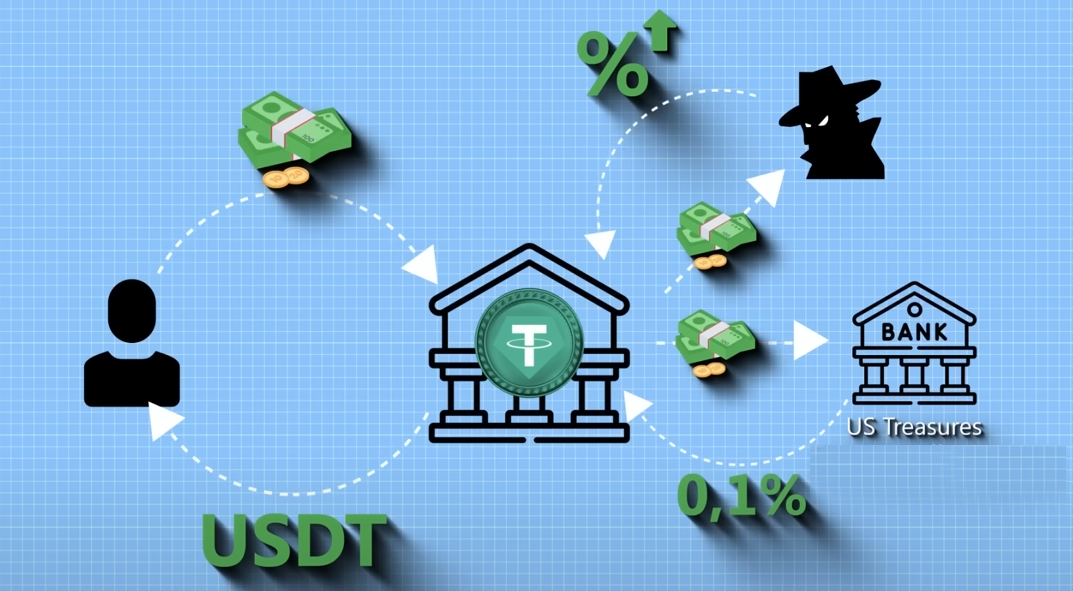

Basically, USDT is a crypto bank. In a regular bank, we invest money on a deposit at interest, and the bank, in turn, tries to lend money at an even higher rate, thus earning on the difference in interest rates.

It turns out that people invest money for free, receiving USDT candy wrappers in return. But at the same time, Tether, of course, also wants to make money on this. Six months ago, investing in reliable assets such as US Treasuries, US government debt or reliable bank deposits, you could earn 0.1% per annum.

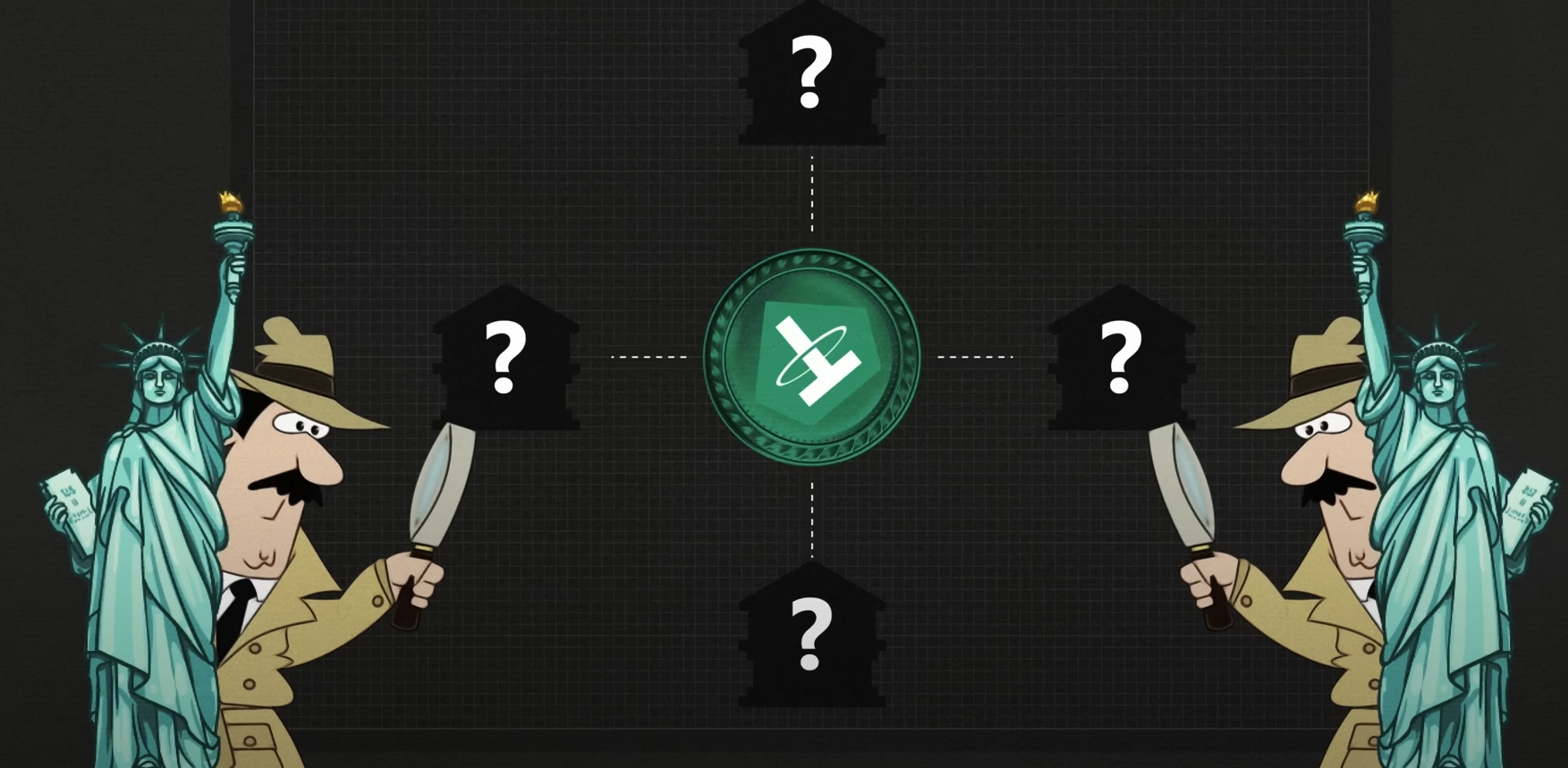

Where does the collateral data come from?

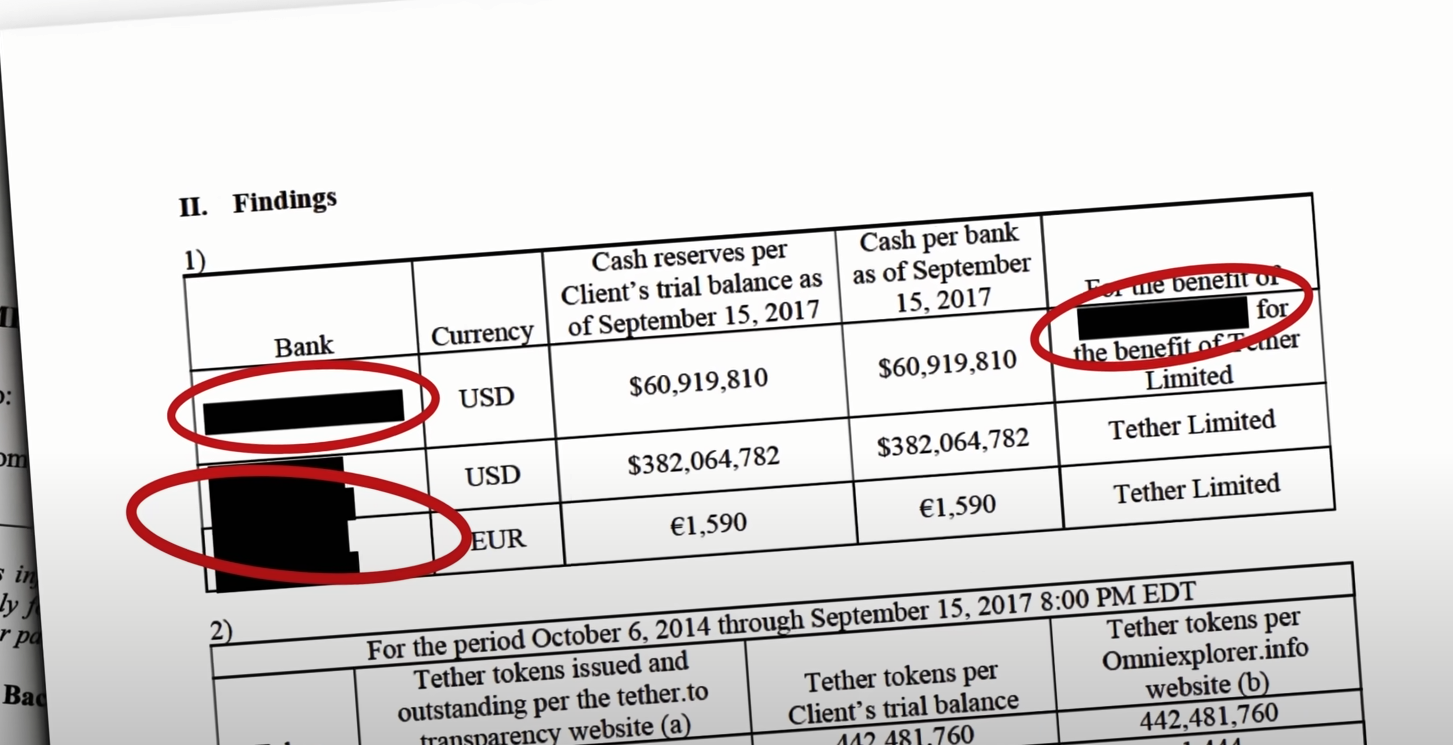

Tether has been publishing some reports since 2017. However, this is not a full-fledged bank audit, but rough information, without specifics.

For example, in the seventeenth year, the report looked so that the name of the banks was glossed over3.

More recently, collateral information has been provided by the Cayman Islands office.4

Are these reports transparent and complete? Do they inspire confidence?

Answer: no and no. But other documents for analytics do not exist in the public domain. We work with what we have.

Much more dirty details were found out by the New York prosecutor’s office, which since 2019 has been trying to find out where the money is.

As a result of the audit, Tether was banned from any activity with New Yorkers. They were also forced to pay an $18.5 million fine5. For what?

- Firstly, Tether directly deceived by publicly declaring that the money was in dollars in a bank account. In fact, Tether hosted various and opaque instruments. And it was the prosecutor’s office that forced to increase the level of transparency.

- Secondly, Tether and Bitfinex tried to hide the loss - $850 million in 2019.

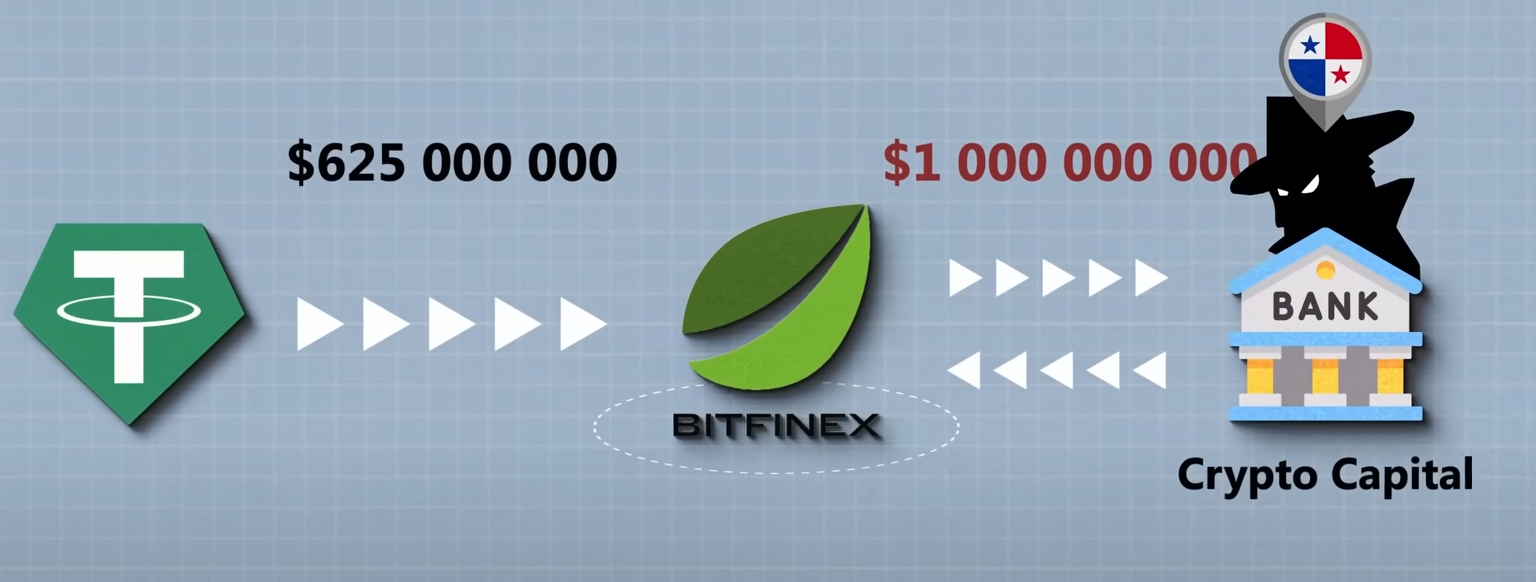

What is Bitfinex?

Bitfinex is a fairly large exchange, owned by Tether International. That is, the cryptodollar USDT is printed by Bitfinex.

The connection with Bitfinex is quite interesting. In November 2018, Tether LTD sent $625 million to Bitfinex6. Why? Because Bitfinex kept one billion of its money in the shady Panamanian pseudo-bank Crypto Capital, which at that moment was having problems with law enforcement in different countries.

Consequently, Bitfinex started having problems accessing the billion placed there. The icing on the cake was delivered by the same New York prosecutor’s office. Quote:

“No contracts or written agreements have been made between Crypto Capital, Bitfinex and Tether7.

It turns out that a billion dollars was sent just like that.

In fact, there’s still a lot more to explore. For the amusement of readers, you can bring the biography of Tether’s chief financier - Giancarlo Devasini. Before the launch of the cryptocurrency, he was a plastic surgeon8.

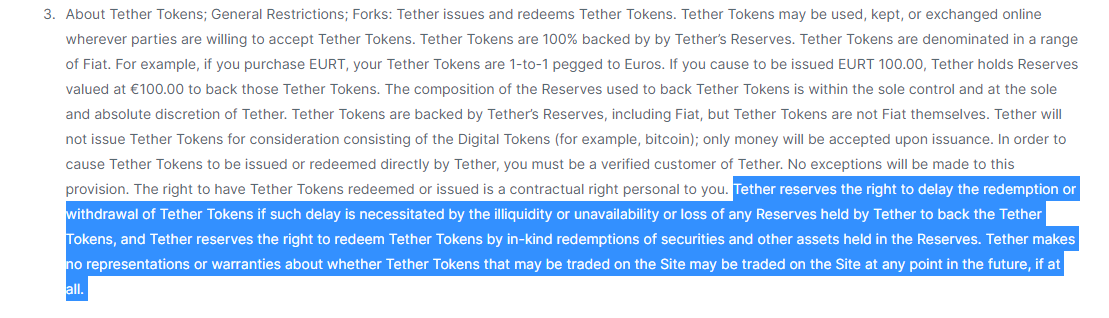

We note one more thing: it seems to be possible to exchange Tether for a dollar through Tether LTD directly. So this is the fundamental idea. However, at the same time, the owners threw off all responsibility. The official site says:

“Tether reserves the right to delay the redemption or withdrawal of Tether tokens if such delay is due to the illiquidity, unavailability or loss of any reserves held by Tether.9”

“To secure the tokens, Tether also reserves the right to redeem Tether tokens by in-kind redemption of securities and other assets held in reserves.”

Translated into understandable language, it says:

“If we can’t exchange, then we can’t exchange.”

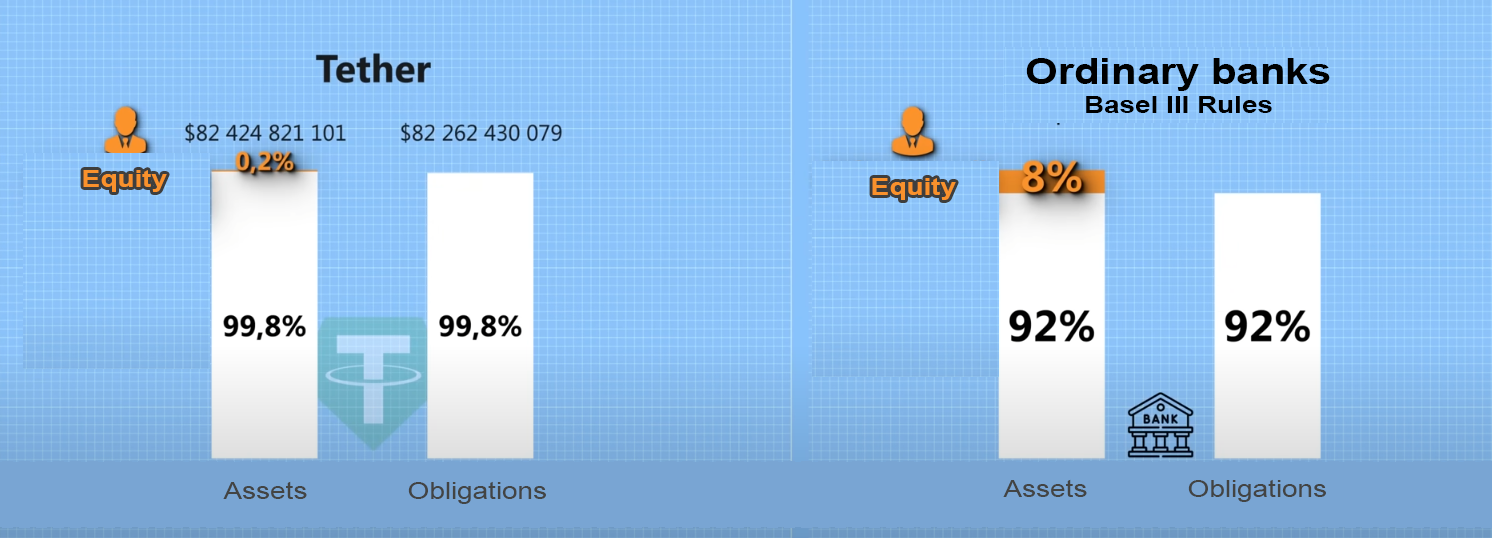

It is understandable, because the equity of Tether is two tenths of a percent. Auditing companies strictly regulate and audit real banks. Although, of course, with themanything happens. Strict Basel III rules force banks to keep equity at least 8 percent of total assets.

This means that even if something happens to eight percent of the bank’s assets and they disappear completely, the owners of the bank, who risked their capital, will bear the brunt. And, for example, those who have invested in this bank will not suffer in any way.

In the case of Tether, their net worth, according to their own reports3410, is 0.2 percent. This is about 40 times less than real banks. Accordingly, Tether holders do not risk anything, unlike USDT holders. Problems could arise even if reserves fell only slightly.

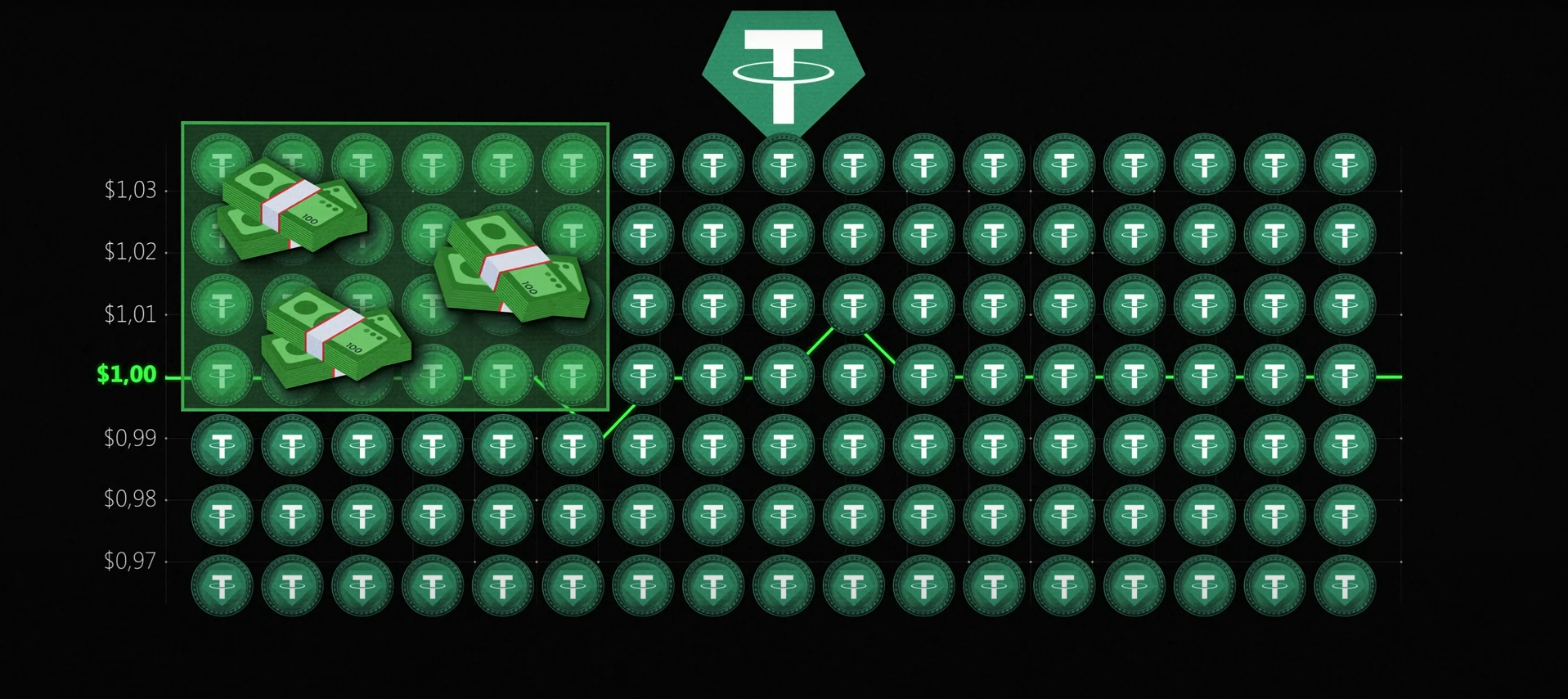

Then why is 1 USDT worth 1 dollar?

Despite all the inconsistencies, deceptions and skeletons in the closet, Tether is quite successfully holding the course one for one.

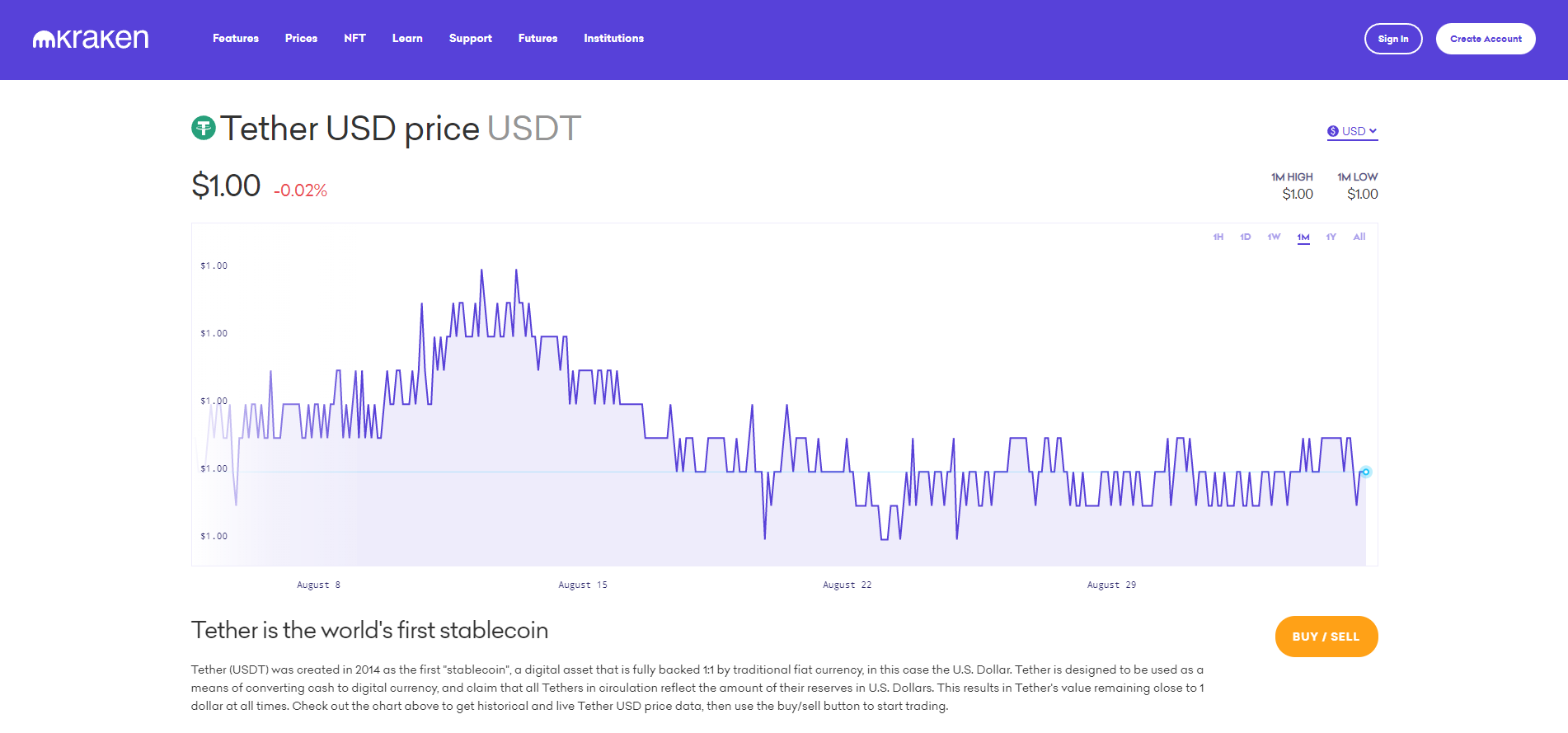

In the middle of the historical chart, you see a run from 91 cents to $1.08. But since the beginning of 2021, the deviation is negligible. How does this hold happen?

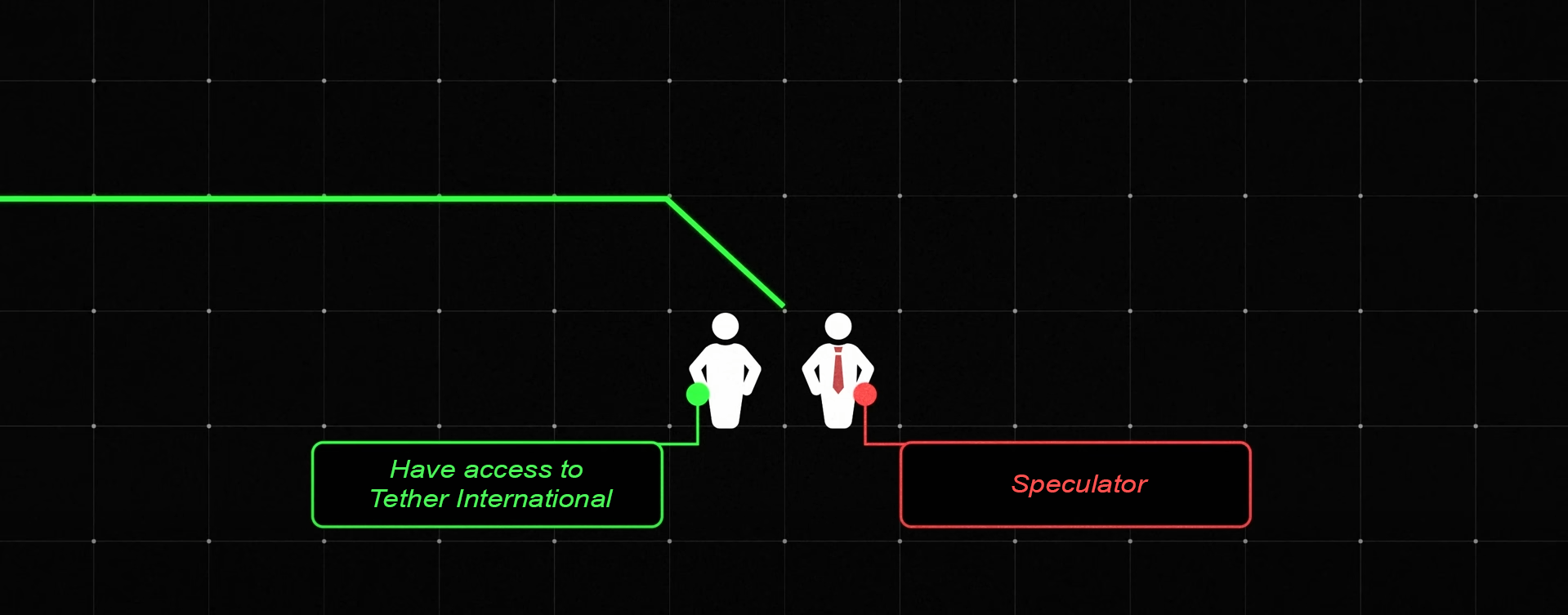

One clear opportunity should be at the forefront - to exchange USDT for a real dollar. It is, in theory, there is, but we personally have not tried. Well, at least because there the exchange and issue is carried out in lots of 100 thousand dollars.

Moreover, people say that not everyone has this opportunity. But the fact that it is provided is for sure. Because if Tether did not give such an opportunity at all, then he would not have existed for 6 years.

Yes, and would not trade on a very transparent American stock exchange Kraken. Moreover, directly in a pair of Tether - a real dollar11.

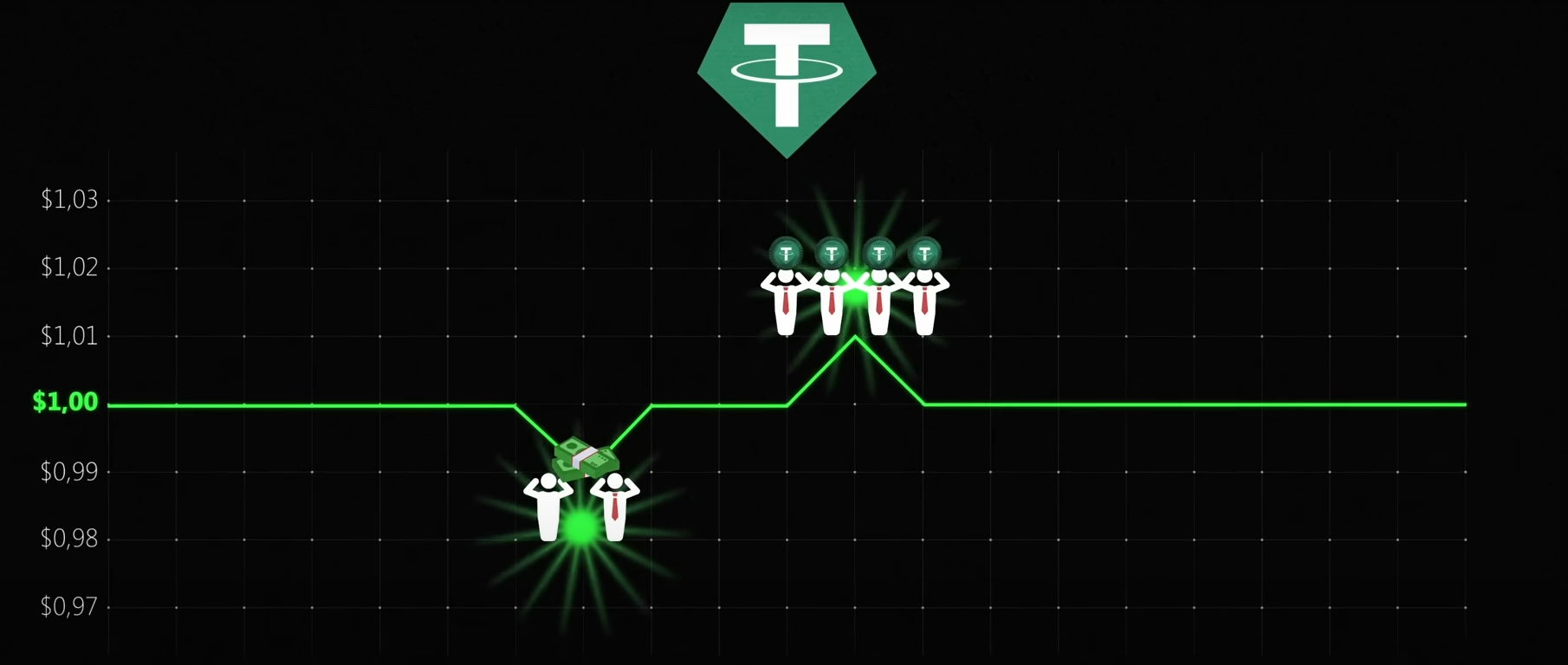

If one Tether starts to cost 99 cents, then, as a rule, buyers run in. These are either the lucky ones who have access to pay off the Tether directly, or simply market speculators who are confident that the rate will even out.

In this way, they increase demand and bring the price back to one dollar. And if suddenly demand goes off scale, and the price of Tether becomes higher than the dollar, then everything is generally simple. Many speculators will gladly sell cryptodollars for real ones.

Or USDT himself will print and satisfy the demand, thereby returning the price to one USD. And the funny thing is that Tether International itself usually does not need to constantly redeem a huge amount of Tether in exchange for a dollar.

The task of Tether International is to maintain a stable exchange rate. And for this, as a rule, it is enough to periodically redeem only a small share of tokens in circulation, maintaining trust in the system, so that you and I, ordinary hamsters, can exchange dollars through peer to peer12.

Hundreds of thousands of Tethers are exchanged daily for rubles, drams, lari, leaders, tenge, dollars and other currencies. This is because in the minds of the majority, you can exchange this USDT for real money at any exchanger at any time.

Big players exchange millions of Tethers for real dollars in Tether International itself. And so there is no motive to run and repay these wrappers real dollars right now.

This awareness allows you to keep Tether for a week, a month. And who even years. It’s like before people lived with the knowledge that dollars can be exchanged for gold, but no one ran to change crunchy papers for ounces of gold. Well, of course, if not a crisis. A similar situation occurs here.

Is there a risk of scam?

The stability and transparency of Tether is still much less than a dollar. In this article, we also talked about non-transparent reports, about the lack of audit, about companies from the Cayman Islands. All this creates the risk of a bank run. Only not to the bank, but to Tether.

Especially in an environment where there are supply chain breaks, global inflation and at the same time a recession, a global pandemic, climate change. In short, the world is cruel, changeable and unstable. Anything can happen.

For example: most recently, Tether redeemed 16 billion of its candy wrappers for the first time in history. That is, someone came and said:

“here’s 16 billion Tether, give me a real dollar.”

Someone will say: “well, the load subsides.” Another will say: “The bubble is already bursting.” But, as they say, we don’t know the whole truth. It all depends on how badly the security is shattered.

Tether reserves do not have such a large share of doubtful assets - only 15 percent.

It doesn’t look like something terrible. But Tether has since repaid more than $15 billion. That is, approximately 20 percent of all USDT tokens in circulation. At the same time, this kind of redemption, as a rule, is carried out at the expense of the most reliable liquid assets.

In the case of Tether, this is money in bank accounts and US Treasuries, that is, the US national debt. But the most murky assets, such as crypto or loans issued to no one knows who, most likely remained on the balance of Tether.

Accordingly, if the capitalization of USDT tokens in circulation continues to fall as rapidly, then the potential hole in the reserves may well grow from 15 to 30 or even 50 percent of the entire balance. In this case, many people will have big questions about the backing of USDT with real real dollar assets.

For more than 6 years, Tether has been, and still is, a great way to save money, both in terms of its nominal value and in terms of management.

Tether can still be transferred to anywhere in the world, avoiding horse commissions, delays and possible failures.

Risks and nuances are everywhere. Ultimately, it is a matter of your personal financial management.

Summary

There are two extreme points of view. On the left: “we have the future for Tezor”, and on the right: “tomorrow scam. The pyramid will collapse.

Remember that the truth is always somewhere in the middle. We don’t say that Tether is a scam, it has a problem with accountability and transparency, but for six years now it has been a great tool for transferring funds.

But at the same time, the world is changing, different events are taking place. You can’t measure the future by the past. It is necessary to take into account both the international conjuncture and the local one.

Almost every few weeks, a new crypto project for tens of billions of dollars bursts loudly:

- Luna/UST

- CELSIUS

- Three Arrows Capital

Therefore, there will be no forecasts here whether Tether will burst or not, and even more so when. But it can be stated that it is definitely not a pyramid. Just by definition. It does not claim a return on investment.

Tether can be compared to an opaque bank that issues its own derivatives. And banks, even the most honest ones, can also go bankrupt. And for Tether International, in particular, which, thanks to the investigation of the New York prosecutor’s office, there are big doubts, these risks are even more strongly higher.

The MiningSoft.org editors defined it as follows:

We both used Tether and will continue to use it, but most likely only during the day for our own needs. Another thing, tho We won’t keep most of the money in it for longer term storage.

It is necessary to carefully study other stablecoins, but even then there are risks. The ideal does not exist.

We will release a new report with an overview of the rest of the stable cryptofantas.

Weighing the Options: Money Market Funds vs. Bank Deposits ↩

Cryptocurrency firms Tether and Bitfinex agree to pay $18.5 million fine to end New York probe ↩

Tether: the former plastic surgeon behind the crypto reserve currency ↩

Tether, Bitfinex and Hypercore Launch Holepunch, a Platform for Building Fully Encrypted Peer-to-Peer Applications ↩